People search for average US salary & household income to understand where they stand financially. They want to compare their earnings. They seek ways to improve their situation.

This article dives deep into the numbers. It combines official data with real-world trends. You will learn about median incomes, breakdowns by demographics, and economic impacts.

Plus, discover how to use this info for your advantage. We include fresh insights from Quora and Reddit users. These show what everyday people ask about average household income US statistics 2025.

Experts project the median household income in the US for 2025 at around $78,171 to $83,150. This range comes from recent estimates. It reflects some volatility. For instance, July 2025 data shows a drop to $78,171 from June’s $83,680.

This signals economic pressures like inflation. Yet, other sources point to $83,150 as a solid figure. Full-time workers earn a median weekly wage of $1,196 in Q2 2025. That adds up to about $62,192 annually for individuals.

Wages grow steadily. But gaps persist. Education, race, and location play big roles.

Readers often want to know: How does this affect my life? Can I use these stats to make better choices?

Yes. Track these numbers to plan budgets. Choose careers. Even relocate. Let’s break it down.

Table of Contents

ToggleUnderstanding Average vs. Median Income: Why It Matters for You

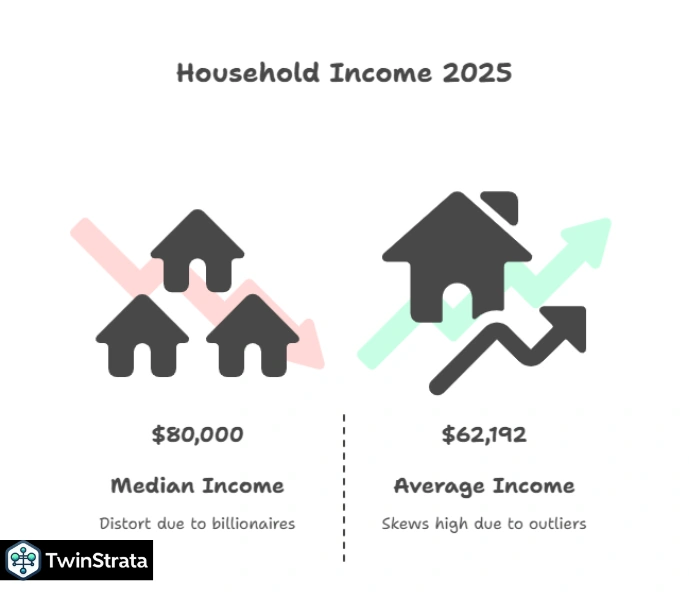

People confuse average and median. Average adds all incomes and divides by the number of households. It skews high due to wealthy outliers.

Median finds the middle value. Half earn more, half less. For average household income US statistics 2025, median gives a realistic picture.

Use median to gauge your position. If your household earns $80,000, you sit near the middle. This helps set goals. Aim for the top 20%? That starts around $165,000, per Reddit discussions.

Quora users ask: “Is $62,192 really the average American salary in Q2 2025?” They note medians hover at $80,000 for households. Averages distort due to billionaires.

- Benefit Tip: Compare your income to medians. Tools like Census Bureau calculators help. Adjust for your state. This reveals if you need a raise or side hustle.

Historical data shows growth. But inflation eats gains.

| Year | Median Household Income (Real, Adjusted) |

| 2015 | $42,168 |

| 2016 | $43,406 |

| 2017 | $44,827 |

| 2018 | $46,196 |

| 2019 | $47,812 |

| 2020 | $51,305 |

| 2021 | $52,009 |

| 2022 | $55,164 |

| 2023 | $59,384 |

| 2024 | $61,984 |

| 2025 | $66,622 (Projected Individual Average) |

Note: These figures focus on individual earnings before taxes. Household medians run higher. From 2024 to 2025, expect a 7.48% jump in average annual income. But household medians dipped in 2025 estimates.

Reddit users debate: “US Median Income $42,220?” One post clarifies full-time medians hit $62,660. They stress education boosts this. Quora echoes: “What is the average monthly income of middle-class individuals?” Answers tie it to $80,000 yearly household figures.

