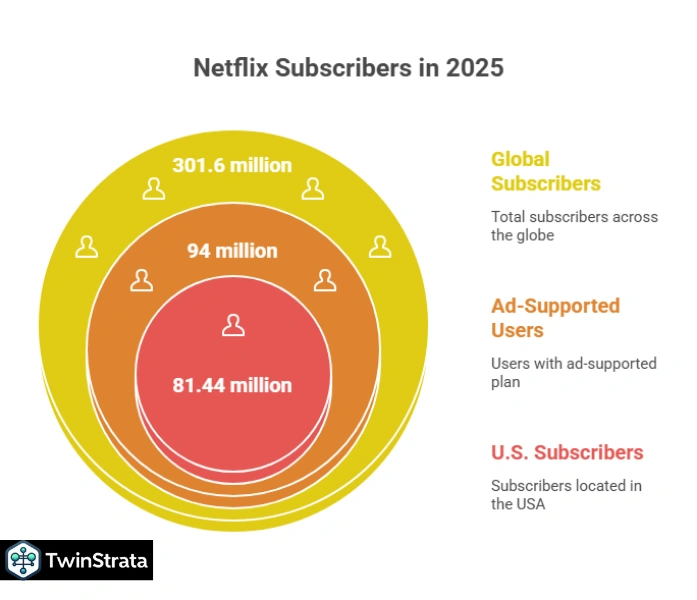

Netflix continues to dominate the global streaming industry with 301.6 million subscribers in 2025, solidifying its position as the world’s leading streaming platform.

With a market valuation of $528.53 billion, Netflix ranks among the top 20 most valuable companies globally. Its innovative strategies, such as ad-supported plans, password-sharing crackdowns, and exclusive live events, have fueled remarkable growth. In Q2 2025, Netflix generated $11.08 billion in revenue, a 16% year-over-year increase, and achieved a record-breaking $3.125 billion net income.

This comprehensive guide explores Netflix subscribers statistics for 2025, covering user demographics, regional growth, engagement trends, and financial performance.

Whether you’re a content creator, marketer, investor, or Netflix enthusiast, this article will help you understand how to leverage Netflix’s vast ecosystem for your benefit. We’ve also included trending questions from Quora and Reddit to provide the latest insights into what users are asking about Netflix in 2025.

Table of Contents

ToggleWhy Netflix Matters in 2026

Netflix isn’t just a streaming service; it’s a cultural powerhouse shaping how people consume entertainment. With 301.6 million subscribers and a 21% U.S. market share, it remains a top choice for viewers worldwide. Its diverse content library, AI-driven recommendations, and new ventures like live sports make it a versatile platform for users and businesses alike.

Here’s what you’ll learn in this article:

- Subscriber Demographics: Who uses Netflix and where they’re located.

- Engagement Trends: How users interact with the platform.

- Financial Performance: Revenue, net income, and growth metrics.

- Business Opportunities: How to use Netflix for marketing or content creation.

- Trending Insights: Answers to popular questions from Quora and Reddit.

- Actionable Tips: Strategies to maximize Netflix’s potential for your goals.

Key Netflix Subscribers Statistics for 2026

Let’s kick off with the most critical Netflix subscribers statistics for 2025 to give you a snapshot of its global impact:

| Statistic | Value |

| Global Subscribers | 301.6 million |

| U.S. Subscribers | 81.44 million |

| Revenue (Q2 2025) | $11.08 billion |

| Net Income (Q2 2025) | $3.125 billion |

| Average Daily Time Spent | 63 minutes |

| Ad-Supported Plan Users | 94 million (monthly active) |

| Market Valuation | $528.53 billion |

These figures highlight Netflix’s massive reach and financial strength. Let’s dive deeper into the details.

Netflix Subscriber Demographics in 2026

Understanding Netflix’s user base is key to tailoring content, campaigns, or investment strategies. Here’s a breakdown of Netflix subscribers by region, country, gender, and generation.

