Yes, CFI is totally worth it if you are looking to enhance your financial modeling skills and advance your career in finance. The comprehensive courses, practical approach, and respected certification make it a valuable investment for professionals aiming to stand out in the industry.

- Practical, hands-on training.

- Recognized certification.

- Flexible, online courses.

- Expert-designed curriculum.

- Useful resources like templates.

- Good for all skill levels.

- Can be pricey.

- Requires basic finance knowledge.

- Limited in-person networking.

I recently explored the Corporate Finance Institute to see if it lives up to the hype as one of the top online finance education platforms. After spending considerable time testing their courses, certifications, and platform features,

I’m sharing my honest experience to help you decide if CFI is the right investment for your finance career.

Table of Contents

ToggleWhat Is Corporate Finance Institute (CFI)?

Corporate Finance Institute, commonly known as CFI, is an online learning platform that specializes in finance and banking education. Founded with the mission to provide practical, job-ready skills, CFI has grown to serve over 2.8 million professionals worldwide across 190+ countries.

Unlike traditional academic programs that focus heavily on theory, CFI takes a hands-on approach. The platform offers industry-recognized certifications, specializations, and individual courses designed to teach you the exact skills that finance professionals use in their day-to-day work.

Is CFI Legitimate and Well-Recognized?

Before investing my time and money, I wanted to make sure CFI was a credible organization. Here’s what I discovered:

Accreditations and Partnerships

CFI maintains impressive credentials that prove its legitimacy:

- Better Business Bureau (BBB): CFI holds an A+ rating with the BBB, which is the highest possible rating

- CPA Institute Recognition: CFI courses are recognized for Continuing Professional Education (CPE) credits in the United States, Canada, United Kingdom, and Australia

- NASBA Partnership: The National Association of State Boards of Accountancy has established training partnerships with CFI, particularly for the FMVA certification program

- 550+ CPE/CPD Credits: Learners can earn over 550 Continuing Professional Education credits through various CFI programs

These partnerships aren’t just for show. When I checked discussions on platforms like Reddit and Quora, I found that many professionals confirm CFI certificates offer legitimate, practical skills that employers value, especially for hands-on financial modeling roles.

Trusted by Major Organizations

CFI is used by teams at some of the world’s leading companies, including:

- Goldman Sachs

- JPMorgan

- Deloitte

- PwC

- Bloomberg

- Amazon

- Microsoft

- Coca-Cola

This widespread adoption by Fortune 500 companies gave me confidence that CFI’s training meets real-world professional standards.

My Experience With CFI’s Platform

User Interface and Navigation

From the moment I logged into CFI’s learning platform, I was impressed by how clean and organized everything looked. The dashboard clearly shows your progress, completed lessons, and what to study next.

One feature I really appreciated was the ability to switch between dark and light modes. I mostly used dark mode while studying after work because it reduced eye strain, but the light mode works perfectly if you prefer a brighter screen.

The courses are organized by:

- Skill level (from Level 1 novice to Level 5 expert)

- Career path (Investment Banking, FP&A, Data Analysis, etc.)

- Certification program

- Individual topics

This organization made it incredibly easy to find exactly what I needed without getting lost in the platform.

Learning Experience

CFI uses a structured learning approach with:

- Pre-recorded video lessons: Each lesson features clear audio and professionally produced content

- Closed captions and multilingual subtitles: Available in 20+ languages for many courses

- Interactive exercises and quizzes: These appear at strategic points to test your understanding

- Downloadable templates and resources: Real Excel templates you can use in your actual work

- Mobile app access: Learn on the go with CFI’s iOS and Android apps

The teaching style is straightforward and practical. Instructors use a combination of animated visuals, step-by-step screen recordings, and clear voice explanations. If a lesson feels too fast or you find a voice hard to understand, you can slow down the video or turn on captions.

Course Quality

What sets CFI apart from other platforms is the quality of instruction. The courses aren’t taught by generic instructors they’re created by experienced finance professionals who have worked in investment banking, corporate finance, commercial lending, and other specialized fields.

Some of the instructors I learned from include:

- Tim Vipond: Financial Modeling & Valuation expert

- Scott Powell: Accounting & Finance specialist

- Duncan McKeen: Financial Modeling professional

- Sebastian Taylor: Business Intelligence expert

Each instructor brings real-world experience, which makes the lessons feel relevant and applicable to actual finance work.

