Cryptocurrencies reshape how people think about money in 2025. From Bitcoin’s rise to new altcoins, the crypto world grows fast. This article dives into the number of cryptocurrencies statistics 2025, revealing how many coins exist, their market size, and user trends.

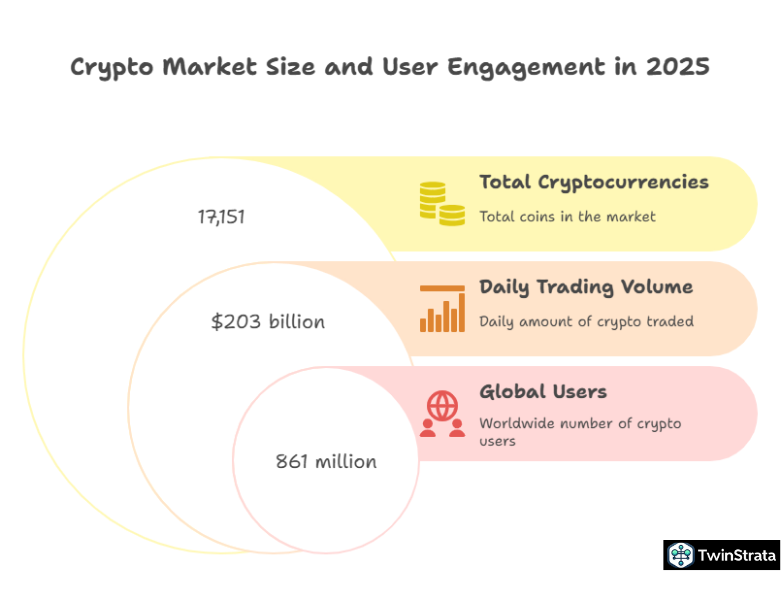

You learn why crypto matters and how you can use it to earn, invest, or explore new tech. With 17,151 cryptocurrencies and a $2.96 trillion market cap, the space offers chances for wealth and innovation.

Readers curious about crypto find clear facts here. The article uses simple English, full sentences, and active voice to explain complex ideas. Tables break down data for easy reading.

Fresh insights from Quora and Reddit show what users ask now, like how to pick coins or spot scams. Whether you’re new or experienced, you discover how to benefit from crypto’s growth.

Table of Contents

ToggleTop Number of Cryptocurrencies Statistics 2026

The crypto market thrives in 2025. Over 17,151 cryptocurrencies exist, up from 10,419 in April. Bitcoin and Ethereum dominate, holding 75% of the $2.96 trillion market cap.

Daily trading volume across 217 exchanges hits $203 billion, led by SuperEx at $163.61 billion. Crypto users reach 861 million globally, with 28% of U.S. adults owning coins. Revenue is set to hit $45.3 billion this year.

These number of cryptocurrencies statistics 2025 show a booming yet volatile market. You can invest, trade, or use crypto for payments. But with over 50% of coins failing, picking the right ones matters. This guide helps you navigate the space.

| Key Crypto Stats 2025 | Value |

| Total Cryptocurrencies | 17,151 |

| Market Cap | $2.96 trillion |

| Daily Trading Volume | $203 billion |

| Global Users | 861 million |

| U.S. Ownership | 28% |

Source: Forbes

How Many Cryptocurrencies Exist in 2026?

As of September 2025, 17,151 cryptocurrencies circulate worldwide, per CoinGecko. Not all thrive—only 10,385 stay active, as many become “dead” due to low value or abandonment. The number grows from 7 in 2013 to over 10,000 by 2024. New coins launch weekly via Initial Coin Offerings (ICOs), fueling this rise.

Bitcoin leads with a $2.1 trillion market cap, followed by Ethereum at $264.67 billion. Together, they hold 75% of the market. Altcoins like Solana and XRP gain traction, while tokens on existing blockchains add variety. You benefit by exploring active coins for investment or utility, but research is key to avoid duds.