Apply this: Track yearly changes. If incomes rise slower than costs, save more. Invest in skills for higher pay.

Average Household Income US Statistics 2026 By State

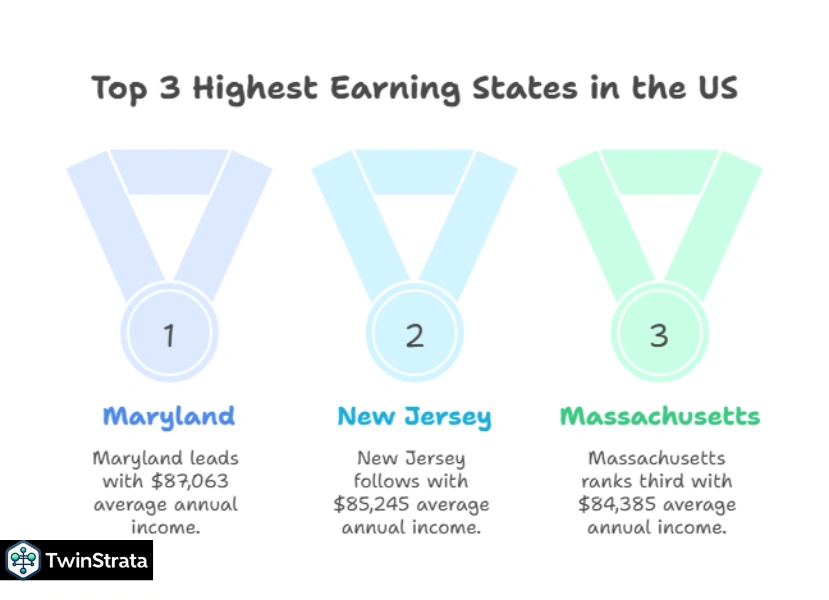

Location plays a big role in income, with states showing significant differences. Maryland leads the way, with an average annual income of $87,063, while Mississippi falls behind at $46,511.

The highest earners are mostly concentrated on the East Coast, though Hawaii stands out as an exception. These income gaps are largely due to the industries dominant in each state, such as tech in California and finance in New York.

| Rank | State | Average Annual Income |

| 1 | Maryland | $87,063 |

| 2 | New Jersey | $85,245 |

| 3 | Massachusetts | $84,385 |

| 4 | Hawaii | $83,173 |

| 5 | Connecticut | $79,855 |

| 6 | California | $78,672 |

| 7 | New Hampshire | $77,923 |

| 8 | Alaska | $77,790 |

| 9 | Washington | $77,006 |

| 10 | Virginia | $76,398 |

Source: Statista

Southern states dominate lows. All under $55,000. National average? $66,622 for individuals, but households average higher.

Reddit asks: “Median household income by US state?” Maps show California at $96,000. Quora: “What is the relationship between median income and cost of living?” High-income states like California face high costs.

- How to Benefit: Relocate strategically. Tech workers move to Washington for $77,006 averages. Factor costs. Use tools like cost-of-living calculators. Save on taxes in low-income but low-cost states.

World Population Review pegs US median at $88,311. But 2025 projections adjust for slowdowns.

Gender Pay Gaps in Average Household Income US Statistics 2025

Men earn more. Women lag. Men hit $67,704 annually. Women reach $56,316. Gap? $11,388. Women make 83 cents per dollar men earn.

Weekly: Men $1,302. Women $1,083.

| Year | Men’s Annual Median | Women’s Annual Median |

| 2015 | $47,008 | $37,908 |

| 2016 | $48,048 | $39,468 |

| 2017 | $49,036 | $40,040 |

| 2018 | $51,584 | $41,340 |

| 2019 | $53,144 | $43,784 |

| 2020 | $55,744 | $46,488 |

| 2021 | $57,408 | $48,308 |

| 2022 | $61,204 | $50,700 |

| 2023 | $61,412 | $51,931 |

| 2024 | $67,704 | $56,316 |

Gaps narrow slowly. Industries differ. Experience counts.