CFI Certification Programs Explained

CFI currently offers seven main certification programs, each targeting specific career paths in finance and banking. Let me break down each one:

1. FMVA (Financial Modeling & Valuation Analyst)

Rating: 4.9/5 from 37,994+ students

The FMVA is CFI’s flagship certification and the most popular program. It teaches advanced financial modeling and valuation skills essential for finance professionals.

What You Learn:

- DCF (Discounted Cash Flow) modeling

- 3-statement financial models

- Scenario and sensitivity analysis

- Advanced Excel mastery

- Business valuation techniques

- M&A modeling

- Real-world case studies

Duration: 3-6 months (depending on your pace and prior experience)

Best For: Professionals pursuing careers in investment banking, corporate development, equity research, private equity, and corporate finance roles

My Take: The FMVA truly stands out for its practical, hands-on approach. I learned to build complete financial models from scratch, which is exactly what employers look for. One learner, Alonso Saponara, even mentioned using the FMVA materials during his Goldman Sachs interview process and acing the case study.

2. FPAP (Financial Planning & Analysis Professional)

Rating: 4.9/5 from 27,323+ students

This newer certification focuses specifically on FP&A skills one of the most in-demand areas in corporate finance.

What You Learn:

- Financial modeling for FP&A

- Budgeting and forecasting

- Data visualization and storytelling

- Business partnering skills

- Financial analysis techniques

- Excel-based FP&A tools

Duration: 3-4 months

Best For: Professionals working in or aspiring to work in Financial Planning & Analysis, Corporate Finance, or Finance Business Partner roles

3. CBCA (Commercial Banking & Credit Analyst)

Rating: 4.9/5 from 24,048+ students

The CBCA program teaches commercial lending and credit analysis skills.

What You Learn:

- The 5 Cs of Credit framework

- Financial statement analysis

- Loan structuring and documentation

- Risk assessment methodologies

- Cash flow analysis

- Business plan evaluation

- Account monitoring

Duration: 4-5 months

Best For: Credit analysts, commercial bankers, risk managers, and professionals in financial institutions

4. CMSA (Capital Markets & Securities Analyst)

Rating: 4.9/5 from 13,723+ students

This certification covers capital markets knowledge across multiple asset classes.

What You Learn:

- Trading fundamentals

- Equities and fixed income

- Derivatives and commodities

- Foreign exchange markets

- Portfolio management

- Analytical methodologies

- Risk management

Duration: 3-4 months

Best For: Professionals in asset management, wealth management, trading, and treasury operations

5. BIDA (Business Intelligence & Data Analyst)

Rating: 4.9/5 from 8,111+ students

The BIDA program teaches data analysis and business intelligence using industry-standard tools.

What You Learn:

- Power BI and Tableau

- SQL and Python programming

- Data transformation and automation

- Data visualization

- Data modeling

- Statistical analysis

- Machine learning fundamentals

Duration: 3-4 months

Best For: Data analysts, business intelligence developers, and data visualization specialists

6. FPWMP (Financial Planning & Wealth Management Professional)

Rating: 4.9/5 from 24,867+ students

This certification prepares you for careers in financial advisory and wealth management.

What You Learn:

- Financial planning cycle

- Investment management

- Insurance planning

- Client relationship skills

- Business development

- Portfolio management

Duration: 3-4 months

Best For: Financial planners, investment advisors, wealth managers, and private bankers

7. FTIP (FinTech Industry Professional)

Rating: 4.9/5 from 15,919+ students

The FTIP program addresses the growing FinTech industry with emerging technology skills.

What You Learn:

- Digital banking fundamentals

- Cryptocurrencies and blockchain

- InsurTech and WealthTech

- Payment systems

- Cybersecurity

- Data science applications in finance

- Regulatory technology

Duration: 2-3 months

Best For: FinTech professionals, data scientists, technology specialists, and consultants in the financial technology space

CFI Specializations

Beyond the main certifications, CFI offers 15 specialization programs that let you deepen expertise in specific areas:

