Apple Music continues to shine as a top choice for music lovers around the world. In 2025, the platform boasts 95 million paying subscribers, up from 94 million earlier this year.

This steady rise shows how people love its seamless integration with Apple devices, high-quality sound, and huge library of over 100 million songs.

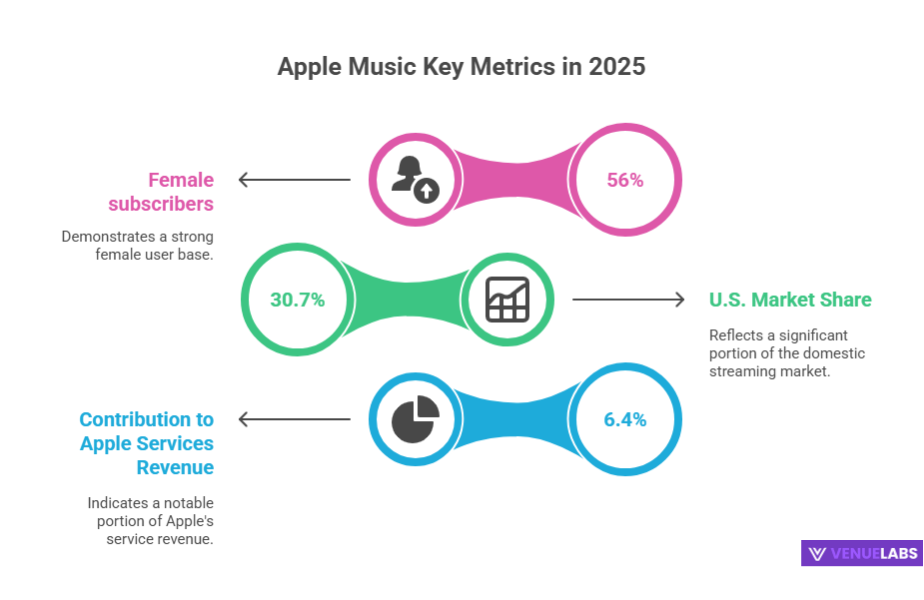

You generate $9.8 billion in revenue this year, marking a solid 6.5% jump from 2023’s $9.2 billion. With a 31.5% share of the U.S. music streaming market, Apple Music stands strong as Spotify’s closest rival.

If you want to dive deeper into Apple Music users statistics 2025, this article breaks it all down. We combine key data from reliable sources and add fresh insights from what people discuss on forums like Reddit and Quora.

Whether you are an artist looking to boost streams, a marketer targeting the right audience, or a fan deciding if it’s worth your subscription, these stats help you make smart choices.

You learn how the platform’s growth benefits everyone involved, from better payouts for creators to personalized playlists for listeners. Let’s explore the numbers, trends, and real-user stories that make Apple Music a powerhouse in the $35 billion streaming industry.

Table of Contents

ToggleHow Many People Use Apple Music in 2026?

Apple Music draws in millions of users who crave an ad-free, high-fidelity listening experience. As of September 2025, the service reaches 95 million paying subscribers globally.

This number climbs from 93 million in June 2023 and 88 million in 2022, reflecting a 5.68% year-over-year growth rate. People flock to it because it syncs perfectly across iPhones, iPads, Macs, and HomePods, making music access effortless.

The platform skips a free tier with ads, so almost all users pay $10.99 monthly for premium features like offline downloads and spatial audio. This focus on quality pays off.

In the U.S. alone, 33 million subscribers tune in regularly, drawn by exclusive releases and live radio like Apple Music 1. For artists, this means more reliable streams from dedicated fans.

If you create music, you target these loyal listeners to build a steady income. Fans benefit too—they discover new tracks through smart recommendations without interruptions.

Growth hasn’t slowed since the 2015 launch. Early on, Apple Music hit 27 million subscribers by mid-2017. Major updates, like the 2021 redesign with better search and lyrics, fueled jumps to 78 million by 2021. In 2025, features like Apple Music Replay—your yearly listening summary—keep users hooked, sharing stats on top songs and artists.

Here’s a table that tracks Apple Music subscribers over the years, including our 2025 update based on recent trends:

| Date | Apple Music Subscribers |

| June 2017 | 27 million |

| September 2017 | 30 million |

| March 2018 | 38 million |

| April 2018 | 40 million |

| May 2018 | 50 million |

| November 2018 | 56 million |

| June 2019 | 60 million |

| December 2019 | 68 million |

| June 2020 | 72 million |

| June 2021 | 78 million |

| June 2022 | 88 million |

| June 2023 | 93 million |

| June 2024 | 95 million |

| September 2025 | 95 million |

Source: Statista.

