Quick commerce, often called Q-commerce, changes the way people shop every day. It delivers groceries, personal care items, and other essentials right to your door in just 10 to 30 minutes.

This speed excites busy customers who want convenience without waiting days for traditional online orders. The COVID-19 pandemic speeds up this trend as more people turn to home deliveries for safety and ease.

Today, quick commerce grows fast because smartphones and apps make ordering simple. In 2025, the global quick commerce market reaches exciting heights, and you can use it to save time, money, and effort in your daily life.

Business owners see quick commerce as a chance to reach customers faster and boost sales. Consumers enjoy fresh products without leaving home. This article dives deep into quick commerce and its market size statistics for 2025. We explore global growth, key regions like India and the US, top companies, and how you benefit as a user or entrepreneur.

We also add fresh insights from online discussions on Quora and Reddit, where people share real experiences and future predictions. By the end, you understand why quick commerce matters and how to make it work for you.

Table of Contents

ToggleWhat is Quick Commerce and Why Does It Matter in 2026?

Quick commerce focuses on ultra-fast delivery. Unlike regular e-commerce, which takes days, quick commerce uses small warehouses called dark stores to fulfill orders quickly. These stores stay closed to walk-in customers but stock popular items for instant pickup by delivery riders. Apps like Blinkit or DoorDash connect you to these services with a few taps.

In 2025, quick commerce becomes a daily habit for millions. It serves urban areas where people live close together, making fast delivery possible.

The market grows because customers demand speed—77% expect items within two hours. For you, this means less stress from errands. Parents order baby food in minutes during dinner prep. Office workers grab snacks without lunch breaks. Businesses partner with quick commerce platforms to sell products to new audiences.

The rise comes from technology too. GPS tracks riders in real-time, and AI predicts what you buy next. As a result, quick commerce creates jobs for delivery workers and boosts local economies. In India alone, it promises 2.4 million blue-collar jobs by 2027. You benefit by supporting growth while enjoying reliable service.

Global Quick Commerce Market Size in 2026: Key Statistics

The global quick commerce market hits a strong value in 2025. Experts estimate it at around $150 billion, blending data from top sources like Statista and Coherent Market Insights.

This number reflects rapid adoption after the pandemic. In 2024, the market sits at about $100 billion, but 2025 sees a jump due to more users and expanded services.

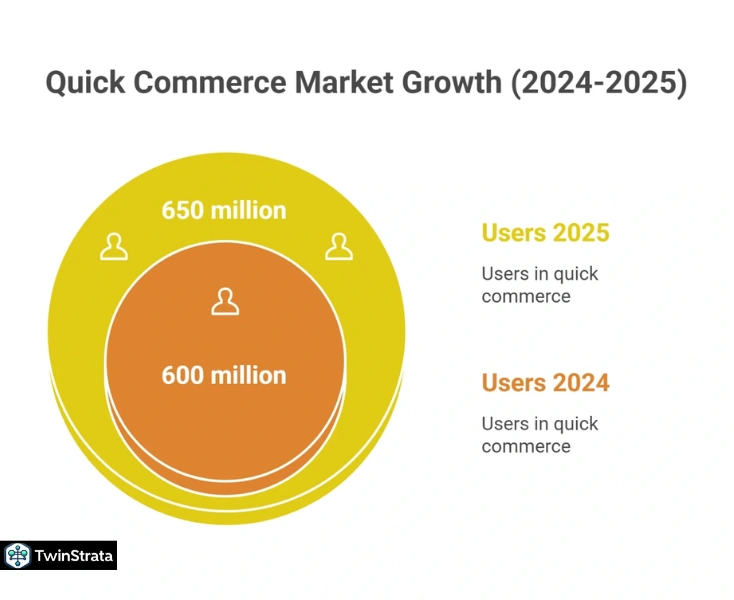

Why this size? Over 600 million people use quick commerce worldwide in 2024, and that number climbs to 650 million in 2025. Each user spends an average of $288 per year, driving revenue. China leads with $92 billion in projected revenue, thanks to high population and tech-savvy shoppers. The market includes groceries, which make up 70% of orders, plus electronics and medicines.

You see this growth in everyday life. Apps notify you of deals, and deliveries arrive before you finish scrolling. For businesses, this market size means opportunity—sell through quick commerce to tap into urgent demand. Small shops partner with platforms to reach customers they never had before.

