Best For | Finance professionals, aspiring analysts | In-depth, structured learning with certifications from top universities. |

Price | Starts at $99/month, Some free courses | Free (with paid certificates starting at $39/month) |

Features | Finance-specific courses | -University-backed courses |

Pros | Focus on finance skills | -High-quality content |

Cons | Focused only on finance | -More expensive |

When I started looking for online platforms to advance my finance career, I came across two big names: Corporate Finance Institute (CFI) and Coursera.

Both platforms have millions of users and offer quality education, but they’re fundamentally different in their approach, pricing, and outcomes.

After spending months testing both platforms, taking courses, and comparing their features, I can tell you that for finance professionals specifically, CFI comes out as the clear winner.

But let me show you exactly why through this detailed comparison.

Table of Contents

ToggleQuick Overview: CFI vs Coursera at a Glance

| Feature | CFI | Coursera |

| Founded | 2015 | 2012 |

| Users | 2.8+ million | 148+ million |

| Focus | Finance & Banking | All subjects |

| Best For | Finance professionals | General learners |

| Pricing | $298-$508/year | $399/year or $39-79/month |

| Certifications | 7 finance-focused | 7,000+ courses across all fields |

| Job Readiness | Practical, hands-on finance skills | Academic + professional mix |

| Industry Recognition | Finance sector | Multiple industries |

| Learning Style | Self-paced, practical | Self-paced, theoretical + practical |

Platform Background and Focus

Corporate Finance Institute (CFI)

CFI was founded in 2015 with one clear mission: to provide practical, job-ready finance skills to professionals worldwide. Unlike traditional educational platforms, CFI focuses exclusively on finance, banking, and related fields.

Key Stats:

- 2.8+ million professionals have used CFI

- Operates in 190+ countries

- Over 5 million course enrollments

- 50,000+ certified professionals

- Trusted by teams at Goldman Sachs, JPMorgan, Deloitte, and other Fortune 500 companies

What makes CFI special is its laser focus on finance. Every course, every certification, and every resource is designed specifically for people working in or aspiring to work in finance roles. This specialization means CFI can go much deeper into finance topics than general platforms.

Coursera

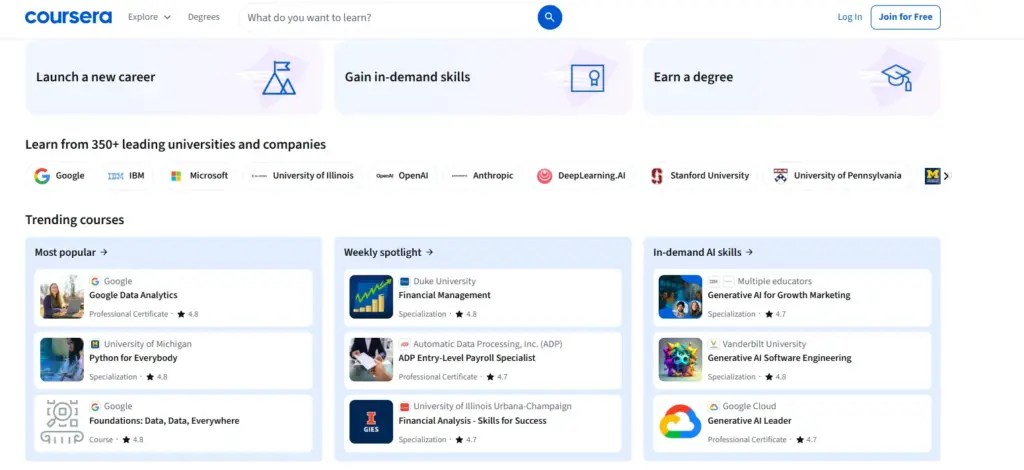

Coursera launched in 2012 as a massive open online course (MOOC) platform partnering with universities and companies to offer online education across virtually every subject imaginable.