- FP&A Excel Modeling: Real-world Excel modeling focused on FP&A scenarios

- AI for Finance: Use AI in modeling, dashboarding, and risk analysis

- Accounting for Financial Analysts: Core and advanced accounting skills

- Business Intelligence Analyst: Build dashboards with top BI tools

- Crypto and Digital Assets: Understand crypto markets and valuation

- Data Analysis in Excel: Practical Excel analysis skills

- Data Science: Learn Python, R, and machine learning for finance

- ESG Specialist: ESG strategy, investing, and risk management

- Excel Skills for Professionals: Master essential Excel skills

- Finance for Non-Finance Managers: Build finance fluency

- Investment Banking & Private Equity Modeling: Advanced M&A and LBO modeling

- Leadership Effectiveness: Essential people and leadership skills

- Macabacus Specialist: Excel, PowerPoint, and Word power tools

- Real Estate Finance: Real estate valuations and modeling

- Risk Management: Assess and manage financial risks

These specializations typically take 2-4 weeks to complete and are perfect for professionals who want to add specific skills without committing to a full certification.

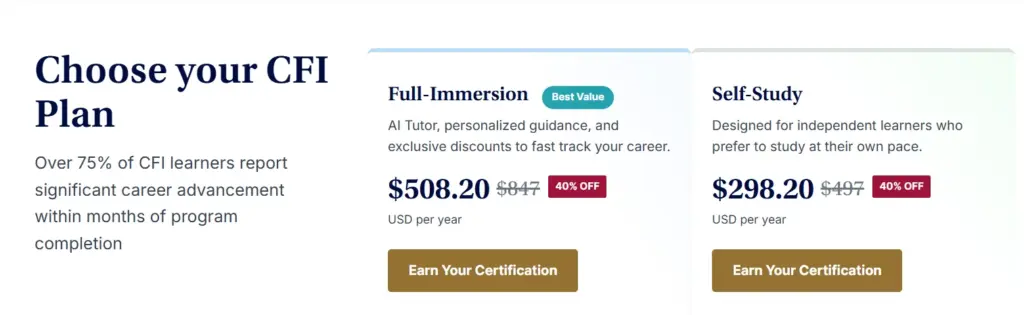

CFI Pricing and Plans

CFI operates on an annual membership model, which I found to be quite reasonable compared to traditional finance courses or MBA programs. Here’s the current pricing structure:

Individual Membership Plans

Full-Immersion Plan

- Original Price: $847/year

- Current Price with 40% Discount: $508.20/year

- What’s Included:

- Access to 250+ courses

- All 7 certifications and 15 specializations

- 550+ CPE/CPD credits

- Blockchain-verified certificates

- AI Tutor (exclusive feature)

- Ask an Expert: 1-on-1 guidance

- Premium templates and guides

- Resume/CV reviews

- Personalized financial model feedback

- Monthly live office hours

- Members-only community access

- Exclusive discounts on partner tools (PitchBook, FinChat, Koyfin, etc.)

Self-Study Plan

- Original Price: $497/year

- Current Price with 40% Discount: $298.20/year

- What’s Included:

- Access to 250+ courses

- All 7 certifications and 15 specializations

- 550+ CPE/CPD credits

- Blockchain-verified certificates

- Standard templates and guides

- Members-only community access

Student Membership Plans

CFI offers special 50% discounts for students with verified academic email addresses (.edu, .ac.uk, and major Canadian university domains):

Student Full-Immersion: $423.50/year (originally $847) Student Self-Study: $248.50/year (originally $497)

What I Think About the Pricing

At $298.20/year for the Self-Study plan or $508.20/year for Full-Immersion, CFI offers tremendous value. Compare this to:

- An MBA program: $50,000-$150,000

- CFA Level 1: $1,450+ (just for one level)

- Individual finance courses: $200-$500 each

With CFI, you get unlimited access to everything for an entire year. That’s over 250 courses, 7 full certifications, and 15 specializations for less than the cost of a single university course.

The 40% discount currently available makes it even more attractive. For students, the 50% discount is an excellent opportunity to build practical finance skills while still in school.