1. Global Subscriber Count

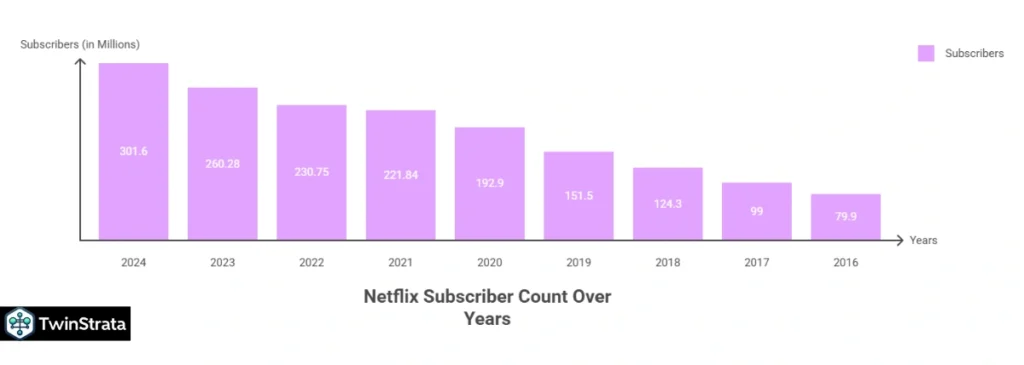

Netflix reached 301.6 million subscribers in Q4 2024, a 15.9% increase from 260.28 million in Q3 2023. This growth reflects the success of strategies like password-sharing restrictions and the ad-supported tier.

| Year | Subscribers |

| 2024 | 301.6 million |

| 2023 | 260.28 million |

| 2022 | 230.75 million |

| 2021 | 221.84 million |

| 2020 | 192.9 million |

| 2019 | 151.5 million |

| 2018 | 124.3 million |

| 2017 | 99 million |

| 2016 | 79.9 million |

Source: Statista

2. Quarterly Subscriber Growth

Netflix added 18.9 million subscribers in Q4 2024 alone, the highest quarterly gain in its history. The password-sharing crackdown, launched in over 100 countries, boosted sign-ups, with 73,000 daily sign-ups in the U.S. during May 2023, a 102% increase from the prior 60-day period.

| Quarter | Subscribers | New Subscribers |

| Q4 2024 | 301.6 million | 18.9 million |

| Q3 2024 | 282.7 million | 5.05 million |

| Q2 2024 | 277.65 million | 8.05 million |

| Q1 2024 | 269.6 million | 9.32 million |

| Q4 2023 | 260.28 million | 13.13 million |

3. Subscribers by Region

The Europe, Middle East, and Africa (EMEA) region leads with 101.13 million subscribers, followed by the U.S. and Canada with 89.63 million. Asia Pacific and Latin America are growing rapidly, driven by localized content.