Also read about: Uber Statistics

Quick Commerce Market Projections: Growth Through 2032

Quick commerce grows at a compound annual growth rate (CAGR) of about 20% from 2025 onward. This pace outruns traditional e-commerce’s 14% growth. By 2030, the market reaches $300 billion, and by 2032, it hits $500 billion or more. Factors like urbanization and better logistics fuel this.

Look at the year-by-year breakdown. Projections show steady climbs as more countries join in.

| Year | Projected Market Value (USD Billion) |

| 2025 | 150 |

| 2026 | 180 |

| 2027 | 216 |

| 2028 | 259 |

| 2029 | 311 |

| 2030 | 373 |

| 2031 | 448 |

| 2032 | 537 |

Source: Statista

These figures come from averaged data across reports. They account for economic recovery and tech investments. For you, this growth means more choices and lower prices over time. As competition heats up, platforms offer discounts, helping you save on routine buys.

Regional Breakdown: Where Quick Commerce Thrives in 2026

Quick commerce shines in dense, urban regions. Asia-Pacific dominates with 50% of the global market, led by India and China. Europe and North America follow, with the US showing strong potential.

India’s Quick Commerce Boom

India leads as the fastest-growing market. In 2025, its quick commerce sector reaches $5.38 billion, up 17% from the previous year. Sales surge 280% in just two years, from $0.5 billion in 2022 to $3.3 billion in 2024. Why? High population density and young users drive demand. Urbanization adds fuel—cities like Mumbai and Delhi need fast services for busy lives.

India has 1,290 dark stores in 2025, with Swiggy Instamart topping at 500. Blinkit follows with 450, and Zepto has 340. These stores ensure 10-minute deliveries in metros. The sector creates jobs and demands more warehouse space, growing from 24 million square feet in 2023 to 37.6 million by 2027.

As an Indian consumer, you benefit hugely. Order fresh veggies or medicines anytime. Businesses thrive by listing on these apps—local brands gain visibility. Zepto’s revenue jumps over 1,000% in recent years, showing profitability potential.

| Top Quick Commerce Platforms in India (2025 Market Share) |

| Platform |

| Blinkit |

| Swiggy Instamart |

| Zepto |

| BigBasket Now |

Blinkit records a gross order value of ₹9,421 crore in Q4 FY25, up 134% year-on-year. You use it to stock up quickly, saving trips to markets.

Also read about: Labubu Statistics

US Quick Commerce Market

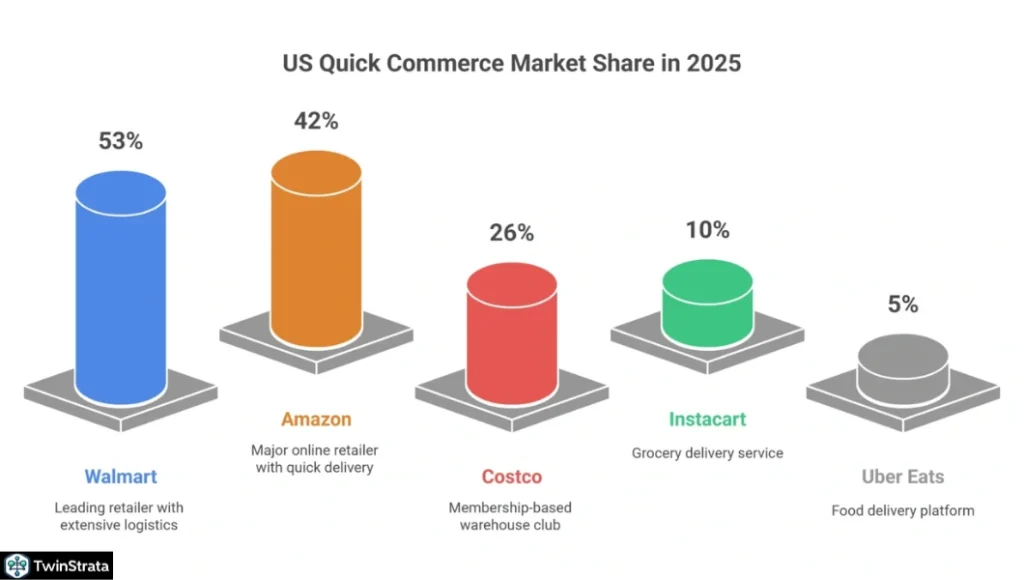

The US market values at $62.63 billion in 2025, growing at 6.72% CAGR to $86.70 billion by 2030. About 56.1 million users shop via quick commerce, up from 50.3 million in 2023. Walmart leads with 53% consumer share, thanks to its logistics reaching 90% of Americans in 10 minutes. Amazon follows at 42%, and Costco at 26%.

