CFI

- Teaches practical financial skills

- Focus on real-world finance tools

- Flexible online learning

- Recognized by finance professionals

CFA

- Globally respected qualification

- Focuses on investment management

- Demands extensive exam prep

- Offers strong career prospects

FRM

- Specializes in risk management

- Recognized in banking and finance

- Covers market and credit risks

- Builds skills for managing financial risks

The finance industry continues to demand professionals with specialized skills and recognized credentials. In 2026, earning the right certification can significantly boost your career prospects, increase your earning potential, and open doors to senior positions in finance and banking.

After researching the current landscape and analyzing cost-effectiveness, career impact, and industry recognition, I have identified the seven best finance certifications for 2026.

Each certification serves different career paths, but all provide substantial value for finance professionals.

Table of Contents

Toggle7 Best Finance Certifications In 2026

1. CFI Certifications (Corporate Finance Institute)

Best For: Finance professionals seeking practical, job-ready skills in financial modeling, analysis, and corporate finance

Overview

CFI has emerged as the leading online platform for practical finance education, serving over 2.8 million professionals across 190 countries. Unlike traditional academic programs, CFI focuses exclusively on teaching the exact skills that finance professionals use daily in their work.

Available Certifications

CFI offers seven specialized certifications, each targeting specific finance careers:

- FMVA (Financial Modeling & Valuation Analyst): Investment banking, corporate finance, equity research

- FPAP (Financial Planning & Analysis Professional): FP&A roles, corporate finance

- CBCA (Commercial Banking & Credit Analyst): Commercial banking, credit analysis

- CMSA (Capital Markets & Securities Analyst): Asset management, trading

- BIDA (Business Intelligence & Data Analyst): Data analysis, business intelligence

- FPWMP (Financial Planning & Wealth Management Professional): Wealth management, financial planning

- FTIP (FinTech Industry Professional): FinTech, digital banking

Cost Structure

- Self-Study Plan: $497 per year (currently $298.20 with 40% discount)

- Full-Immersion Plan: $847 per year (currently $508.20 with 40% discount)

- Student Plans: 50% discount (as low as $248.50 per year)

- Access: Unlimited access to all 7 certifications plus 250+ courses

Time to Complete

- Individual certifications: 3-6 months

- Study commitment: 8-10 hours per week

- All programs are self-paced

Why CFI Ranks #1

Unmatched Value for Money:

- At $298-$508 per year, you get access to all 7 certifications

- Compare to CFA ($3,520-$4,600) or MBA programs ($50,000-$150,000)

- Cost per certification if you complete all 7: $43-$73

Practical, Job-Ready Skills:

- Learn by building actual financial models used in investment banking

- Heavy emphasis on Excel mastery

- Real-world case studies and templates

- Directly applicable to daily finance work

Industry Recognition:

- Trusted by teams at Goldman Sachs, JPMorgan, Deloitte, PwC, Bloomberg

- 75% of learners report career advancement within months

- Particularly valued in investment banking and corporate finance

Comprehensive Support:

- AI Tutor for instant help (Full-Immersion)

- One-on-one expert guidance sessions

- Personalized financial model reviews

- Resume reviews and career support

- 550+ CPE/CPD credits

Blockchain-Verified Credentials:

- Instantly verifiable by employers

- Permanent digital certificates

- Professional credibility

Career Impact

CFI certifications have helped thousands transition into finance roles:

- Investment banking analysts

- Financial modelers

- FP&A professionals

- Corporate finance managers

- Credit analysts

Ideal Candidates

- Finance students seeking practical skills

- Working professionals advancing their careers

- Career changers entering finance

- Anyone needing hands-on financial modeling expertise

2. CFA (Chartered Financial Analyst)

Best For: Investment management, portfolio management, and equity research professionals

Overview

The CFA charter is the most prestigious credential in investment management, offered by the CFA Institute. It represents the gold standard for investment professionals globally.