| Region | Subscribers |

| EMEA | 101.13 million |

| U.S. & Canada | 89.63 million |

| Asia Pacific | 57.54 million |

| Latin America | 53.33 million |

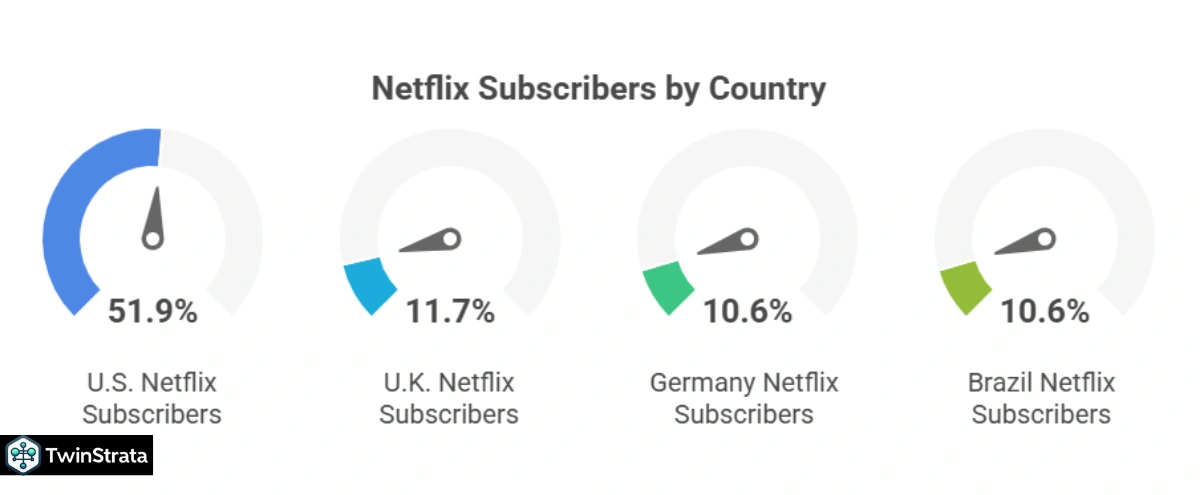

4. Subscribers by Country

The U.S. remains Netflix’s largest market with 81.44 million subscribers, followed by the U.K. (18.4 million), and Germany and Brazil (16.59 million each). Emerging markets like India (12.37 million) and South Korea (8.36 million) show strong growth potential.

| Country | Subscribers |

| United States | 81.44 million |

| United Kingdom | 18.4 million |

| Germany | 16.59 million |

| Brazil | 16.59 million |

| Mexico | 13.87 million |

| India | 12.37 million |

5. Gender Demographics

Netflix’s user base is nearly evenly split, with 51% female and 49% male subscribers, making it appealing to diverse audiences.

| Gender | Share (%) |

| Female | 51% |

| Male | 49% |

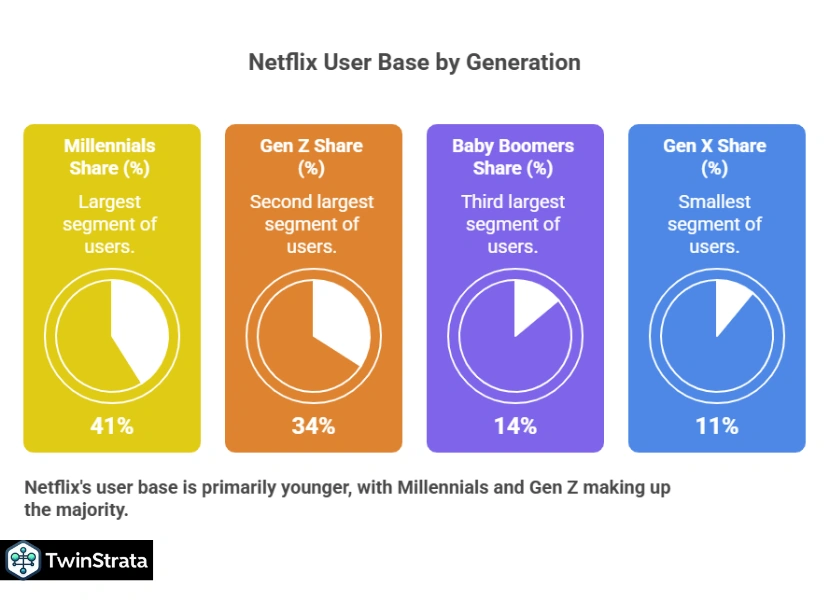

6. Generational Demographics

Millennials (41%) and Gen Z (34%) dominate Netflix’s user base, reflecting its appeal to younger audiences. Baby Boomers (14%) and Gen X (11%) also contribute significantly.

| Generation | Share (%) |

| Millennials | 41% |

| Gen Z | 34% |

| Baby Boomers | 14% |

| Gen X | 11% |

Source: Netflix

Engagement Trends: How Users Interact with Netflix

Netflix’s ability to keep users engaged is unmatched, with an average of 63 minutes daily spent on the platform in 2025. Here’s how users interact with Netflix:

1. Time Spent on Netflix

U.S. users spend 63 minutes daily on Netflix, up from 62.1 minutes in 2024. This is higher than competitors like YouTube (48.7 minutes) and TikTok (58.4 minutes).

| Year | Average Daily Time (U.S.) |

| 2025 | 63 minutes |

| 2024 | 62.1 minutes |

| 2023 | 61.8 minutes |

| 2022 | 61.3 minutes |

| 2021 | 60.5 minutes |

2. Viewing Frequency

In 2023, 25% of U.S. Millennials watched Netflix multiple times daily, while 30% of Gen Z used it a few times weekly. Baby Boomers are the least frequent users, with 49% reporting never using Netflix.

| Generation | Multiple Times Daily (%) | A Few Times Weekly (%) | Never (%) |

| Gen Z | 19% | 30% | 12% |

| Millennials | 25% | 23% | 15% |

| Gen X | 17% | 21% | 31% |

| Baby Boomers | 7% | 20% | 49% |

3. Binge-Watching Habits

On average, users take 5 days to binge-watch a series, with 8.4 million global users finishing a series within 24 hours of its release. Subscribers watch approximately 60 films annually, or one every six days.

4. Algorithm-Driven Viewing

Netflix’s recommendation algorithm drives 80% of views, helping users discover content tailored to their preferences. This keeps viewers hooked and boosts engagement.

Financial Performance: Netflix’s Revenue and Market Strength

Netflix’s financial growth reflects its dominance in the streaming industry. Here’s a detailed look at its revenue, net income, and market valuation.

1. Revenue in 2026

Netflix generated $21.61 billion in the first two quarters of 2025, with $11.08 billion in Q2 alone. For 2024, total revenue reached $39 billion, a 15.7% increase from 2023’s $33.72 billion.

| Year/Quarter | Revenue |

| Q2 2025 | $11.08 billion |

| Q1 2025 | $10.53 billion |

| 2024 | $39 billion |

| 2023 | $33.72 billion |

| 2022 | $31.61 billion |

| 2021 | $29.69 billion |

2. Net Income

Netflix’s net income hit $3.125 billion in Q2 2025, a record high, up from $2.89 billion in Q1 2025. In 2023, annual net income was $5.4 billion, a 20.3% increase from 2022.

| Year/Quarter | Net Income |

| Q2 2025 | $3.125 billion |

| Q1 2025 | $2.89 billion |

| 2024 | $8.71 billion |

| 2023 | $5.4 billion |

| 2022 | $4.49 billion |

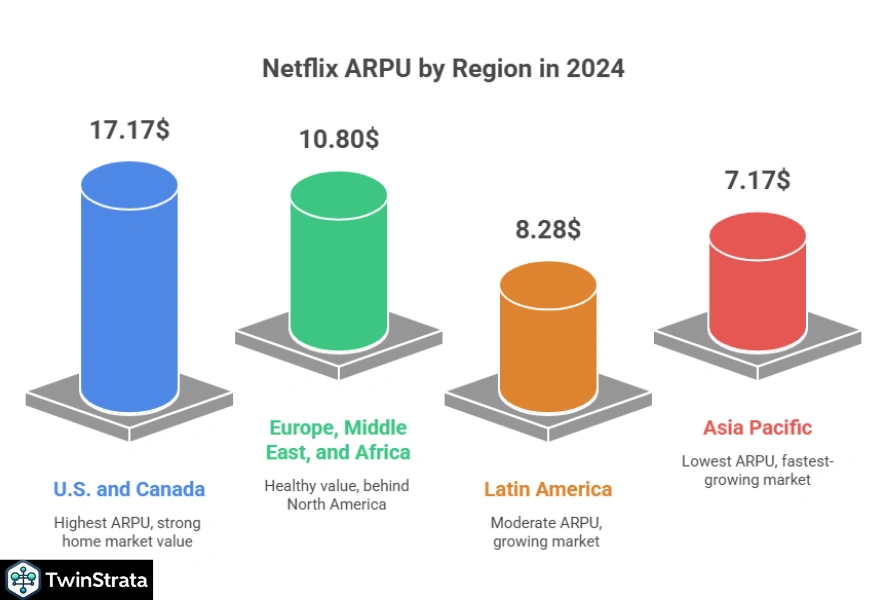

3. Average Revenue Per User (ARPU)

Netflix’s global ARPU in 2024 was $11.7, with the U.S. and Canada leading at $17.17. The Asia Pacific region has the lowest ARPU at $7.17, reflecting affordable pricing strategies.