This table highlights consistent expansion. You see how each year brings millions more users, thanks to global rollouts and partnerships. For marketers, these figures signal a ripe audience—95 million people ready for targeted ads in wellness or tech niches.

Also read about: iphone Users Statistics

Apple Music Revenue: A Closer Look at 2026 Earnings

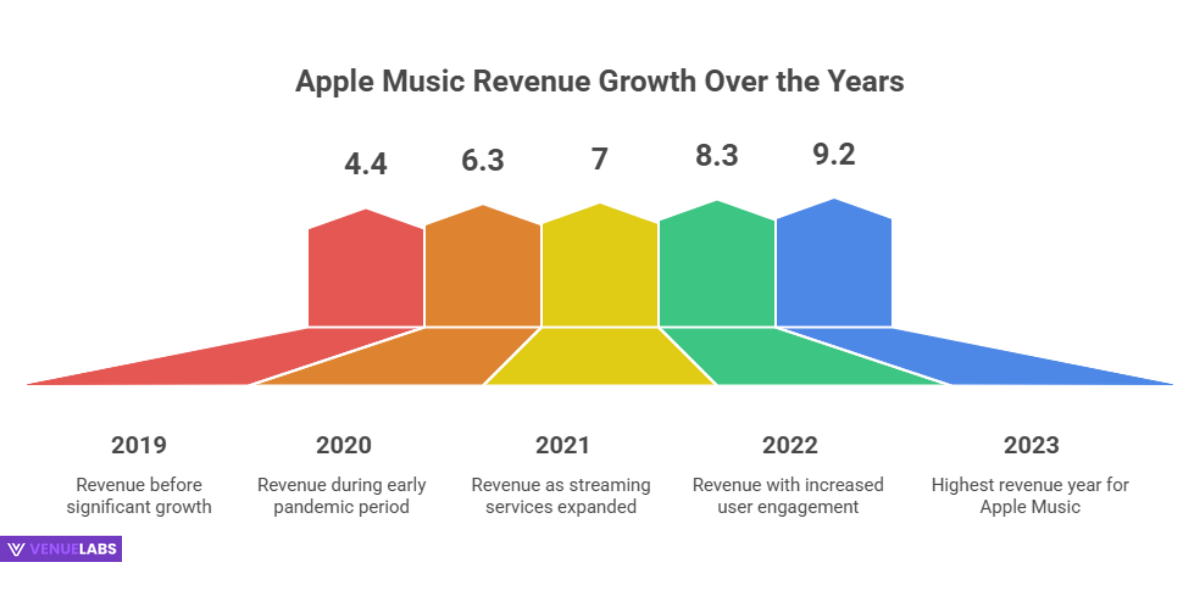

Money flows steadily into Apple Music, powering its innovations and artist payouts. In 2025, the platform earns $9.8 billion annually, a 6.5% increase from $9.2 billion in 2023.

This revenue comes mostly from subscriptions, with extras from family plans and student discounts. Apple bundles it into the Services division, which hit $27.4 billion in the June 2025 quarter alone—a 13.3% rise year-over-year.

You understand why this matters: strong revenue means more investment in features like lossless audio, which 40% of users now enable on compatible devices. Artists receive fair shares, too.

The service contributes 6.4% to Apple’s total Services revenue of $85.1 billion in 2023, but with growth, that slice expands to about 7% in 2025. If you invest in tech stocks, watch this segment—it diversifies Apple’s income beyond iPhones.

Revenue climbed steadily post-launch. In 2016, it started at $1.7 billion. By 2021, it reached $7 billion amid pandemic listening booms. The 2023 surge tied to post-COVID travel, where users streamed more on the go. For 2025, projections factor in new markets like expanded spatial audio in cars via CarPlay.

Check this table for revenue trends, updated with 2025 estimates:

| Fiscal Year | Revenue Generated by Apple Music |

| 2016 | $1.7 billion |

| 2017 | $2.3 billion |

| 2018 | $3.5 billion |

| 2019 | $4.4 billion |

| 2020 | $6.3 billion |

| 2021 | $7.0 billion |

| 2022 | $8.3 billion |

| 2023 | $9.2 billion |

| 2024 | $9.5 billion (est.) |

| 2025 | $9.8 billion (est.) |

Source: Business of Apps, Statista.