Certification Structure

The CFA program consists of three progressive levels:

- Level 1: Foundational knowledge of investment tools

- Level 2: Asset valuation and application

- Level 3: Portfolio management and wealth planning

Cost Structure

New 2026 Pricing (Enrollment Fee Eliminated):

- No enrollment fee (previously $350)

- Level 1 Early Registration: $1,140 (increased from $990)

- Level 1 Standard Registration: $1,490 (increased from $1,290)

- Level 2 Early Registration: $1,140 (increased from $990)

- Level 2 Standard Registration: $1,490 (increased from $1,290)

- Level 3 Early Registration: $1,240 (increased from $1,090)

- Level 3 Standard Registration: $1,590 (increased from $1,390)

Total Cost:

- Minimum (all early registrations): $3,520

- Maximum (all standard registrations): $4,570

- Additional costs: Study materials ($750-$1,500 per level)

Time to Complete

- Minimum duration: 2-4 years

- Study time per level: 300-400 hours

- Pass rates: 40-45% per level

- Exams offered: Four times per year

Requirements

- Bachelor’s degree or equivalent

- 4,000 hours of qualified work experience

- Pass all three levels

- Member of CFA Institute ($299 annually)

Career Impact

CFA charterholders work in:

- Portfolio management

- Investment research

- Risk management

- Asset management

- Private equity

- Hedge funds

Strengths

- Most prestigious finance credential globally

- Strong recognition in investment management

- Comprehensive investment education

- Global network of 200,000+ charterholders

Limitations

- Very expensive ($3,520-$8,000+ total with materials)

- Requires 2-4 years minimum

- Very difficult (low pass rates)

- More theoretical than practical

- Not focused on hands-on modeling

3. FRM (Financial Risk Manager)

Best For: Risk management professionals in banking, insurance, and financial institutions

Overview

Offered by the Global Association of Risk Professionals (GARP), the FRM certification is the leading credential for financial risk management professionals.

Certification Structure

Two-part examination system:

- Part 1: Foundations of risk management, quantitative analysis, financial markets

- Part 2: Application of risk tools, market risk, credit risk, operational risk

Cost Structure (2026)

Registration Fees:

- One-time Enrollment Fee: $400 (new candidates only)

- Part 1 Early Registration: $600

- Part 1 Standard Registration: $800

- Part 2 Early Registration: $600

- Part 2 Standard Registration: $800

Total Minimum Cost:

- Early registration both parts: $1,600 (plus $400 enrollment)

- Total: $2,000

Additional Costs:

- Study materials: $400-$800 per part

- GARP membership: $195 annually (optional)

- Calculator: $50-$150

Time to Complete

- Typical duration: 6-12 months

- Study time per part: 200-240 hours

- Exams offered: Three times per year (May, August, November)

Requirements

- No formal education requirement to sit for exam

- Two years of professional work experience in risk management

- Experience must be submitted within 5 years of passing Part 2

Career Impact

FRM certified professionals work in:

- Risk management departments

- Investment banks

- Commercial banks

- Asset management firms

- Insurance companies

- Regulatory bodies

Strengths

- Focused specifically on risk management

- Strong industry recognition in banking

- Faster completion than CFA

- More affordable than CFA

- No strict educational prerequisites

Limitations

- Limited to risk management roles

- Not as prestigious as CFA

- Requires self-motivation for exam prep

- Work experience verification required

4. CPA (Certified Public Accountant)

Best For: Accounting professionals, auditors, tax specialists, and financial reporting experts

Overview

The CPA is the premier accounting credential in the United States, issued by the American Institute of Certified Public Accountants (AICPA). It is essential for public accounting and highly valued in corporate finance.

Certification Structure

Four exam sections (as of CPA Evolution):

- Three core sections

- One discipline section (choose from Taxation, Information Systems, or Finance)

Cost Structure (2026)

Exam Fees:

- Application/Evaluation Fee: $50-$200 (varies by state)

- Registration Fee per Section: $93 (NASBA recommended)

- Exam Fee per Section: $262.64 (NASBA recommended)

- Total per section: approximately $355

- Total for 4 sections: $1,050-$1,420

Additional Costs:

- Study materials: $1,000-$3,000

- Ethics exam: $100-$150

- Licensing fee: $100-$500 (varies by state)

- Total realistic cost: $3,000-$7,000

Time to Complete

- Typical duration: 6-18 months

- Study time per section: 80-120 hours

- Exams available: Continuous testing windows throughout year

Requirements

2026 Changes – New Pathways:

- Traditional Path: 150 credit hours (bachelor’s + 30 additional)

- New Bachelor’s Pathway: Bachelor’s degree + 2 years experience + exam

- Additional accounting coursework requirements vary by state

Career Impact

CPAs work in:

- Public accounting firms (Big 4 and regional)