Key Stats:

- 148+ million registered learners

- Partners with 350+ universities and companies

- Offers 10,000+ courses across all subjects

- 7,000+ courses in Coursera Plus subscription

- Provides accredited degrees from major universities

Coursera’s strength lies in its breadth. Whether you want to learn about artificial intelligence, humanities, healthcare, or finance, Coursera has courses for it. However, this broad approach means it can’t go as deep into specialized finance topics as CFI does.

Course Quality and Content

CFI’s Finance-Focused Approach

I found CFI’s courses to be incredibly practical and directly applicable to real finance work. Here’s what sets them apart:

Teaching Methodology:

- Hands-on financial modeling: You build actual models used in investment banking and corporate finance

- Real-world case studies: Every concept is taught through actual business scenarios

- Excel-based learning: Heavy emphasis on Excel mastery, which is essential in finance

- Industry best practices: Taught by professionals who’ve worked in the field

- Practical templates: Downloadable Excel templates you can use in your actual work

Course Structure: CFI organizes content into five difficulty levels:

- Level 1 (Novice): Basic finance concepts

- Level 2 (Intermediate): Foundational skills

- Level 3 (Advanced): Professional-level content

- Level 4 (Expert): Specialized techniques

- Level 5 (Master): Industry-leading practices

This progression ensures you build skills systematically, moving from basics to advanced topics in a logical way.

Coursera’s Academic Approach

Coursera’s finance courses are typically taught by university professors and follow a more academic structure:

Teaching Methodology:

- Theoretical foundations: Strong emphasis on finance theory

- Academic rigor: University-level content with assignments and quizzes

- Peer-reviewed projects: Learn through group discussions and peer feedback

- Mixed quality: Since anyone can create courses, quality varies significantly

- General business focus: Finance courses often part of broader business programs

Course Structure:

- Individual courses (4-6 weeks typically)

- Specializations (series of related courses, 3-6 months)

- Professional Certificates (job-focused programs)

- Full degrees (bachelor’s and master’s programs)

Certification Programs Compared

CFI’s Seven Industry-Recognized Certifications

CFI offers seven certifications, each targeting specific finance careers:

| Certification | Focus Area | Duration | Rating | Best For |

| FMVA® | Financial Modeling & Valuation | 3-6 months | 4.9/5 (37,994 ratings) | Investment Banking, Corporate Finance |

| FPAP™ | Financial Planning & Analysis | 3-4 months | 4.9/5 (27,323 ratings) | FP&A, Corporate Finance |

| CBCA® | Commercial Banking & Credit | 4-5 months | 4.9/5 (24,048 ratings) | Commercial Banking, Credit Analysis |

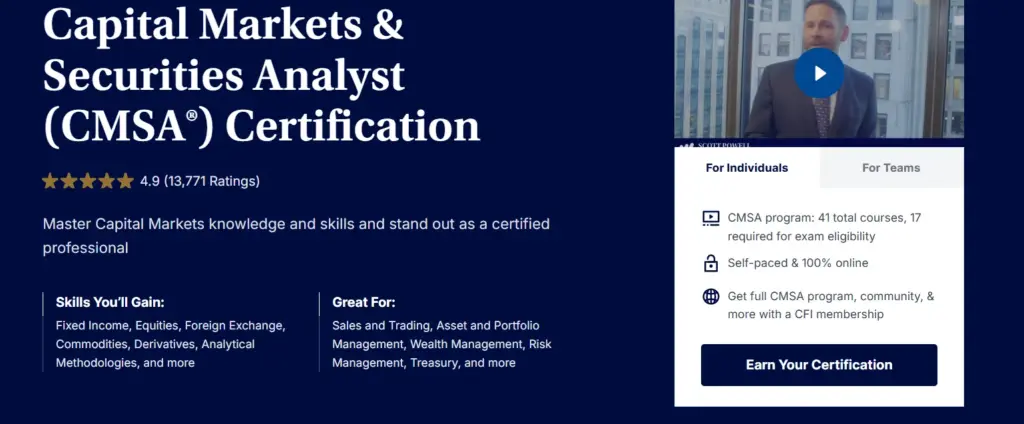

| CMSA® | Capital Markets & Securities | 3-4 months | 4.9/5 (13,723 ratings) | Asset Management, Trading |

| BIDA® | Business Intelligence & Data | 3-4 months | 4.9/5 (8,111 ratings) | Data Analysis, BI |

| FPWMP® | Financial Planning & Wealth | 3-4 months | 4.9/5 (24,867 ratings) | Wealth Management |

| FTIP® | FinTech Industry | 2-3 months | 4.9/5 (15,919 ratings) | FinTech, Digital Banking |