Quora users query: “What is the average annual income for a middle class person?” They note gender impacts middle-class status. Reddit: Women discuss closing gaps via negotiations.

- Benefit Tip: Negotiate salaries. Women, ask for raises. Use stats to benchmark. Switch fields like tech for better pay.

Age Breakdowns: Peak Earnings in Average Household Income US Statistics 2025

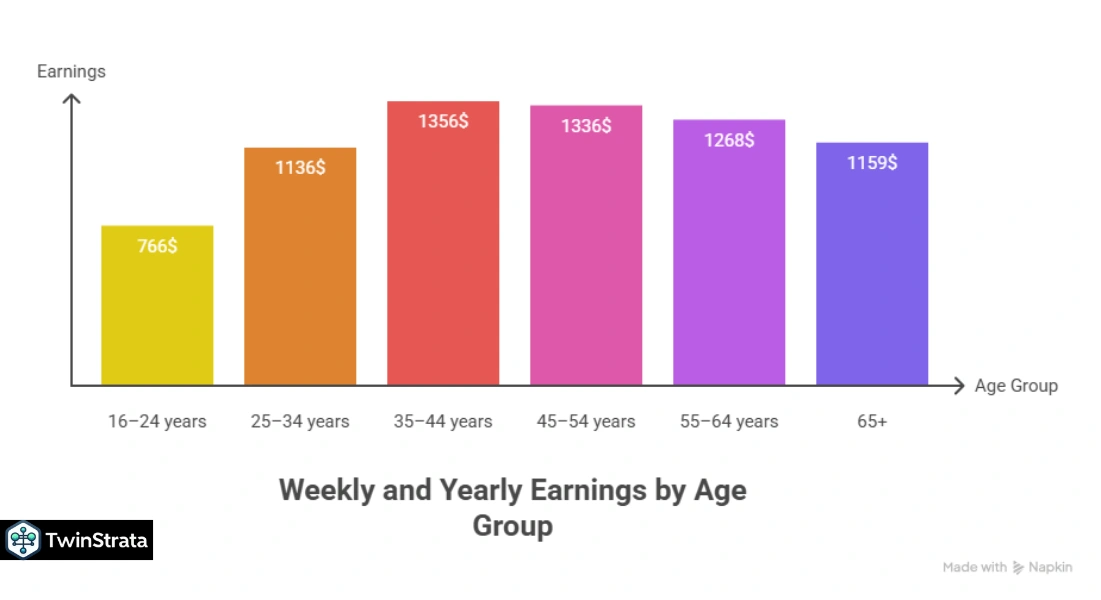

Earnings peak mid-career. Ages 35-44 top at $1,356 weekly. Then 45-54 at $1,336.

Younger workers start low. 16-24: $766 weekly. It jumps to $1,136 for 25-34.

| Age Group | Total Weekly | Men Weekly | Women Weekly |

| 16+ | $1,192 | $1,302 | $1,083 |

| 16-24 | $766 | $796 | $721 |

| 25-34 | $1,136 | $1,187 | $1,062 |

| 35-44 | $1,356 | $1,488 | $1,205 |

| 45-54 | $1,336 | $1,468 | $1,193 |

| 55-64 | $1,268 | $1,442 | $1,097 |

| 65+ | $1,159 | $1,313 | $1,055 |

Experience builds pay. Education accelerates it.

Reddit: “53.3% of Americans will have made a top 20% household income.” Peaks in 40s. Quora: Older users ask about retirement incomes.

- How to Use: Plan career arcs. Invest early. In 20s, focus skills. In 40s, maximize earnings. Save for dips post-55.

Racial Disparities in Average Household Income US Statistics 2025

Asians lead. $1,507 weekly. Whites: $1,207. Blacks: $1,040. Hispanics: $920.

Factors? Education. Jobs. Access.

| Race | 2022 Household Median | 2023 Household Median |

| All Races | $77,500 | $80,600 |

| White | $80,300 | $84,600 |

| White Non-Hispanic | $84,300 | $89,100 |

| Black | $55,000 | $56,500 |

| Asian | $113,100 | $112,800 |

| Hispanic | $65,300 | $65,500 |

Gains uneven. Whites grew most.