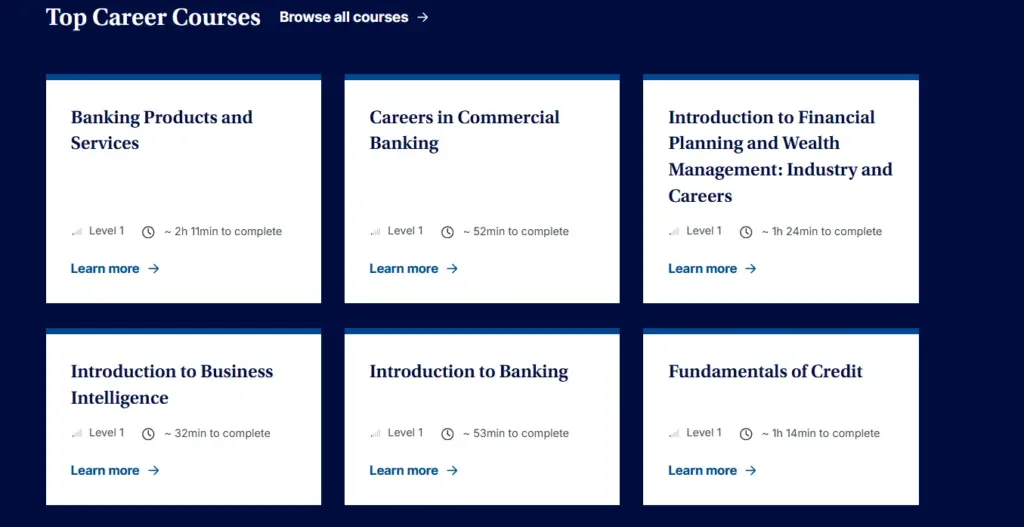

CFI Free Courses and Resources

Before committing to a paid membership, CFI lets you test their platform through free offerings:

What’s Available for Free:

Free Course Previews: You can watch selected videos from every program to evaluate teaching style and content quality

29 Complete Free Courses: Topics include:

- Accounting Fundamentals

- Excel Fundamentals – Formulas for Finance

- Reading Financial Statements

- Corporate Finance Fundamentals

- Introduction to Business Intelligence

- Introduction to ESG

- Fundamentals of Credit

- Introduction to Banking

Free Resources:

- Financial Ratios Guide for Business Analysis

- Excel templates and modeling guidelines

- Articles on current finance topics

- Webinars featuring industry experts

- Breaking Into FP&A Guide

I recommend taking advantage of these free offerings before purchasing a membership. It gives you a real feel for CFI’s teaching approach and helps you determine if it’s the right fit.

Exams and Assessments

To earn a CFI certification, you need to pass a final exam. Here’s what I learned about the assessment process:

How Exams Work:

- Required Score: 70-80% to pass (varies by certification)

- Exam Format: Multiple choice questions, case studies, and practical exercises

- Difficulty: More challenging than the practice quizzes within courses

- Retake Policy: If you fail, there’s a 30-day waiting period before you can retake the exam

- Preparation: Each course includes quizzes and practice questions to prepare you

Specialization programs follow a different approach. Instead of a large final exam, once you complete all required lessons, you receive a course completion certificate.

The exams aren’t easy, which actually adds credibility to the certifications. They ensure that anyone who earns a CFI credential has truly mastered the material.

Community and Networking Opportunities

One of the less talked about but valuable aspects of CFI is the members-only LinkedIn community.

What the Community Offers:

- Industry updates and news

- Learning and exam tips

- Career discussions and advice

- Direct help with course questions

- Networking with finance professionals worldwide

- Job opportunities and referrals

From my experience, most questions get answered quickly through focused peer discussions. The conversations stay centered on real finance topics rather than becoming purely social, which I appreciated.

You can connect with learners and professionals from different countries, which adds perspective and helps maintain motivation during longer courses.

Does CFI Actually Help You Get Jobs?

This is the million-dollar question, right? Based on Reddit discussions, learner testimonials, and job market research, here’s what I found:

Career Impact Statistics:

- 75%+ of CFI learners report significant career advancement within months of completing their certification

- Many professionals credit CFI (especially FMVA) for landing roles in investment banking, corporate development, and financial analysis

- Smaller firms often put junior staff through CFI training programs

- The certifications are particularly valued for interview preparation and demonstrating practical skills

Real Success Stories:

Alonso Saponara (FMVA certified, now Investment Banking Analyst at Goldman Sachs): “The FMVA was incredibly valuable during the Goldman Sachs interview process. I had it open on my second screen while working through the case study. When I interviewed at Goldman Sachs, two of the three interviewers were familiar with the FMVA and spoke highly of it.”