What Makes CFI Certifications Valuable:

- Industry-specific: Each certification addresses actual job requirements in finance

- Practical exams: Tests require you to build models and solve real problems

- Blockchain-verified: Digital credentials that employers can verify instantly

- CPE credits: Earn 550+ Continuing Professional Education credits

- Employer recognition: Recognized by major financial institutions

Comprehensive: Cover everything needed for specific finance roles

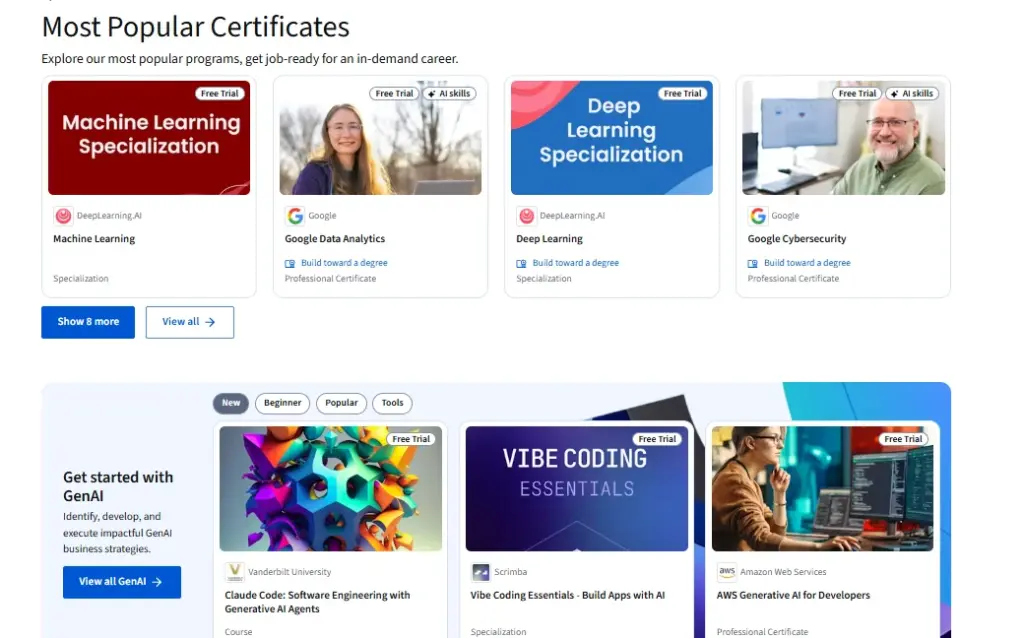

Coursera’s Professional Certificates

Coursera offers thousands of certificates across all fields. In finance specifically, they have:

Finance-Related Programs:

- Google Data Analytics Professional Certificate

- IBM Data Analyst Professional Certificate

- University courses in finance, accounting, and business

- MBA and master’s degrees in finance from various universities

- Specialized finance topics from different instructors

Coursera Certificate Types:

- Course Certificates: Completion of individual courses

- Specialization Certificates: Completion of course series (3-6 courses)

- Professional Certificates: Job-focused programs by companies like Google, IBM

- MasterTrack Certificates: University graduate-level course credits

- Degree Certificates: Full bachelor’s or master’s degrees

The Coursera Challenge:

The problem I found with Coursera’s finance offerings is inconsistency. Since courses come from different universities and instructors, the quality, depth, and practical applicability vary widely. Some courses are excellent, while others feel outdated or too theoretical.