Quora: “What is the income range for rich, upper-middle?” Race affects brackets. Reddit: Discussions on systemic issues.

- Benefit: Advocate for equity. Diverse networks help. Seek inclusive employers.

Family Size and Income: Average Household Income US Statistics 2026

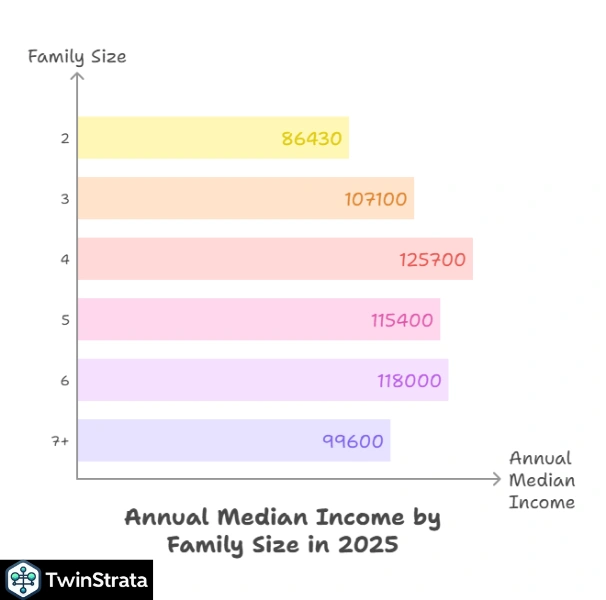

Four-person families earn most. $125,700. Two-person: $86,430. Larger? Dips to $99,600 for 7+.

| Family Size | Annual Median Income |

| 2 | $86,430 |

| 3 | $107,100 |

| 4 | $125,700 |

| 5 | $115,400 |

| 6 | $118,000 |

| 7+ | $99,600 |

Costs rise with size. Balance key.

Reddit: “Salary Needed to Live Comfortably in Each U.S State – 2025.” For four-person, $200-300k in high-cost areas. Quora: Family incomes tie to middle class.

- Tip: Plan family finances. Use stats for budgeting. Four-person? Aim high earnings.

Education’s Impact on Earnings

Higher degrees pay off. Professional degree: $2,206 weekly. No high school: $708.

| Education Level | Median Weekly Income |

| Less than HS | $708 |

| HS Diploma | $899 |

| Some College | $992 |

| Associate | $1,058 |

| Bachelor’s | $1,493 |

| Master’s | $1,737 |

| Professional | $2,206 |

| Doctoral | $2,109 |

Bachelor’s adds $600 weekly over HS.

Q1 2025: $1,258 for 25+ full-time. Reddit: Education debates.

- Benefit: Invest in education. Online courses boost pay. ROI high.

Economic Implications: How 2026 Income Trends Affect Sectors

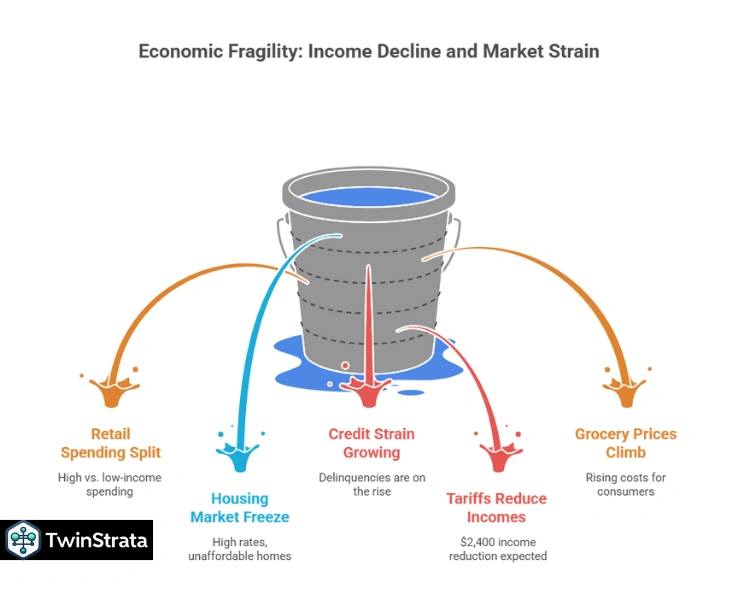

Incomes saw a decline in July 2025, highlighting economic fragility. Retail spending reflects this split: high-income individuals are splurging, while low-income earners are cutting back.