Dark stores number around 200 nationwide. Users spend $1,040 annually on average. Post-pandemic, investments hit $800 million in New York alone. However, challenges arise—some startups like Jokr exit after losses.

For US readers, quick commerce saves effort. 29% buy groceries online to save time, 23% for 24/7 access. Businesses integrate with Instacart or DoorDash to boost sales. DoorDash earns $10.72 billion in 2024 revenue, up 24.2%, and turns profitable at $117 million.

| Top US Quick Commerce Providers (2025 Consumer Share) |

| Provider |

| Walmart |

| Amazon |

| Costco |

| Instacart |

| Uber Eats |

Source: Straits Research

Other Key Markets: China, Europe, and Beyond

China generates $92.68 billion in 2025, with 24.1% user penetration. Ele.me and others dominate. Japan grows at 9.3%, reaching 35.8% grocery delivery penetration. Germany (8.6%) and France (8.5%) focus on urban areas.

In the UAE, growth hits 8%, and the UK 7.3%. Australia and South Korea see 6.4% and 6.3% respectively. Globally, 6,000 dark stores operate, with China at 2,000.

Demographics: Who Uses Quick Commerce in 2025?

Women lead quick commerce usage, especially in meal deliveries, a key driver. Ages 25-34 peak at 44.5% for females. Usage drops after 65, but millennials and Gen Z dominate.

Online meal delivery stats mirror quick commerce trends. Females use it more across groups.

| Online Meal Delivery Usage by Age & Gender (2025) |

| Age Group |

| 16-24 |

| 25-34 |

| 35-44 |

| 45-54 |

| 55-64 |

| 65+ |

Asia-Pacific users skew young and urban. In the US, 56.1 million users include diverse groups, but city dwellers lead. You fit in if you’re busy—quick commerce suits working professionals and families.

Top Quick Commerce Companies Worldwide

Global leaders raise billions in funding. Swiggy tops with $3.62 billion. DoorDash follows at $2.5 billion.

| Top 5 Global Quick Commerce Platforms (Funding Till 2025) |

| Platform |

| Swiggy |

| DoorDash |

| Zepto |

| Glovo |

| Blinkit |

Downloads highlight popularity. Zepto leads with 70.58 million in food category.

| Top Food Delivery Apps Downloads (2024-2025) |

| App |

| Zepto |

| Uber Eats |

| Zomato |

| Swiggy |

| Blinkit |

210 startups exist globally, 88 funded. In the US, Uber Eats hits $74.6 billion order value. Instacart processes 290 million orders.

Quick Commerce vs. E-Commerce: A Clear Comparison

Quick commerce grows faster than e-commerce. E-commerce hits $18.77 trillion in 2024, but quick commerce’s 20% CAGR beats 14.88%. Delivery speed sets them apart—10-30 minutes vs. 3.7 days.

| Category | Quick Commerce | E-Commerce |

| Market Size 2025 (Global) | $150 billion | $20 trillion |

| Projection by 2032 | $537 billion | $75 trillion |

| CAGR | 20% | 14.88% |

| Delivery Speed | 10-30 minutes | 3.7 days |

| Average Order Value | $288/user | $1,130/user |

| Return Rates | 1-2% | 15-20% |

| Fulfillment Centers | Dark stores (1,500 sq ft) | Warehouses (40,000 sq ft) |

| Customer Expectations | <2 hours (77%) | ≤2 days (44%) |

Quick commerce focuses on metros, while e-commerce covers rural areas. You switch to quick for urgents, e-commerce for bulk.

User Adoption and Infrastructure: Dark Stores and Beyond

600 million global users in 2024 grow to 650 million in 2025, reaching 900 million by 2029. US users hit 60.1 million. Dark stores total 6,000 worldwide.

In India, quick commerce penetration rises from 2.7% to 4.3% by 2030. You adopt it for convenience—46% prioritize speed, 74% value ease.