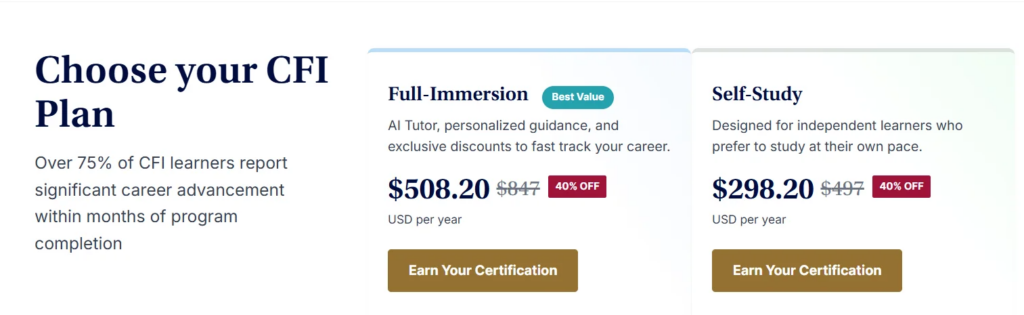

Pricing Plans Overview

CFI Pricing

CFI uses a straightforward annual subscription model:

| Plan | Regular Price | Current Price (40% Off) | What’s Included |

| Self-Study | $497/year | $298.20/year | • 250+ courses• All 7 certifications• 15 specializations• 550+ CPE credits• Standard templates• Community access |

| Full-Immersion | $847/year | $508.20/year | • Everything in Self-Study• AI Tutor• 1-on-1 expert guidance• Resume reviews• Premium templates• Model feedback• Partner discounts ($300+ value) |

| Student Plans | 50% off | $248.50-$423.50/year | Same benefits with student discount |

CFI Cost Per Certification:

- If you complete just 2 certifications in a year: $149-$254 per certification

- If you complete all 7 certifications: $43-$73 per certification

- Plus unlimited access to all courses and specializations

Coursera Pricing

Coursera’s pricing is more complex and varies by program:

| Option | Price | What You Get |

| Individual Courses | $29-$99 per course | Single course access, certificate upon completion |

| Specializations | $39-$79/month | Series of 3-6 courses, takes 2-6 months |

| Professional Certificates | $39-$79/month | Job-focused programs, 3-6 months duration |

| Coursera Plus | $399/year (50% off = $199) | Access to 7,000+ courses |

| Degrees | $15,000-$40,000 | Full bachelor’s or master’s degree |

| Audit Option | Free | Video access only, no certificate or assignments |

Coursera Hidden Costs:

- Monthly subscriptions can add up quickly if you take longer to complete

- Most valuable programs require $39-$79/month ongoing payments

- Degree programs are extremely expensive

- You need to pay separately for each specialization

Cost Comparison Example:

Let’s say you want to learn financial modeling and data analysis over 6 months:

With CFI:

- Cost: $298.20 for the year (Self-Study) or $508.20 (Full-Immersion)

- You Get: FMVA, BIDA, and all other certifications, plus 250+ courses

- Total: $298-$508 for everything

With Coursera:

- Financial Modeling Specialization: $49/month × 4 months = $196

- Data Analysis Certificate: $49/month × 4 months = $196

- Additional business courses: $49/month × 2 months = $98

- Total: $490+ and you still only have 2-3 programs

Learn more about Coursera Pricing 👉 Coursera Pricing Plans : Free, Paid or Degree Programs

Learning Experience and Platform Features

CFI Platform Features

After using CFI extensively, here are the standout features:

User Interface:

- Clean, professional dashboard

- Dark and light mode options

- Clear progress tracking

- Mobile app for iOS and Android

- Organized by career path and skill level

Learning Tools:

- AI Tutor (Full-Immersion): Instant answers trained on all CFI content

- Interactive exercises: Practice problems throughout courses

- Downloadable templates: 250+ Excel models and templates

- Case studies: Real-world business scenarios

- Quizzes: Regular assessments to test understanding

- Multilingual subtitles: 20+ languages available

Support and Community:

- Members-only LinkedIn community: Connect with finance professionals

- Ask an Expert (Full-Immersion): 1-on-1 guidance sessions

- Model reviews (Full-Immersion): Personalized feedback on your work

- Resume reviews (Full-Immersion): Professional CV feedback

- Monthly live office hours: Direct interaction with instructors

Partner Benefits (Full-Immersion):

- PitchBook access

- FinChat discounts

- Koyfin research platform

- Hiration career tools

- Value Sense stock analysis

- Total value: $300+ in exclusive discounts

Coursera Platform Features

Coursera’s platform is mature and feature-rich:

User Interface:

- Intuitive course browser

- Mobile apps available

- Progress tracking

- Course recommendations

- Can feel overwhelming due to sheer volume of content

Learning Tools:

- Video lectures

- Peer-reviewed assignments

- Discussion forums

- Quizzes and assessments

- Reading materials

- Quality varies by instructor

- Limited practical templates

Support:

- Community forums

- Course-specific discussion boards

- No direct instructor access in most courses

- Limited personalized feedback

- Support depends on individual course

Career Impact: Which Platform Gets You Hired?

CFI’s Track Record

Based on user testimonials and platform data:

Career Advancement Statistics:

- 75%+ of learners report significant career advancement within months

- 50,000+ professionals have earned CFI certifications

- Widely used by teams at:

- Goldman Sachs

- JPMorgan

- Deloitte

- PwC

- Bloomberg

- Amazon

- Microsoft

Real Success Stories:

Alonso Saponara (FMVA®) – Investment Banking Analyst at Goldman Sachs:

“The FMVA was incredibly valuable during the Goldman Sachs interview process. I had it open on my second screen while working through the case study. Two of the three interviewers were familiar with the FMVA and spoke highly of it.”

Alessandro Rovere (FMVA®) – Strategic Corporate Finance:

“As a CPA who spent many years working as an auditor and consultant, I now work in strategic corporate finance, leading complex, multi-million-dollar valuations, financial modeling, and challenging forecasting.”

Chris Caldwell (FMVA® and CFA) – Canada:

“As a CFA Charterholder who put 900 hours into that designation, I found just as much value in your FMVA program. This designation only took me 60-70 hours to complete. What I like is that it’s very practical for the workplace as opposed to just pure theory.”

Coursera’s Career Impact

Coursera has helped millions transition careers, but results vary:

General Statistics:

- 148+ million learners worldwide

- Partners with 350+ universities and companies

- Offers accredited degrees recognized globally

- Professional certificates from Google, IBM, Meta, etc.

Coursera’s Strength:

- Better for career changers entering entirely new fields (tech, data science, etc.)

- Valuable for academic credentials and university degrees

- Good for broad skill development across multiple areas

Coursera’s Limitation for Finance:

- Less specialized in finance compared to CFI

- Finance courses mixed quality depending on instructor

- More theory, less practical application

- Fewer employer-specific recognitions in the finance sector

Industry Recognition and Accreditation

CFI Accreditations

CFI holds multiple industry recognitions:

| Organization | Recognition | Impact |

| Better Business Bureau | A+ Rating | Highest possible trust rating |

| CPA Institute | CPE Credits | Earn 550+ continuing education credits |

| NASBA | Training Partner | Recognized for professional development |

| Blockchain Verified | Digital Credentials | Instantly verifiable certifications |

Employer Recognition:

CFI certifications are particularly valued in:

- Investment banking firms

- Commercial banks

- Corporate finance departments

- Private equity firms

- Asset management companies

- Financial advisory firms

Smaller to mid-sized firms often put junior staff through CFI training as part of onboarding.