| Region | ARPU |

| U.S. and Canada | $17.17 |

| Europe, Middle East, and Africa | $10.80 |

| Latin America | $8.28 |

| Asia Pacific | $7.17 |

4. Market Valuation

Netflix’s market cap soared to $528.53 billion in 2025, a 36.24% increase from 2024’s $387.93 billion, making it the 18th most valuable company globally.

| Year | Market Cap |

| 2025 | $528.53 billion |

| 2024 | $387.93 billion |

| 2023 | $213.09 billion |

| 2022 | $131.22 billion |

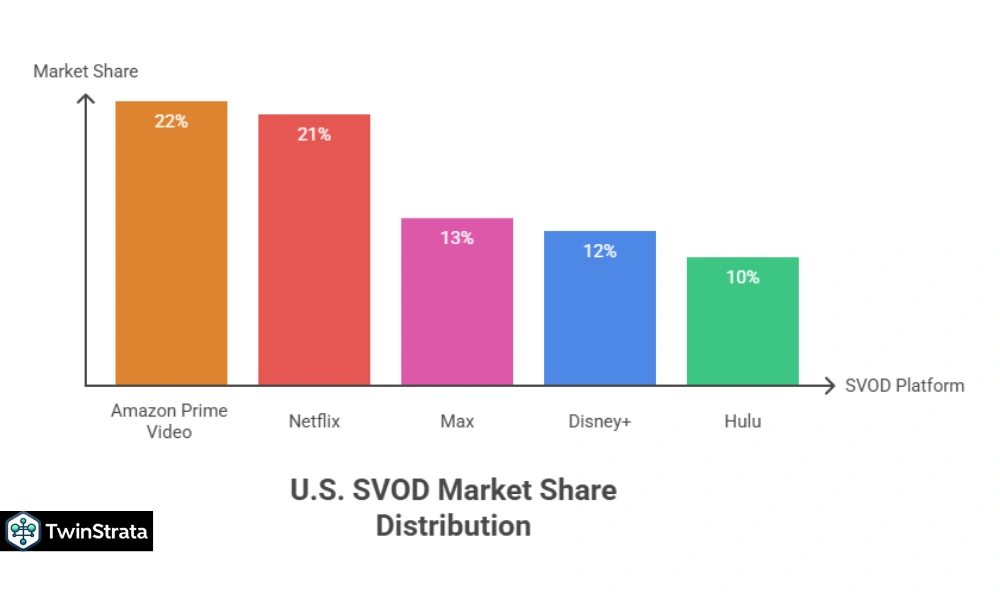

Netflix’s Market Share and Competitive Edge

Netflix holds a 21% market share in the U.S. SVOD market, trailing only Amazon Prime Video (22%). Its diverse content and innovative features keep it ahead of competitors like Disney+ (12%) and Hulu (10%).

| SVOD Platform | Market Share (%) |

| Amazon Prime Video | 22% |

| Netflix | 21% |

| Max | 13% |

| Disney+ | 12% |

| Hulu | 10% |

Key Competitive Advantages

- Ad-Supported Tier: With 94 million monthly active users, the ad-supported plan (launched in 2022) attracts budget-conscious users and advertisers.

- Live Events: Netflix’s first NFL Christmas games in 2024 drew 30 million viewers each, signaling its entry into live sports.

- Content Investment: Netflix plans to spend $17 billion on content in 2024, ensuring a robust library of originals and licensed titles.