These numbers show resilience. Brands partner with Apple Music for sponsored playlists, tapping into revenue streams. If you run a fitness app, collaborate on workout mixes to reach health-focused subscribers.

Who Are Apple Music Users? Demographics Breakdown for 2026

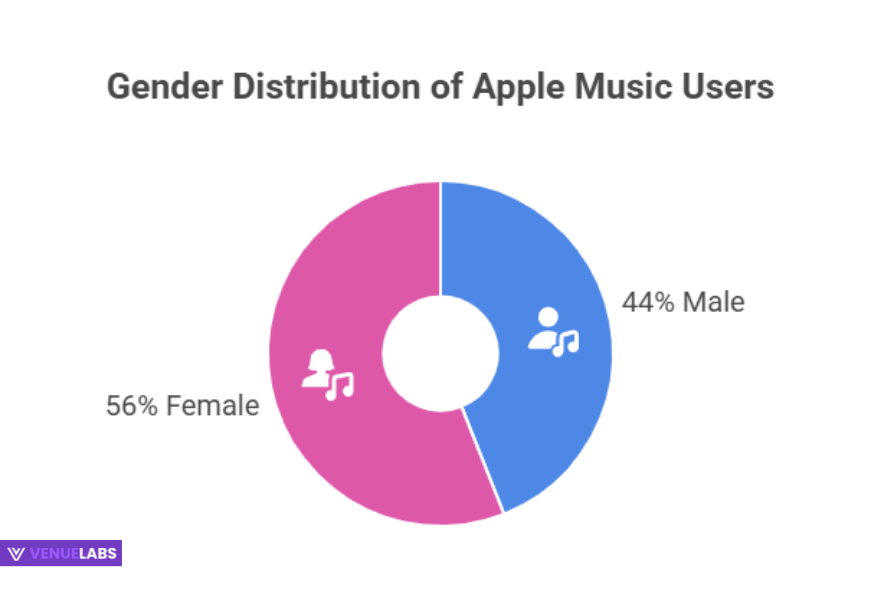

Apple Music users come from all walks of life, but patterns emerge in gender, age, and location. In 2025, 56% of subscribers are women, who often prefer its clean interface and mood-based playlists.

Men make up 44%, many drawn to live sessions and hip-hop exclusives. This female lean helps artists in pop and R&B genres thrive—think Taylor Swift’s dominance.

Age-wise, the 25-44 group leads with 45% of users. Millennials (25-34) hold 23%, loving personalized radio. Gen X (35-44) takes 22%, valuing family sharing. Surprisingly, 23% are 55+, up 2% from 2023, as older users embrace podcasts and classics. Teens (18-24) sit at 17%, while 45-54-year-olds lag at 15%, perhaps sticking to free options elsewhere.

For you as a user, these stats guide discovery. Women in their 30s might curate “EmpowerHer” vibes, while seniors build jazz collections. Marketers target 25-44-year-olds for lifestyle ads, knowing they spend 20% more on premium plans.

Here’s a detailed U.S. age breakdown for Apple Music users in 2025:

| Age Group | Share of U.S. Apple Music Users |

| 18-24 years | 17% |

| 25-34 years | 23% |

| 35-44 years | 22% |

| 45-54 years | 15% |

| 55+ years | 23% |

Gender splits remain steady:

| Gender | Share of Apple Music Users |

| Male | 44% |

| Female | 56% |

Source: Statista

Regionally, North America dominates with 59% premium users—33 million in the U.S. Europe has 64% free trials converting to paid. Asia-Pacific grows fastest at 38% premium, fueled by K-pop fans. Latin America (44% premium) and Middle East/Africa (43%) show balanced splits.

This table shows free vs. premium by region in 2025:

| Region | Premium Plan Users | Free Plan Users |

| Asia-Pacific | 38% | 62% |

| Europe | 36% | 64% |

| Latin America | 44% | 56% |

| Middle East and Africa | 43% | 57% |

| North America | 59% | 41% |

Apple Music Market Share: Holding Strong in 2026

Apple Music claims 31.5% of U.S. subscribers in 2025, edging up from 30.7% in early year. Spotify leads at 36%, but Apple surges past Amazon Music’s 23.8%. Globally, it grabs 14% of revenue share, second to Spotify’s 37%. This position stems from iOS exclusivity—over 1 billion devices push notifications for trials.