Alessandro Rovere (FMVA certified, Strategic Corporate Finance): “As a CPA who spent many years working as an auditor and consultant, I now work in strategic corporate finance, leading complex, multi-million-dollar valuations, financial modeling, and challenging forecasting.”

Chris Caldwell (FMVA and CFA Charterholder): “As a CFA Charterholder who put a good 900 hours into that designation, I found just as much value in your FMVA program. This designation only took me about 60-70 hours to complete. What I like about the approach is that it’s very practical for the workplace as opposed to just pure theory.”

Important Reality Check:

CFI certifications work best as a supplement to traditional qualifications rather than a replacement for degrees or CFA. They won’t automatically land you a job, but they will:

- Give you practical skills that directly apply to finance roles

- Help you stand out in interviews with technical competency

- Demonstrate commitment to professional development

- Provide talking points and examples for your resume and interviews

Advanced Features (Full-Immersion Plan)

If you opt for the Full-Immersion plan, you get access to several premium features:

AI Tutor

CFI’s AI tutor is trained on their entire library of learning materials. It provides instant, well-crafted answers to your questions about course content, financial concepts, and practical applications. I found this particularly helpful when studying complex topics like DCF modeling or analyzing financial statements.

Ask an Expert

With this feature, you get direct access to CFI’s team of finance experts for personalized guidance. If you’re stuck on a concept or need feedback on your work, you can submit questions and receive detailed responses.

Personalized Financial Model Review

Submit your financial models for expert review and get detailed feedback on your work. This is invaluable for improving your modeling skills and catching mistakes before they become bad habits.

Premium Templates

Access to over 250+ advanced templates including:

- DCF model templates

- 3-statement model templates

- 12-month rolling forecast templates

- LBO models

- M&A models

- Real estate financial models

Exclusive Partner Discounts

Full-Immersion members receive over $300 in savings from CFI’s partners:

- PitchBook: Comprehensive data and research on global capital markets

- FinChat: AI-powered investment research platform

- Koyfin: Modern global investment research terminal

- FT Future Forum: Strategic insights and connections

- Hiration: ChatGPT-powered resume and career tools

- Value Sense: Stock analysis and valuation platform

Pros and Cons of CFI

Based on my experience, here’s an honest assessment:

Pros

- Industry-recognized certifications that employers actually value

- Self-paced learning that fits busy professional schedules

- Expert instructors with real-world finance experience

- Practical skills focus rather than purely theoretical

- 550+ CPE credits help maintain professional licenses

- Strong community for networking and support

- Blockchain-verified certificates for credible verification

- Interactive exercises and case studies enhance learning

- Lifetime access to course materials with active membership

Cons

- No refund policy except for EU citizens (14-day period)

- Self-motivation is required without live instructor guidance

- No free trial period to test before purchasing

Who Should Enroll in CFI?

CFI is ideal for:

1. Finance Students

If you’re studying finance or accounting, CFI gives you practical skills that complement your academic learning. The student discount makes it very affordable.

2. Career Changers

Transitioning into finance from another field? CFI provides the technical foundation you need without requiring a full degree program.

3. Working Professionals

Already in finance but want to level up your skills? CFI’s self-paced format lets you learn without disrupting your work schedule.

4. Recent Graduates

Bridge the gap between academic theory and real-world application. Many employers value CFI certifications because they demonstrate job-ready skills.

5. International Professionals

With courses available in 20+ languages and students across 190+ countries, CFI serves a truly global audience.

CFI vs. Alternatives

CFI vs. CFA

- CFA: More prestigious, requires 900+ hours of study, costs $1,450+ per level, takes 2-4 years minimum

- CFI: More practical, 60-150 hours per certification, costs $298-$508/year, can complete in 3-6 months

- Verdict: CFA is better for investment management careers; CFI is better for corporate finance and practical modeling skills

CFI vs. MBA

- MBA: $50,000-$150,000, 2 years full-time, comprehensive business education

- CFI: $298-$508/year, self-paced, focused on finance skills

- Verdict: MBA is better for leadership roles and networking; CFI is better for specific technical skills

CFI vs. Coursera/Udemy

- Coursera/Udemy: Individual courses $20-$200, variable quality, limited career support