- Corporate accounting and finance

- Government accounting

- Tax consulting

- Forensic accounting

- CFO and controller positions

Strengths

- Highly respected in accounting profession

- Required for public accounting

- Strong salary premium

- Versatile career applications

- State licensure provides credibility

Limitations

- Primarily accounting-focused

- State-specific requirements

- Expensive total cost

- Requires ongoing CPE credits

- Limited to U.S. (not global like CFA)

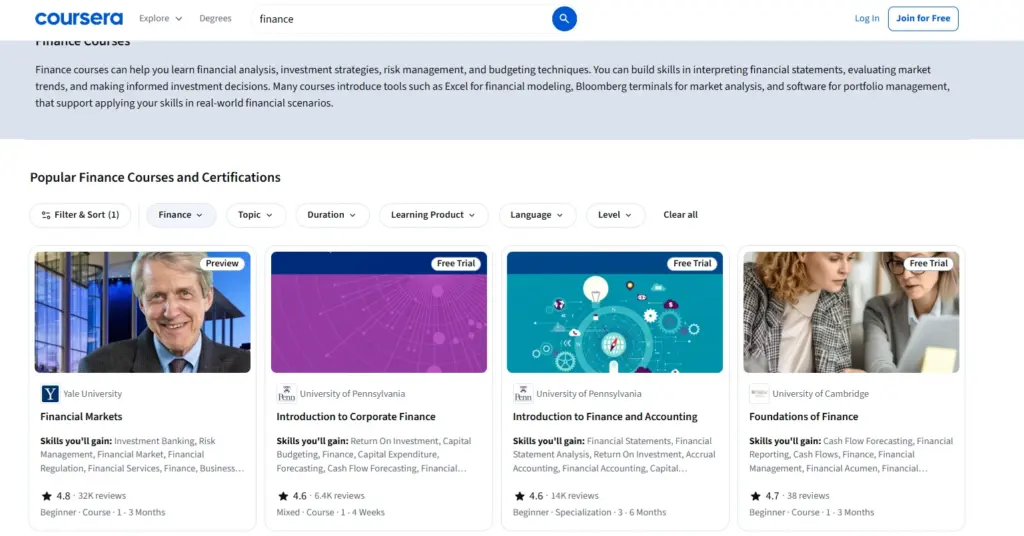

5. Coursera Finance Certificates

Best For: Learners seeking affordable, university-backed finance education across multiple topics

Overview

Coursera partners with top universities and companies to offer online finance courses, specializations, and degrees. It provides broad access to finance education from institutions like Yale, Stanford, and Wharton.

Available Programs

Professional Certificates:

- Google Data Analytics (with finance applications)

- IBM Data Analyst

- University-specific finance specializations

Specializations:

- Financial management

- Investment strategies

- Corporate finance

- Financial markets

- Accounting fundamentals

Full Degrees:

- Bachelor’s in finance

- Master’s in finance

- MBA programs

Cost Structure (2026)

Individual Courses:

- $29-$99 per course

- Audit option: Free (no certificate)

Specializations:

- $39-$79 per month

- Typical duration: 2-6 months

- Total cost: $80-$474

Coursera Plus:

- $399 per year (currently $199 with 50% discount)

- Access to 7,000+ courses

- Unlimited certificates

Degree Programs:

- Bachelor’s degrees: $10,000-$25,000

- Master’s degrees: $15,000-$40,000

Time to Complete

- Individual courses: 4-6 weeks

- Specializations: 3-6 months

- Degrees: 1-4 years

Strengths

- Wide variety of finance topics

- University-backed credentials

- Affordable individual courses

- Flexible learning schedule

- Free audit options available

- Global accessibility

Limitations

- Variable quality across courses

- Less specialized in practical finance skills

- Limited employer recognition in finance sector

- Monthly subscription can add up

- Minimal hands-on financial modeling

- More theoretical than practical

6. MBA in Finance

Best For: Professionals seeking comprehensive business education with finance specialization and leadership development

Overview

An MBA with finance concentration provides broad business education combined with specialized finance knowledge. Top programs offer networking, prestige, and access to elite career opportunities.