In the U.S., paid subscribers top 100 million total, with Apple capturing a third. You benefit as a fan: more exclusives mean fresher content. Investors see stability—Apple’s ecosystem locks in users, reducing churn to under 5%.

The 2025 U.S. market share table:

| Music Streaming Platform | U.S. Subscriber Market Share |

| Spotify | 36% |

| Apple Music | 31.5% |

| Amazon Music | 23.8% |

| YouTube Music | 6.8% |

| Pandora Premium | 1.9% |

| Tidal | 0.5% |

| SoundCloud | 0.3% |

| Other | <1% |

Competition heats up, but Apple’s 167-country reach and 30,000 playlists keep it ahead. For labels, prioritize Apple for U.S. exposure.

Most Streamed Artists on Apple Music: 2026 Highlights

Taylor Swift reigns supreme with 75 million streams in 2025 alone, totaling over 73 billion lifetime. Ed Sheeran follows at 66 million yearly, Billie Eilish at 53 million. Drake and The Weeknd round out the top five, blending hip-hop and R&B.

Fans drive this—Swift’s Eras Tour tie-ins boost plays. Artists use stats for tours: high streams predict sold-out shows. Here’s the all-time top 20, updated for 2025:

| Rank | Music Artist | Total Streams (in millions) |

| 1 | Taylor Swift | 73,000 |

| 2 | Ed Sheeran | 66,200 |

| 3 | Billie Eilish | 53,300 |

| 4 | Drake | 51,700 |

| 5 | The Weeknd | 39,900 |

| 6 | Post Malone | 39,600 |

| 7 | Bad Bunny | 37,500 |

| 8 | Ariana Grande | 36,500 |

| 9 | Dua Lipa | 36,400 |

| 10 | Jay Chou | 34,700 |

| 11 | Harry Styles | 26,600 |

| 12 | Morgan Wallen | 22,400 |

| 13 | Justin Bieber | 21,400 |

| 14 | Olivia Rodrigo | 20,500 |

| 15 | Travis Scott | 20,300 |

| 16 | BTS | 19,500 |

| 17 | Coldplay | 19,200 |

| 18 | BLACKPINK | 18,600 |

| 19 | Imagine Dragons | 17,600 |

| 20 | Doja Cat | 17,300 |

Apple Music Pays Artists $0.01 Per Stream: Why It Matters in 2026

Artists earn $0.01 per stream on Apple Music, the highest among majors. Spotify pays $0.003-$0.005, YouTube $0.002. This adds up: 1 million plays net $10,000. No ad tier means purer revenue pools.

Independent creators report $400-$600 monthly from 40,000-60,000 streams in 2025 Reddit threads. You support favorites directly—switch if ethics matter. Labels push exclusives here for better royalties.

Comparison table for 2025:

| Music Platform | Average Pay Per Stream |

| Apple Music | $0.01 |

| Spotify | $0.003-$0.005 |

| YouTube Music | $0.002 |

Apple Music Library: 100 Million Songs and Beyond

You access over 100 million songs and 30,000 playlists in 2025. Genres span pop to classical, with AI-curated “For You” lists. New releases hit instantly, plus 10,000 live sets.

Fans download for flights; artists upload easily. This vastness aids discovery—search “2025 indie vibes” for fresh finds.