Here’s the growth of cryptocurrencies over time:

| Year | Number of Cryptocurrencies |

| 2013 | 7 |

| 2014 | 513 |

| 2015 | 564 |

| 2016 | 663 |

| 2017 | 789 |

| 2018 | 2,073 |

| 2019 | 2,986 |

| 2020 | 5,392 |

| 2021 | 8,714 |

| 2022 | 8,856 |

| 2023 | 9,002 |

| 2024 | 10,510 |

| 2025 | 17,151 |

Also read about: PrimeXBT Review

Cryptocurrency Market Size and Growth

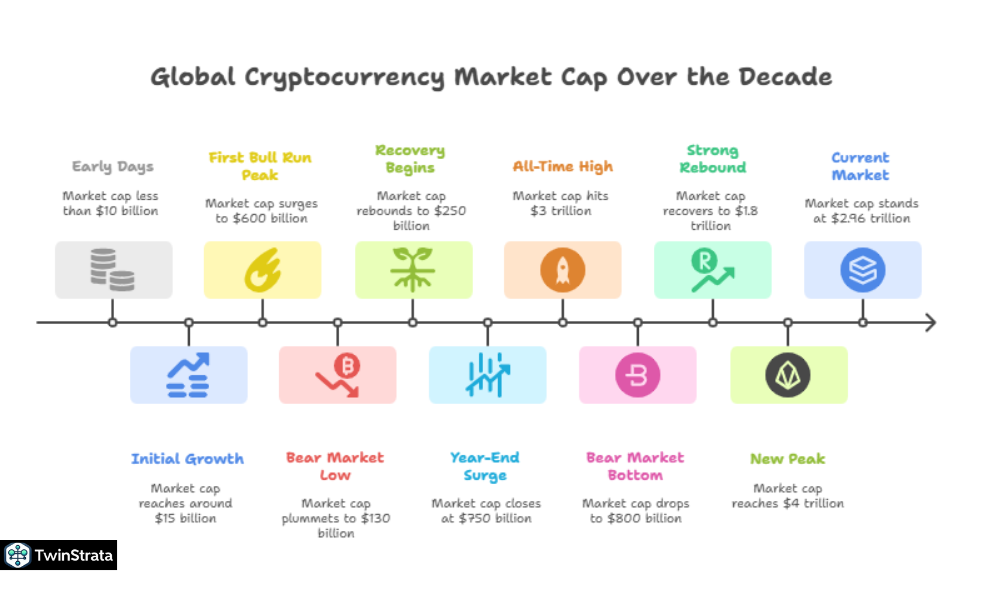

The crypto market cap stands at $2.96 trillion in 2025, down from a $4 trillion peak in 2024. Despite dips, it grows 2600% since 2017’s $100 billion. By 2030, experts predict a $69.39 billion market with a 7.11% annual growth rate. Revenue hits $45.3 billion in 2025, with the U.S. contributing $9.4 billion.

Bitcoin’s price soars to $105,510, up 12.5% in 30 days. Ethereum dips to $3,217.96, down 4.6%. Volatility defines crypto, but long-term gains attract investors. You can profit by buying during dips or holding for years.

Market cap history:

| Year | Market Cap ($ Billion) |

| 2015 | <10 |

| 2016 | 15 |

| 2017 | 600 |

| 2018 | 130 |

| 2019 | 250 |

| 2020 | 750 |

| 2021 | 3,000 |

| 2022 | 800 |

| 2023 | 1,800 |

| 2024 | 4,000 |

| 2025 | 2,960 |

Source: Statista

This table from CoinGecko tracks the market’s ups and downs. Use it to time investments or diversify into stablecoins like Tether for safety.

Types of Cryptocurrencies and Their Uses

Cryptocurrencies come in 12 types, each with unique roles. You can use them for payments, investing, or tech projects. Here’s a breakdown with stats to guide your choices.

- Payment Cryptocurrencies (e.g., Bitcoin, Litecoin) Used as digital cash. Bitcoin’s market cap is $2.1 trillion, Litecoin’s 84 million coin supply offers fast transactions. You pay for goods or transfer money globally without banks.

- Stablecoins (e.g., Tether, USDC) Pegged to assets like the dollar, Tether’s $142.69 billion market cap makes it stable for trading. USDC’s $57.23 billion is fully backed. You store value without price swings.

- Smart Contract Platforms (e.g., Ethereum, Solana) Ethereum’s $264.67 billion market cap supports 1 million daily transactions. Solana’s 65,000 TPS powers apps. You build or use decentralized apps (DApps).

- Privacy Coins (e.g., Monero, Zcash) Monero hides 95% of transactions; Zcash has 20 million private deals. You prioritize anonymity for sensitive payments.

- Utility Tokens (e.g., Chainlink, BNB) BNB’s $84.33 billion market cap cuts Binance fees. Chainlink secures $500 billion in contracts. You access platform services.