Trending Questions from Quora and Reddit (2025)

To provide the latest insights, we’ve gathered trending questions about Netflix subscribers statistics from Quora and Reddit:

- “Is Netflix still growing in 2025, or is it losing ground to competitors?”

Reddit users note that Netflix’s 301.6 million subscribers and 18.9 million Q4 2024 additions show robust growth. Its ad-supported tier and live events like NFL games keep it competitive despite rivals like Disney+. - “How effective is Netflix’s ad-supported plan for advertisers?”

Quora discussions highlight that the ad-supported tier, with 94 million monthly active users, offers advertisers access to a young audience (18–34-year-olds). Netflix’s in-house ad platform, launching by late 2025, will enhance targeting capabilities. - “Why is Netflix so popular in emerging markets like India?”

Reddit users point to Netflix’s localized content (e.g., Bollywood originals) and affordable pricing as key drivers. India’s 12.37 million subscribers reflect its focus on regional content and mobile-first strategies. - “How has the password-sharing crackdown impacted Netflix’s growth?”

Quora users confirm that the crackdown, affecting 100 million households, led to 9.33 million new subscribers in 2023, with daily U.S. sign-ups spiking to 73,000 post-announcement.

How to Leverage Netflix for Your Benefit

Netflix offers opportunities for various audiences. Here’s how you can make the most of it:

1. For Businesses and Advertisers

- Tap into the Ad-Supported Tier: Reach 94 million users with targeted ads, especially the 18–34 demographic.

- Sponsor Live Events: Partner with Netflix for high-viewership events like NFL games to boost brand visibility.

- Use Data Insights: Leverage Netflix’s analytics (via partnerships) to understand viewer preferences and tailor campaigns.

2. For Content Creators

- Pitch Original Content: Netflix’s $17 billion content budget supports diverse projects. Submit scripts or concepts through agents.

- Create for Regional Markets: Focus on content for growing markets like India or South Korea to align with Netflix’s localization strategy.

- Engage Audiences: Use social media to promote your Netflix projects, capitalizing on the platform’s 80% algorithm-driven views.

3. For Viewers

- Explore the Ad-Supported Plan: Save money with the ad-supported tier, ideal for budget-conscious users.

- Discover New Content: Trust Netflix’s algorithm to recommend shows tailored to your tastes.

- Join Live Events: Watch exclusive events like sports or concerts to stay engaged with new offerings.

FAQs About Netflix Subscribers Statistics

1. How many subscribers does Netflix have in 2025?

Netflix has 301.6 million subscribers worldwide as of Q4 2024, with 81.44 million in the U.S. alone.

2. Which region has the most Netflix subscribers?

The Europe, Middle East, and Africa (EMEA) region leads with 101.13 million subscribers, followed by the U.S. and Canada with 89.63 million.

3. How much time do users spend on Netflix daily?

In 2025, U.S. users spend an average of 63 minutes daily on Netflix, more than competitors like YouTube (48.7 minutes) and TikTok (58.4 minutes).

4. How has Netflix’s ad-supported plan impacted its growth?

The ad-supported plan has 94 million monthly active users in 2025, with 40% of new sign-ups choosing this tier in available countries, boosting subscriber growth.

5. What is Netflix’s market valuation in 2025?

Netflix’s market cap is $528.53 billion in 2025, making it the 18th most valuable company globally.

Also Read:

- Amazon Statistics

- WeChat Statistics

- Facebook Statistics

- YouTube Statistics

- Microsoft Teams Statistics

Conclusion

Netflix’s 301.6 million subscribers in 2025 underscore its dominance in the streaming industry. With $21.61 billion in revenue in the first half of 2025, a 21% U.S. market share, and innovative features like ad-supported plans and live sports, Netflix continues to redefine entertainment.

By understanding these Netflix subscribers statistics for 2025, businesses, creators, and viewers can unlock its potential—whether through targeted advertising, content creation, or personalized viewing experiences. As Netflix invests in AI, localization, and exclusive events, its influence will only grow.