The housing market is also in a freeze, with rates between 6.6% and 7%, and homes now costing an average of $416,900—five times the median income.

In comparison, X posts highlight that it now takes 5.7 years of income to afford a home, compared to just 2.9 years in 1975. In finance, credit strain is growing, with delinquencies on the rise.

Tariffs are expected to reduce incomes by about $2,400, and grocery prices could continue to climb. On Reddit, users expressed frustration about the $80k median income, and on Quora, there’s debate over how current living standards compare to 1955.

How to Benefit

To navigate these challenges, consider investing in resilient sectors like luxury retail and essential goods. Hedge against housing risks by diversifying investments and building emergency funds.

Latest from Quora and Reddit:

Users are seeking honest insights online. On Reddit, the conversation centers around the income needed to be considered middle class in each state.

The middle class is generally defined as earning between two-thirds to twice the median income, which ranges from $65,779 to $197,356 in higher-income states. For example, a four-person household in LA County needs around $106,600.

On Quora, people are debating whether Americans’ standard of living in 2025 is lower than it was in 1955, especially in terms of income versus costs. Many also ask what salary is needed to be considered “rich,” with many pegging it at $150k+.

User Concerns: Housing Outpaces Income, Middle Class Squeezed

The general consensus points to growing concerns over housing affordability and the squeeze on the middle class. Discussions on X and Reddit highlight the strain on homeownership and the impact of tariffs on income.

Tip: Engage in forums, ask personalized questions, and tap into collective knowledge to make informed decisions.

How to Use Average Household Income US Statistics 2026 for Your Benefit

Knowledge empowers. Benchmark yourself. Set targets.

- Budgeting: If below median, cut expenses. Aim 50/30/20 rule.

- Career Moves: Target high-pay states/fields. Education ups earnings 50%.

- Investing: Low income? Start small. Roth IRA. High? Diversify.

- Relocation: Move to Maryland for boosts. Weigh costs.

- Side Hustles: Gig economy adds 20-30%.

- Policy Awareness: Vote on wage issues. Tariffs affect you.

SmartAsset: Middle class range $47,568-$142,718 in cities. Use for goals.

Quora/Reddit: Users share hacks. Network. Upskill.

FAQs About Average US Salary & Household Income

1. What is the average household income in the US in 2025?

The average household income in the US is about $87,864 in 2025, while the median household income is around $80,610, reflecting a 4% increase from 2022.

2. Which state has the highest average household income?

Maryland leads with an average household income of $90,203, followed closely by Massachusetts at $89,645 and New Jersey at $89,296.

3. Which state has the lowest average household income?

Mississippi has the lowest average household income at $48,716, followed by West Virginia at $51,248.

4. How does household income vary by race in 2025?

Asian households earn the highest median income at $112,800, followed by White non-Hispanic households at $89,100. Black households earn $56,500, and Hispanic households earn $65,500.

5. Does education level affect household income?

Yes, households with a bachelor’s degree or higher earn a median weekly income of $1,732 for individuals, compared to $899 for high school graduates.

Also Read:

- Email Marketing Statistics 2025

- Instagram Statistics 2025

- Smartwatch Statistics 2025

- Semrush AI Statistics 2025

Conclusion: Navigate 2025 with Confidence

The average household income in the U.S. in 2025 shows growth despite various challenges, with medians around $80,000. However, income gaps still exist across different demographics. Economic changes are affecting key areas like housing and retail.

To make the most of these trends, it’s important to use the data available, plan accordingly, and stay flexible. Keeping up with updates from sources like the Census Bureau and the Bureau of Labor Statistics will help you stay informed and better navigate the changing landscape.

Source: BLS.gov