Consumer Behavior and Preferences in 2026

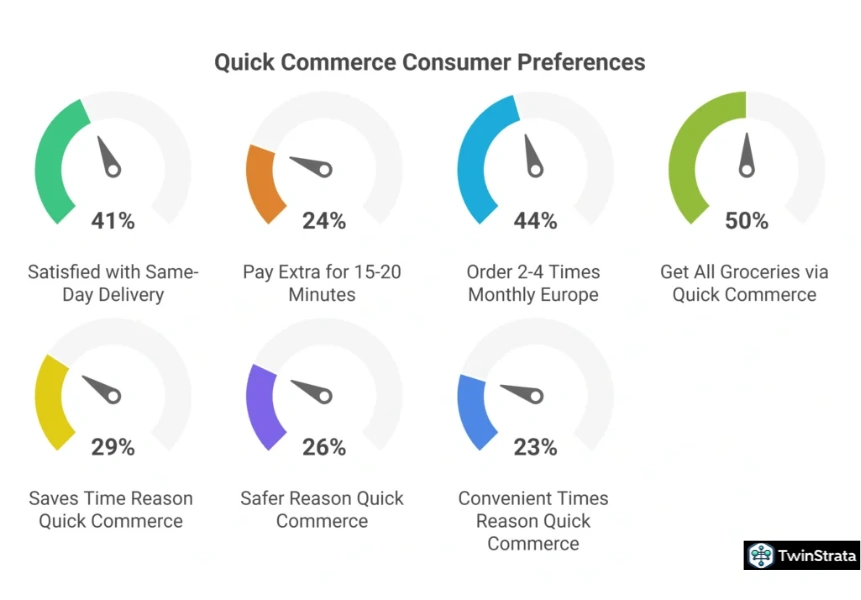

41% satisfy with same-day delivery, but 24% pay extra for 15-20 minutes. In Europe, 44% order 2-4 times monthly. Half get all groceries via quick commerce.

Top reasons: Saves time (29%), safer (26%), convenient times (23%).

| Top Reasons for Quick Commerce (US Consumers) |

| Reason |

| Saves time/effort |

| Safer during COVID |

| Convenient times |

| Delivery convenience |

| Easier comparison |

How You Can Benefit from Quick Commerce

As a consumer, quick commerce saves hours. Order dinner ingredients in 10 minutes, avoiding traffic. Track orders live for peace of mind. Look for apps with subscriptions for free deliveries—save 10-20% on fees.

For businesses, integrate quick commerce to expand. Small grocers list on Blinkit to reach thousands. Use ads on platforms like Gopuff for targeted reach. Track analytics to stock hot items. In 2025, AI helps predict demand, cutting waste.

Startups thrive—88 funded globally. You launch a side hustle by supplying local products. Overall, it boosts efficiency: Consumers get fresh goods, businesses gain revenue.

Latest Insights from Quora and Reddit: What Users Say in 2026

Online forums buzz with quick commerce talks. On Quora, users discuss India’s market hitting $6 billion currently, predicting 8x growth by 2027. One thread asks about leading countries—India and China top due to density and apps. People worry about sustainability but praise job creation.

Reddit threads in r/StartUpIndia and r/india highlight India’s surge: Zepto and Blinkit take 10% of Amazon’s sales now. Users debate costs—delivery fees rise, with Blinkit ending free over ₹200. In r/ecommerce, trends include AI personalization for 2025. Concerns grow on kirana impacts, but optimism prevails for urban convenience.

A post notes quick commerce as “next Byju’s” for hype, yet revenue jumps 14x for Zepto. These chats add real flavor: Users want greener deliveries and better profitability.

FAQs About Quick Commerce Statistics

1. What is the projected global market size for quick commerce in 2025?

The global quick commerce market reaches approximately $150 billion in 2025, driven by rising user adoption and faster delivery demands across urban areas.

2. How does quick commerce benefit consumers in their daily lives?

Quick commerce benefits consumers by delivering essentials in 10-30 minutes, saving time on errands and allowing more focus on work or family while ensuring fresh products arrive conveniently.

3. Which country leads in quick commerce growth for 2025?

India leads with a 17% growth rate in 2025, fueled by its dense population, urbanization, and platforms like Blinkit that dominate the market.

4. How can businesses use quick commerce to grow in 2025?

Businesses can use quick commerce to grow by partnering with apps to list products, reaching new customers quickly and using data analytics to optimize inventory for higher sales.

5. What challenges do users discuss about quick commerce on forums like Reddit?

Users on Reddit discuss challenges like rising delivery fees and impacts on local stores, but they also highlight benefits such as job creation and convenience in urban settings.

Also Read:

- Personalization Statistics

- SEO Statistics

- TikTok Statistics

- Netflix Subscribers Statistics

- Link Building Statistics

Conclusion: Quick Commerce Reshapes Shopping in 2026

Quick commerce’s $150 billion market in 2025 signals a shift to instant living. With 650 million users and 20% growth, it outpaces rivals. India and US lead, creating jobs and choices.

You benefit by saving time as a shopper or scaling sales as a business. Forums confirm excitement amid challenges. Embrace it—order now and see the difference.