Coursera Accreditations

Coursera’s accreditation depends on the partner institution:

University Partnerships:

- Stanford University

- Yale University

- University of Pennsylvania

- University of Michigan

- Johns Hopkins University

- And 350+ other institutions

Corporate Partnerships:

- IBM

- Microsoft

- Meta

- Amazon Web Services

- DeepLearning.AI

Accreditation Varies:

- Degree programs are fully accredited through partner universities

- Professional certificates backed by corporate brands

- Individual course certificates carry instructor/university reputation

- Recognition varies by field and employer

Course Depth and Specialization

CFI’s Finance Depth

What impressed me most about CFI is how deep it goes into finance topics:

Financial Modeling Coverage:

- DCF (Discounted Cash Flow) models

- 3-statement financial models

- Merger and acquisition models

- Leveraged buyout (LBO) models

- Real estate financial models

- Startup valuation models

- Scenario and sensitivity analysis

- Monte Carlo simulations

Excel Mastery:

- Advanced formulas and functions

- Power Query and Power Pivot

- VBA for automation

- Data visualization and dashboards

- Financial modeling best practices

- Keyboard shortcuts for efficiency

Specialized Finance Topics:

- Commercial lending and credit analysis

- Capital markets and trading

- Wealth management strategies

- FinTech and digital banking

- ESG (Environmental, Social, Governance)

- Business intelligence with finance data

- Risk management frameworks

Each topic is covered comprehensively with multiple courses building on each other.

Coursera’s Finance Breadth

Coursera offers finance courses, but they’re spread across different programs:

Finance Course Types:

- Individual finance courses (200+)

- Business school finance modules

- Financial management basics

- Investment strategies

- Corporate finance theory

- Accounting fundamentals

- Financial markets overview

The Challenge:

- Topics scattered across different programs

- Varying levels of depth

- Some courses outdated

- Less focus on practical modeling

- More emphasis on theory

- Quality inconsistent across instructors

Learning Format and Time Commitment

CFI’s Structured Path

CFI provides clear learning paths for each career:

Time Investment:

- Individual courses: 30 minutes to 5 hours

- Specializations: 2-4 weeks

- Full certifications: 3-6 months

- Typical weekly commitment: 8-10 hours

Learning Approach:

- Self-paced but structured

- Clear progression through levels

- Practice exercises throughout

- Final exams for certifications

- Lifetime access to materials (with active subscription)

Flexibility:

- Study anytime, anywhere

- Pause and resume as needed

- Mobile learning available

- No deadline pressure

- Requires self-discipline

Coursera’s Flexible Options

Coursera offers more variety in learning formats:

Time Investment:

- Individual courses: 4-6 weeks typically

- Specializations: 3-6 months

- Professional certificates: 3-8 months

- Degrees: 1-4 years

- Typical weekly commitment: 3-10 hours

Learning Formats:

- Video lectures

- Reading materials

- Peer-reviewed projects

- Discussion forums

- Capstone projects

- Live sessions (some programs)

Flexibility:

- Self-paced options available

- Some structured programs with deadlines

- Mobile learning supported

- Monthly subscription can pressure completion

- Degree programs have strict schedules

Support and Guidance

CFI’s Personalized Support

CFI excels in providing direct support, especially with the Full-Immersion plan:

Available Support:

AI Tutor (Full-Immersion Only)

- Instant answers to questions

- Trained on all CFI content

- Available 24/7

- Supports 25+ languages

Ask an Expert (Full-Immersion Only)

- Up to 5 one-on-one sessions per week

- Guidance from curriculum specialists

- Help with difficult concepts

- Career advice

Personalized Model Feedback (Full-Immersion Only)

- Submit one financial model per week

- Expert review and detailed feedback

- Catch mistakes before they become habits

- Improve modeling skills faster

Community Support (All Plans)

- Members-only LinkedIn group

- Peer discussions

- Networking opportunities

- Industry updates and tips

Monthly Live Office Hours (Full-Immersion)

- Direct interaction with instructors

- Q&A sessions

- Group learning

Coursera’s Community Support

Coursera relies more on community-based support:

Available Support:

Discussion Forums

- Course-specific forums

- Peer discussions

- Some instructor participation

- Response time varies

Peer Reviews

- Fellow students review assignments

- Learn from others’ work

- Quality of feedback varies

Help Center

- Knowledge base articles

- Technical support

- FAQs

- Limited for content questions

No Direct Instructor Access

- Most courses don’t offer direct instructor support

- Relies on community for help

- Premium programs may have better support

Free Content and Trial Options

CFI Free Offerings

CFI provides limited but valuable free content:

Free Access:

29 complete free courses, including:

- Accounting Fundamentals

- Excel Fundamentals

- Reading Financial Statements

- Corporate Finance Basics

- Introduction to ESG

Free course previews for all paid programs

Free resources:

- Financial Ratios Guide

- Excel templates

- Articles and guides

- Breaking Into FP&A Guide

Limitations:

- No free trial of paid memberships

- Limited free content compared to Coursera

- No refund policy (except EU: 14 days)

Coursera Free Content

Coursera offers extensive free access:

Free Access:

Audit thousands of courses for free

- Watch all video lectures

- Access reading materials

- No certificate or graded assignments

- 7-day free trial of Coursera Plus

- Free first module of most courses

- Financial aid available for paid programs

Advantage: Coursera’s free offering is more generous, letting you explore extensively before committing.

The Verdict: Why CFI Wins for Finance Professionals

After thoroughly testing both platforms, I can confidently say that CFI is the superior choice for finance professionals. Here’s why:

10 Reasons CFI Beats Coursera for Finance Careers

1. Laser-Focused Specialization

CFI does one thing and does it exceptionally well: finance education. Every course, template, and resource is designed specifically for finance professionals. Coursera’s broad approach means finance is just one of hundreds of topics, resulting in less depth and specialization.

2. Practical, Job-Ready Skills

CFI teaches you to build actual financial models used in investment banking, corporate finance, and financial analysis. You learn by doing, not just by watching lectures. Coursera’s finance courses tend to be more theoretical and academic.

3. Better Value for Money

At $298-$508 per year, CFI gives you unlimited access to all 7 certifications, 15 specializations, and 250+ courses. With Coursera, you’d pay $39-$79 per month for each specialization, quickly exceeding CFI’s annual cost.

Cost Comparison for 6 Months:

- CFI: $298.20 (entire year, all certifications)

- Coursera: $294-$474 (just 1-2 specializations)

4. Industry Recognition in Finance

CFI certifications are specifically recognized by finance employers. Major firms like Goldman Sachs, JPMorgan, and Deloitte actively recognize and value CFI credentials. Coursera certificates have broader recognition but less specific weight in finance.

5. Comprehensive Career Support

With CFI’s Full-Immersion plan, you get:

- AI Tutor for instant help

- One-on-one expert guidance

- Resume reviews

- Model feedback

- Partner tool discounts

Coursera offers minimal personalized support outside of community forums.

6. Structured Learning Paths

CFI provides clear roadmaps for specific finance careers (investment banking, FP&A, commercial banking, etc.). Coursera requires you to piece together courses from different programs, making it harder to build a cohesive skill set.

7. Excel Mastery

Finance jobs require advanced Excel skills. CFI integrates Excel throughout all programs, teaching you to build models from scratch. Coursera’s finance courses have minimal hands-on Excel training.

8. Faster Completion Time

CFI certifications take 3-6 months to complete with practical knowledge you can apply immediately. Coursera’s degree programs take 1-4 years, and specializations often drag on due to less structured paths.

9. Blockchain-Verified Credentials

CFI certificates are blockchain-verified, making them instantly verifiable by employers. This digital credibility is particularly valuable in finance where trust and verification matter.

10. Active Finance Community

CFI’s LinkedIn community consists exclusively of finance professionals. You network with people in your field, share job opportunities, and discuss industry-specific topics. Coursera’s broader community dilutes this focused networking.

When Coursera Might Be Better

To be fair, Coursera has advantages in specific scenarios:

If you want a full university degree in finance (MBA, Master’s in Finance), or if you’re exploring multiple career paths outside of finance.