- Governance Tokens (e.g., Maker, Aave) Maker manages $8 billion in assets; Aave oversees $10 billion in DeFi. You vote on blockchain rules.

- Exchange Tokens (e.g., BNB, OKB) OKB grows 200% in two years. You save on trading fees.

- Meme Coins (e.g., Dogecoin, Shiba Inu) Dogecoin’s $29.84 billion market cap supports Tesla payments. Shiba Inu has 1.3 million holders. You trade for fun or profit.

- Gaming & Metaverse Tokens (e.g., Sandbox, Axie Infinity) Sandbox powers $500 million in virtual land; Axie hits $3 billion in NFTs. You invest in virtual worlds.

- Layer 2 & Scaling Solutions (e.g., Polygon, Arbitrum) Polygon processes 2.3 million transactions daily; Arbitrum holds $10 billion in DeFi. You cut Ethereum fees.

- Central Bank Digital Currencies (CBDCs) (e.g., Digital Yuan) China’s e-CNY has 260 million users, $14 billion in deals. You use government-backed digital cash.

- Asset-Backed Tokens (e.g., Paxos Gold, WBTC) Paxos Gold backs $500 million in gold; WBTC bridges 160,000 BTC. You own digital assets like gold.

Top Cryptocurrencies by Market Cap

Bitcoin rules with a $2.1 trillion market cap, seven times Ethereum’s $264.67 billion. Tether and XRP follow at $142.69 billion and $124 billion. Only Bitcoin and Ethereum exceed $1,000 per token; 13 of the top 20 are under $5.

Top 20 cryptocurrencies:

| Rank | Currency | Abbr. | Price ($) | Market Cap ($ Billion) |

| 1 | Bitcoin | BTC | 105,510 | 2,100 |

| 2 | Ethereum | ETH | 3,217.96 | 264.67 |

| 3 | Tether | USDT | 1.00 | 142.69 |

| 4 | XRP | XRP | 3.11 | 124 |

| 5 | BNB | BNB | 611.59 | 87 |

| 6 | Solana | SOL | 241.19 | 65 |

| 7 | USDC | USDC | 1.00 | 57.23 |

| 8 | Dogecoin | DOGE | 0.17 | 29.84 |

| 9 | Cardano | ADA | 0.67 | 24 |

| 10 | TRON | TRX | 0.24 | 22 |

| 11 | Toncoin | TON | 4.07 | 10 |

| 12 | Chainlink | LINK | 13.95 | 9.2 |

| 13 | UNUS SED LEO | LEO | 9.36 | 8.6 |

| 14 | Stellar | XLM | 0.27 | 8.4 |

| 15 | Avalanche | AVAX | 19.34 | 8 |

| 16 | Sui | SUI | 2.36 | 7.7 |

| 17 | SHIBA INU | SHIB | 0.00002 | 7.5 |

| 18 | Hedera | HBAR | 0.17 | 7.5 |

| 19 | Polkadot | DOT | 4.18 | 6.5 |

| 20 | Litecoin | LTC | 128.43 | 6.4 |

Cryptocurrency Exchanges in 2026

217 exchanges operate globally, up from 184 in 2024. SuperEx leads with $163.61 billion in 24-hour volume, dwarfing Binance’s $15.41 billion. Decentralized exchanges like Uniswap grow, handling $2 billion daily.

Top 10 exchanges:

| Exchange | 24h Volume ($ Billion) |

| SuperEx | 163.61 |

| Binance | 15.41 |

| 4E | 3.52 |

| BiFinance | 3.32 |

| HTX | 2.99 |

| Darkex Exchange | 2.95 |

| Zedcex Exchange | 2.59 |

| Bybit | 2.47 |

| MEXC | 2.45 |

| OKX | 2.30 |

Crypto Usage Demographics

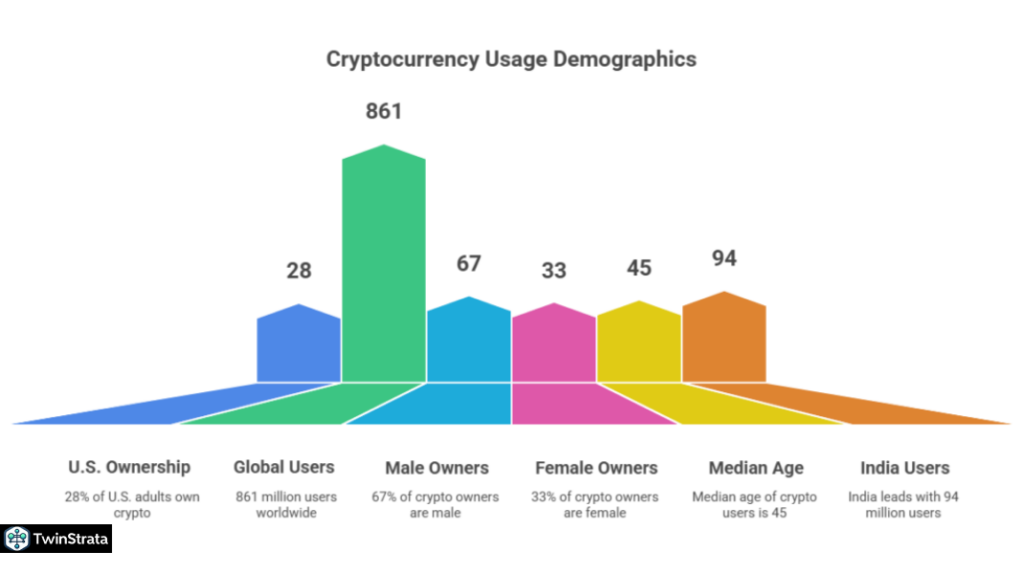

28% of U.S. adults (65 million) own crypto, up from 15% in 2021. Globally, 861 million users engage, with Asia leading at 263 million. India tops countries with 94 million users. Men dominate at 67%, and the median age is 45.

Demographics table:

| Metric | Value |

| U.S. Ownership | 28% (65 million) |

| Global Users | 861 million |

| Male Owners | 67% |

| Female Owners | 33% |

| Median Age | 45 |

| Top Country (India) | 94 million users |

Bitcoin’s Journey and Price Trends

Bitcoin, launched in 2009, sets the pace. It hits $105,510 in 2025, up from $100 in 2013. Volatility persists—90% drops in 2014, 73% in 2018. Yet, returns shine: 30,203% in 2010, 5,870% in 2013.

Bitcoin price history:

| Year | Start Price ($) | End Price ($) | Return (%) |

| 2010 | 0.00099 | 0.30 | 30,203 |

| 2011 | 0.30 | 4.70 | 1,467 |

| 2013 | 13.50 | 805 | 5,870 |

| 2017 | 960 | 13,850 | 1,338 |

| 2020 | 7,200 | 28,949 | 302 |

| 2024 | 42,000 | 100,000+ | 138+ |

| 2025 | 100,000+ | 105,510 | N/A |

You buy Bitcoin for long-term gains or trade altcoins for quick profits. Trump’s 2024 policies boost optimism, with 60% expecting value rises.

Failed Cryptocurrencies

Over 50% of coins fail—14,039 of 24,000+ are “dead” since 2014. 2021 saw 5,724 failures (70% rate). Reasons include scams, low adoption, or developer abandonment.

Failure table:

| Year | Dead Coins | Failure Rate |

| 2014 | 37 | Low |

| 2017 | 346 | ~70% |

| 2018 | 1,104 | ~70% |

| 2021 | 5,724 | ~70% |

| 2023 | 289 | <10% |

You avoid losses by researching teams, use cases, and trading volume before investing.