- CFI: Comprehensive programs, industry-recognized, built for finance careers

- Verdict: CFI is significantly better for finance professionals seeking recognized credentials

Tips for Success With CFI

Based on my experience, here are my recommendations:

- Start with free courses to test the platform before committing

- Set a study schedule of 8-10 hours per week for steady progress

- Join the community early to connect with other learners

- Use the templates in your actual work to reinforce learning

- Take notes as you watch videos – don’t just passively watch

- Complete the quizzes thoroughly to test your understanding

- Build real models alongside the lessons for hands-on practice

- Ask questions in the community or use the AI Tutor

- Review before the exam – the final tests are harder than practice quizzes

- Apply what you learn immediately in your work

My Final Verdict: Is CFI Worth It?

After thoroughly testing CFI’s platform, courses, and certifications, I can confidently say that CFI is worth the investment for most finance professionals and students.

Who Will Get the Most Value:

- Aspiring finance professionals who need practical, job-ready skills

- Working professionals looking to advance in their current roles

- Career changers transitioning into finance

- Students who want to supplement their academic education

- Anyone serious about financial modeling, data analysis, or FinTech

When CFI Might Not Be Right:

- If you’re looking for live, instructor-led classes

- If you need a traditional degree program

- If you lack self-discipline for online learning

- If you’re not willing to commit to at least 3-6 months of study

The Bottom Line:

At $298-$508 per year (with current discounts), CFI offers exceptional value. You get access to world-class finance training, industry-recognized certifications, and practical skills that directly apply to your work. The platform is legitimate, well-designed, and trusted by major employers.

While it requires self-motivation and won’t replace a degree or CFA, CFI is one of the strongest platforms available for learning practical finance and banking skills. The combination of quality content, expert instructors, and career-focused training makes it a solid investment in your professional development.

If you’re serious about advancing in finance and want skills that make a real difference in your career, I recommend trying CFI’s free courses first, then investing in a Self-Study or Full-Immersion membership. The 40% discount currently available makes this an excellent time to start your journey.

Frequently Asked Questions

❓How long does it take to complete a CFI certification?

Most learners complete a certification in 3-6 months, studying about 8-10 hours per week. However, since courses are self-paced, you can go faster or slower based on your schedule and prior knowledge.

❓Are CFI certifications recognized by employers?

Yes, many employers recognize CFI certifications, particularly smaller firms and those focused on practical skills. While not as prestigious as CFA, they demonstrate practical competency and are valued in interviews.

❓Can I get a refund if I’m not satisfied?

Generally, no, except for EU citizens who get a 14-day refund period. CFI recommends trying their free courses first to assess suitability before purchasing.

❓Is there a mobile app?

Yes, CFI recently launched mobile apps for both iOS and Android. However, the desktop experience remains optimal for complex modeling exercises.

❓Do I need prior finance experience?

No, CFI courses start from beginner level (Level 1) and progress to expert level (Level 5). The structured progression makes it accessible to newcomers while still valuable for experienced professionals.

❓What happens after my year subscription ends?

Your subscription will auto-renew annually. You can turn off auto-renewal in your account settings. If you don’t renew, you’ll lose access to the course content but keep your earned certifications.

❓Can I share my account with others?

No, CFI accounts are individual licenses. However, they offer team memberships for organizations wanting to train multiple employees.

❓How does CFI compare to university finance courses?

CFI is more practical and focused on applied skills, while university courses tend to be more theoretical. CFI complements formal education rather than replacing it.

Quicklinks:

- Manychat Review : Is Chat Automation Still Effective?

- Ontraport Review: Best Tool For Marketing Automation?

- WordPress Review: Best Choice for Your Website?

- Wix Review : The Ultimate Website Builder for Everyone

- Instapage Review : Still the Best Landing Page Builder?

Ready to Start Your CFI Journey?

If you’ve made it this far, you’re clearly serious about advancing your finance career. My recommendation is simple:

- Start with free courses at corporatefinanceinstitute.com

- Evaluate the teaching style and platform features

- Choose a membership plan that fits your goals and budget

- Set aside 8-10 hours per week for focused study

- Engage with the community for support and networking

- Apply what you learn immediately in your work

The investment in your professional development will pay dividends throughout your career. CFI gives you the practical skills and recognized credentials to stand out in the competitive finance industry.

Good luck with your finance education journey!