Program Types

Full-Time MBA:

- 2 years full-time study

- Internships and networking

- Campus-based learning

Part-Time MBA:

- 3-4 years while working

- Weekend or evening classes

- Maintain current employment

Executive MBA:

- 1.5-2 years for experienced professionals

- Cohort-based learning

- Higher cost but senior-level focus

Online MBA:

- Flexible schedule

- Lower cost than campus programs

- Growing employer acceptance

Cost Structure (2026)

Top-Tier Programs (Harvard, Stanford, Wharton):

- Tuition: $60,000-$150,000 per year

- Total cost: $120,000-$250,000

- Living expenses: $30,000-$60,000 per year

Mid-Tier Programs:

- Tuition: $40,000-$80,000 per year

- Total cost: $80,000-$160,000

Online MBA:

- Tuition: $20,000-$60,000 total

- More affordable but less networking

Time to Complete

- Full-time: 2 years

- Part-time: 3-4 years

- Executive: 1.5-2 years

- Online: 2-3 years

Career Impact

MBA graduates pursue:

- Investment banking

- Management consulting

- Corporate finance leadership

- Private equity

- Venture capital

- CFO and executive positions

Strengths

- Comprehensive business education

- Strong alumni networks

- Career switching opportunities

- Leadership development

- High earning potential

- Employer recognition

Limitations

- Very expensive ($80,000-$250,000)

- Requires 1-2 years out of workforce (full-time)

- Not specifically focused on technical finance skills

- Return on investment varies by program

- Opportunity cost of lost income

7. CAIA (Chartered Alternative Investment Analyst)

Best For: Professionals specializing in alternative investments like hedge funds, private equity, real estate, and commodities

Overview

The CAIA Association offers this specialized certification for professionals working with alternative investments. It is the only credential specifically designed for the alternative investment industry.

Certification Structure

Two-level examination system:

- Level 1: Introduction to alternative investments, asset allocation, risk management

- Level 2: Advanced topics in alternative investments, portfolio management

Cost Structure (2026)

Exam Fees:

- Enrollment Fee: $450 (one-time for new candidates)

- Level 1 Early Registration: $800

- Level 1 Standard Registration: $950

- Level 2 Early Registration: $900

- Level 2 Standard Registration: $1,050

Total Minimum Cost:

- Early registration: $2,150 (including enrollment)

- Standard registration: $2,450

Additional Costs:

- Study materials: $500-$1,200

- Membership: $395 annually (optional)

Time to Complete

- Typical duration: 6-18 months

- Study time per level: 200-250 hours

- Exams offered: Twice per year (March and September)

Requirements

- Bachelor’s degree or equivalent

- One year of professional work experience

- Or four years of professional experience without degree

Career Impact

CAIA charterholders work in:

- Hedge funds

- Private equity firms

- Venture capital

- Real estate investment

- Commodities trading

- Fund of funds management

- Alternative investment consulting

Strengths

- Only credential focused on alternative investments

- Growing recognition in hedge fund industry

- Faster than CFA (6-18 months vs. 2-4 years)

- More affordable than CFA

- Specialized knowledge valued by employers

Limitations

- Narrow focus limits career flexibility

- Less prestigious than CFA

- Limited to alternative investments

- Smaller global recognition

- Fewer charterholders than CFA

Comparison Table: All 7 Certifications at a Glance

| Certification | Total Cost | Duration | Best For | Industry Recognition |

| CFI | $298-$508/year | 3-6 months | Practical finance skills, modeling | High in finance sector |

| CFA | $3,520-$8,000+ | 2-4 years | Investment management | Very High globally |

| FRM | $2,000-$4,000 | 6-12 months | Risk management | High in banking |

| CPA | $3,000-$7,000 | 6-18 months | Accounting, audit, tax | Very High in accounting |

| Coursera | $80-$40,000 | Varies | Broad finance education | Moderate |

| MBA | $80,000-$250,000 | 1-4 years | Leadership, career switching | Very High |

| CAIA | $2,150-$4,000 | 6-18 months | Alternative investments | Moderate |

How to Choose the Right Certification for Your Career

Consider Your Career Goals

If you want to work in investment banking or corporate finance:

- First choice: CFI (FMVA or FPAP) for practical modeling skills

- Long-term: CFA for prestige and career advancement

If you want to specialize in risk management:

- Best choice: FRM

- Alternative: CFI (CBCA) for commercial banking focus

If you want to work in accounting or audit:

- Best choice: CPA

- Complement with: CFI for financial analysis skills

If you want to work in alternative investments:

- Best choice: CAIA

- Foundation: CFI for modeling basics

If you want career flexibility and leadership:

- Best choice: MBA

- Practical skills: CFI before or during MBA

Consider Your Budget

Limited budget ($300-$1,000):

- CFI provides maximum value

- Coursera Plus for broad learning

Moderate budget ($2,000-$5,000):

- FRM for specialized risk management

- CAIA for alternative investments

- CPA if pursuing accounting

Significant budget ($5,000+):

- CFA for investment management

- MBA for leadership positions

Consider Your Timeline

Need quick results (3-6 months):

- CFI certifications

- Individual Coursera specializations

Moderate timeline (6-18 months):

- FRM

- CPA

- CAIA

Long-term commitment (2-4 years):

- CFA

- MBA

Consider Practical vs. Theoretical Learning

If you prefer hands-on, practical learning:

- CFI excels at practical application

- Focus on building real models and templates

If you prefer academic, theoretical learning:

- CFA provides comprehensive investment theory

- Coursera university courses

- MBA programs

Final Recommendation: Why CFI Stands Out in 2026?

After analyzing all seven certifications, CFI emerges as the best overall choice for most finance professionals in 2026. Here is why:

Unbeatable Value

At $298-$508 per year, CFI provides access to seven complete certifications plus 250+ courses. You would pay more for a single CFA level or even a few Coursera specializations.

Practical Skills That Employers Want

CFI teaches exactly what you need for finance jobs: building financial models, Excel mastery, valuation techniques, and real-world analysis. These are the skills listed in every investment banking and corporate finance job description.

Fast Career Impact

Most CFI learners report career advancement within 3-6 months. Compare this to the 2-4 years required for CFA or MBA programs. You can start applying new skills immediately in your current role.

Industry Recognition

Major firms like Goldman Sachs, JPMorgan, and Deloitte use CFI to train their teams. The certifications are recognized specifically where they matter most: in finance and banking.

Flexible Learning

CFI works around your schedule. Study whenever and wherever you want, at your own pace, with lifetime access to materials.

Comprehensive Support

The Full-Immersion plan includes AI tutoring, expert guidance, model reviews, and career support at no additional cost.

Multiple Certification Options

Whether you want financial modeling (FMVA), FP&A (FPAP), data analysis (BIDA), or FinTech (FTIP), CFI has a specialized certification for your career path.

Frequently Asked Questions

❓Can I pursue multiple certifications simultaneously?

Yes, with CFI you get access to all certifications in one subscription. For others, you would need to register and pay for each separately.

❓Which certification has the best ROI?

CFI provides the best immediate ROI due to low cost and quick completion time. CFA and MBA have strong long-term ROI but require much larger upfront investment.

❓Do employers recognize these certifications?

All seven certifications are recognized, but in different sectors. CFA and CPA are most prestigious overall, while CFI is highly valued specifically in finance roles requiring practical skills.

❓Can I take these certifications while working full-time?

CFI, FRM, CPA, and CAIA are all designed for working professionals. CFA is possible but demanding. Full-time MBA requires leaving work, though part-time options exist.

❓Which certification is hardest?

CFA is generally considered the most difficult due to length, difficulty, and low pass rates. CFI is more accessible but still rigorous.

❓Should I get multiple certifications?

Many professionals combine certifications. Common combinations:

Any certification + MBA for leadership

CFI + CFA for investment management

CFI + CPA for corporate finance

CFI + FRM for risk management

Quicklinks:

- CFI Review : Is this Financial Modeling Institute Worth It?

- CFI Vs Coursera: Best Finance Learning Platform?

- Datacamp Vs Coursera: Which Offers Better Hands-On Learning?

- Udemy vs Pluralsight : Which Is Best for Career Growth?

Conclusion

The finance industry in 2026 offers multiple paths to professional credentialing, each with distinct advantages. While all seven certifications provide value, CFI stands out as the best overall choice for most finance professionals due to its affordability, practical focus, quick completion time, and strong industry recognition.

However, your ideal choice depends on your specific career goals, budget, and learning preferences. Consider your long-term objectives, evaluate the trade-offs, and choose the certification that aligns best with your professional aspirations.

For those seeking immediate, practical skills that directly apply to finance work, CFI is the clear winner. For specialized career paths or long-term prestige, the other certifications offer valuable alternatives.

The most important step is to start. The finance industry rewards continuous learning and professional development. Choose your certification, commit to the process, and take the next step in advancing your finance career.