If you prefer academic-style learning with university professors, or if you want courses from prestigious universities like Stanford or Yale

If you need broader business education beyond just finance, and if you qualify for financial aid for expensive programs

My Final Recommendation

For anyone serious about a career in finance, CFI is the clear winner. Here’s my advice:

Choose CFI if you:

- Want to work in investment banking, corporate finance, or financial analysis

- Need practical, hands-on financial modeling skills

- Want to complete certifications in 3-6 months

- Prefer affordable, comprehensive access to all finance content

- Value employer recognition specifically in the finance sector

- Want to build Excel mastery

- Need a clear, structured learning path

- Want personalized support and feedback

Best CFI Plan for Most People: Start with Self-Study ($298.20/year) to test the platform. If you want AI Tutor, personalized feedback, and premium support, upgrade to Full-Immersion ($508.20/year).

Choose Coursera if you:

- Want a full university degree (MBA, Master’s)

- Are exploring careers outside of finance

- Prefer academic teaching from university professors

- Want courses across multiple subjects

- Have time for longer programs (1-4 years)

- Want free audit options to explore first

- Qualify for financial aid for expensive programs

Best Coursera Option: If you’re committed to multiple courses, Coursera Plus at $199/year (with current 50% discount) gives good value for breadth. For finance specifically, look for courses from top universities like Yale or Penn.

Conclusion: CFI Delivers Better ROI for Finance Professionals

Both CFI and Coursera are excellent platforms, but they serve different needs. If your goal is to advance in finance, build job-ready skills, and earn industry-recognized certifications at an affordable price, CFI is unquestionably the better choice.

The combination of:

- Specialized finance focus

- Practical, hands-on training

- Industry recognition

- Comprehensive support

- Affordable pricing ($298-$508/year)

- Faster completion times (3-6 months)

- Direct applicability to finance jobs

…makes CFI the superior investment for your finance career.

I recommend starting with CFI’s free courses to test the platform, then committing to a Self-Study or Full-Immersion membership. With the current 40% discount, there’s never been a better time to invest in your finance education through CFI.

For those needing broader education or university degrees, Coursera remains a valuable resource, but for targeted finance career advancement, CFI simply can’t be beaten.

Ready to start your finance career transformation? Visit corporatefinanceinstitute.com to explore free courses and see why 2.8+ million professionals trust CFI for their finance education.

Quicklinks:

- CFI Review : Is this Financial Modeling Institute Worth It?

- Manychat Review : Is Chat Automation Still Effective?

- Ontraport Review: Best Tool For Marketing Automation?

- WordPress Review: Best Choice for Your Website?

- Wix Review : The Ultimate Website Builder for Everyone

- Instapage Review : Still the Best Landing Page Builder?

Frequently Asked Questions

❓Can I use both CFI and Coursera?

Absolutely! Some professionals use CFI for finance-specific skills and Coursera for complementary topics like data science or business strategy. However, for most finance professionals, CFI alone provides everything needed.

❓Which certification is better: CFI FMVA or a Coursera Finance Specialization?

For finance careers, the FMVA is significantly more valuable. It’s specifically recognized in the finance industry, covers practical modeling skills, and is more affordable. Coursera specializations are broader but less specialized.

❓Is CFI worth it if I already have a finance degree?

Yes! Many finance graduates find that CFI teaches the practical skills their degree program didn’t cover, particularly hands-on financial modeling and Excel mastery.

❓Does Coursera offer anything comparable to CFI’s FMVA?

Not really. While Coursera has financial modeling courses, none match the depth, structure, and industry recognition of CFI’s FMVA program.

❓Can I get a job with just a CFI certification?

CFI certifications significantly improve your chances, especially when combined with relevant experience or education. They won’t replace a degree, but they demonstrate practical competency that employers value highly.

❓Which is better for complete beginners?

Both platforms work for beginners. CFI offers a more structured path from beginner to expert specifically in finance. Coursera might feel less overwhelming due to shorter individual courses, but CFI’s clear progression is actually better for focused learning.

❓Are CFI certifications recognized internationally?

Yes, CFI certifications are recognized globally, with students in 190+ countries. Major international firms recognize CFI credentials.

❓Can I access CFI or Coursera content offline?

Both platforms offer mobile apps. CFI’s app allows downloading for offline viewing. Coursera also supports offline access through their mobile app.