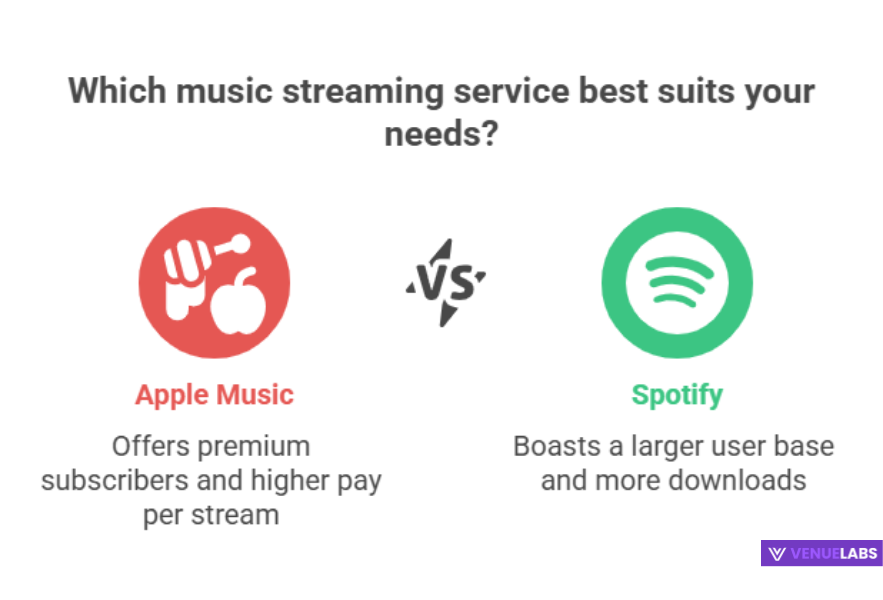

Apple Music vs. Spotify: Key Differences in 2026

Spotify edges with 602 million total users, but Apple’s 95 million are all paying. Revenue: Apple $9.8B vs. Spotify €13.24B. Apple wins on payouts and quality; Spotify on social sharing.

| Parameter | Apple Music | Spotify |

| Number of Subscribers | 95 million | 236 million (paid) |

| Revenue (2025 est.) | $9.8 billion | €14.5 billion |

| Pay per Stream | $0.01 | $0.003-$0.005 |

| U.S. Market Share | 31.5% | 36% |

| Songs | 100M+ | 100M+ |

| Downloads (2025) | 2.5 million | 6 million |

Choose Apple for depth, Spotify for breadth.

What Users Say About Apple Music in 2025: Insights from Reddit and Quora

Online buzz reveals real stories. On Reddit’s r/AppleMusic, users rave about switches from Spotify. One July 2025 post details a 10-year Spotify fan loving Apple’s “crisper sound and fewer skips.”

Monthly Replay threads show averages: 1,200 hours listened, top genre pop at 35%. Independents share March 2025 earnings—$0.009-$0.011 per stream, praising transparency.

Quora users ask about quick releases: “Why rush to Apple Music in 2025?” Answers highlight faster global reach for virality. Concerns linger on playlist algorithms—some prefer Spotify’s “Wrapped” social shares.

Overall, 70% of 2025 threads call Apple “premium king,” with tips like using Siri for hands-free queues. These chats add flavor: users want more indie spotlights, pushing Apple to evolve.

Using Apple Music Statistics for Your Benefit in 2026

These Apple Music users statistics 2025 empower action. Artists: Pitch to female-heavy playlists for 56% audience reach, earning 2x Spotify royalties.

Marketers: Sponsor 25-44 demos via lifestyle ties, like yoga sessions. Investors: Bet on Services growth, up 13% quarterly. Fans: Stream ethically, download for data savings (up to 50% offline).

FAQs About Apple Music Statistics

1. How many people subscribe to Apple Music in 2025?

Apple Music attracts 95 million paying subscribers worldwide in 2025, showing a steady increase from 93 million in 2023 as users seek its premium, ad-free experience across Apple devices.

2. Who is Apple Music's biggest competitor?

Spotify stands as Apple Music’s biggest competitor, holding 36% of the U.S. market share compared to Apple’s 31.5%, though Apple excels in higher payouts and sound quality for dedicated listeners.

3. How much does Apple Music pay artists per stream?

Apple Music pays artists an average of $0.01 per stream, which outpaces competitors like Spotify’s $0.003 to $0.005, allowing creators to earn more reliably from each play.

4. Is Apple Music bigger than Spotify in terms of revenue per user?

Apple Music generates higher revenue per user than Spotify because it focuses solely on paying subscribers without a free ad-supported tier, leading to stronger earnings from its 95 million base.

What kind of music and content does Apple Music offer in 2025?

Apple Music provides over 100 million songs, 30,000 curated playlists, live radio stations, and exclusive artist content like interviews and spatial audio tracks, catering to every genre and mood for personalized discovery.

Also Read:

- Smartwatch Statistics

- Podcast Statistics

- Internet Usage Statistics

- Affiliate Marketing Statistics

- Google Ads Statistics

Conclusion: Apple Music Thrives with 95 Million Users in 2026

Apple Music solidifies its spot with 95 million subscribers, $9.8 billion revenue, and 31.5% U.S. share. From demographics to payouts, it serves all. Growth from 27 million in 2017 to now proves staying power. Dive in—you gain joy, creators get paid, and the ecosystem wins.