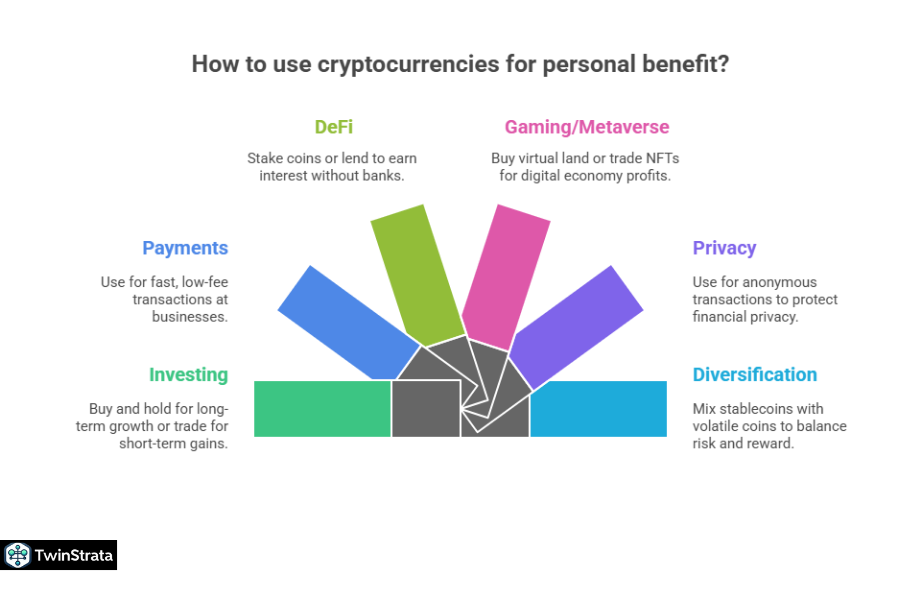

How to Use Cryptocurrencies for Your Benefit

Crypto offers wealth, freedom, and innovation. Here’s how you use it:

- Investing: Buy Bitcoin or Ethereum on exchanges like Coinbase. Hold long-term for growth or trade altcoins like Solana for short-term gains. Start small to manage risks.

- Payments: Use Dogecoin or USDT for fast, low-fee transactions. Over 18,000 businesses accept crypto. Pay for Tesla gear or online services.

- DeFi: Stake coins like Cardano for 5-7% annual returns. Use Aave to lend and earn interest. You control funds without banks.

- Gaming/Metaverse: Buy SAND for virtual land in Sandbox. Trade NFTs on Axie Infinity. You profit from digital economies.

- Privacy: Use Monero for anonymous transactions. Protect financial privacy for sensitive deals.

- Diversification: Mix stablecoins (USDC) with volatile coins (XRP). Balance risk and reward.

Start with $100 on Binance or Bybit. Use wallets like MetaMask for safety. Track prices on CoinGecko. You gain by learning trends and avoiding scams.

Latest Insights from Quora and Reddit

Reddit users discuss number of cryptocurrencies statistics 2025, citing CoinGecko’s 17,151 coins. Threads ask, “How to spot legit coins?” Users suggest checking developer activity and community size. One post warns of 70% failure rates, urging due diligence.

Quora questions focus on crypto’s future. Users ask, “Will new coins overtake Bitcoin?” Most say no, but Solana’s speed (65,000 TPS) sparks debate.

Another thread on “best altcoins for 2025” highlights Onyxcoin’s 1,550% surge. Privacy coins like Monero gain traction for security concerns, with 32% of owners fearing cyberattacks.

FAQs About Cryptocurrencies Statistics

1. How many cryptocurrencies are active in 2025?

In 2025, 17,151 cryptocurrencies exist worldwide, but only about 10,385 remain active. Many become inactive or fail due to low market value, lack of community support, or developer abandonment, as reported by CoinGecko.

2. Which cryptocurrencies should beginners invest in during 2025?

Beginners should consider investing in established cryptocurrencies like Bitcoin and Ethereum for their stability and long-term growth potential. Stablecoins like USDC offer low-risk options for those wary of volatility. Always research the project’s team and use case before investing to minimize risks.

3. How can I use cryptocurrencies for daily transactions in 2025?

You can use cryptocurrencies like Dogecoin or Tether for quick, low-fee payments at over 18,000 businesses globally, including online retailers and services like Tesla. Set up a wallet like MetaMask, load it with crypto, and check if the merchant accepts your chosen coin.

4. Why do so many cryptocurrencies fail?

Over 50% of cryptocurrencies fail, with 14,039 deemed “dead” since 2014, according to CoinGecko. Common reasons include scams, lack of real-world use, or developers abandoning projects. The 2021 crypto boom saw a 70% failure rate, highlighting the need for careful research.

5. What are the benefits of using decentralized exchanges in 2025?

Decentralized exchanges like Uniswap provide lower fees, direct control over your funds via personal wallets, and access to new tokens not listed on centralized platforms. They suit traders seeking privacy and flexibility, handling $2 billion in daily volume in 2025.

Also Read:

- Social Media Statistics

- Video Marketing Statistics

- Digital Marketing Statistics

- CRM Statistics

- Paypal Statistics

Conclusion

The number of cryptocurrencies statistics 2025 reveals a vibrant market with 17,151 coins, $2.96 trillion cap, and 861 million users. Bitcoin leads, but altcoins offer growth. You benefit by investing wisely, using crypto for payments, or exploring DeFi. Stay informed to seize opportunities.