In the fast-evolving world of digital finance, PayPal continues to be a dominant force, shaping how individuals and businesses conduct online transactions.

As we move further into 2025, understanding the latest PayPal statistics is crucial for anyone looking to optimize their digital payment strategies, gain a competitive edge, or simply stay informed about the trends influencing their financial interactions.

This comprehensive article dives deep into the most current data, offering detailed insights into PayPal’s revenue, user base, market position, and much more.

Whether you’re a budding entrepreneur, an established e-commerce business, or a curious consumer, this guide will illuminate how PayPal’s impressive scale and innovative offerings can benefit you.

We’ll explore the numbers, highlight key growth areas, delve into security aspects, and even address questions circulating in online communities like Quora and Reddit, ensuring you have the freshest and most relevant information at your fingertips.

Table of Contents

TogglePayPal’s Unstoppable Growth: Key Statistics for 2026

PayPal’s journey from Cofinity in 1998 to a global fintech giant is a testament to its continuous adaptation and innovation. Today, it stands as a formidable two-sided network, powering e-commerce for millions worldwide.

Here’s a snapshot of PayPal’s top-line statistics for 2025:

- Active Users: PayPal boasts 434 million active users as of December 2024, marking a steady increase year-over-year.

- Market Dominance: With a commanding 45% share of the global payments market, PayPal remains the undisputed leader in online payment options.

- Web Presence: An astounding 10.3 million live websites globally proudly offer PayPal as a payment option.

- Total Payment Volume (TPV): PayPal processed a staggering $1.68 trillion in TPV in 2024.

- Revenue Powerhouse: The company generated $31.8 billion in net revenue in 2024.

- Global Reach: PayPal operates in over 200 markets worldwide, facilitating seamless cross-border transactions.

- Financial Health: PayPal enters 2025 with a robust $6.8 billion in free cash flow.

PayPal’s enduring success lies in its ability to consistently deliver user-friendly, secure, and efficient payment solutions.

Global User Count and Growth

PayPal currently serves approximately 434 million active users worldwide as of December 2024. This represents a healthy 2.1% year-over-year increment, translating to an additional 8.8 million active account holders. This growth encompasses both individual consumers and merchants, highlighting the platform’s broad appeal.

Let’s look at the quarterly breakdown of PayPal’s active accounts:

| Quarter | PayPal Active Accounts (in millions) |

| Q4 2024 | 434 |

| Q3 2024 | 432 |

| Q2 2024 | 429 |

| Q1 2024 | 427 |

| Q4 2023 | 426 |

| Q3 2023 | 428 |

| Q2 2023 | 431 |

| Q1 2023 | 433 |

| Q4 2022 | 435 |

Source: Statista

While the most recent quarter shows a slight dip compared to previous peaks in 2022 and Q1 2023, the overall trend reflects a robust and expanding user base that adapted to changes in the market.

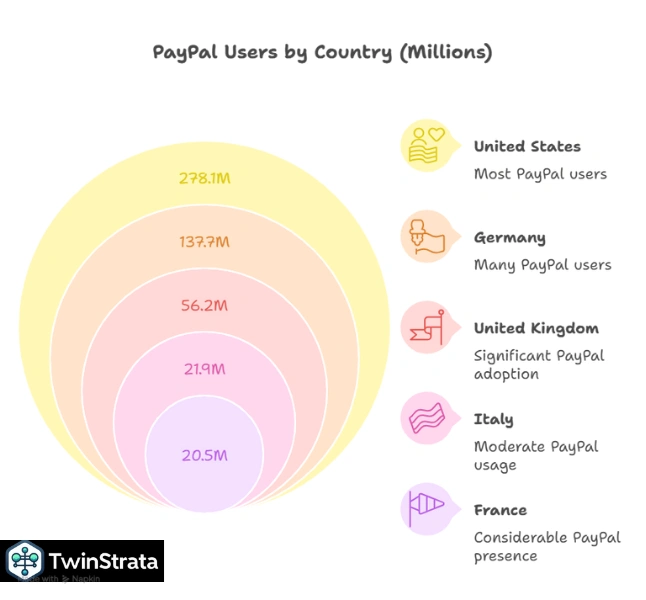

PayPal Usage by Country: A Global Footprint

The United States leads the pack with an impressive 278.1 million PayPal users. However, PayPal’s global presence is undeniable, with strong adoption in various countries.

| Country | Number Of PayPal Users (in millions) |

| United States | 278.1 |

| Germany | 137.7 |

| United Kingdom | 56.2 |

| Italy | 21.9 |

| France | 20.5 |

Source: World Population Review

Interestingly, reports indicate that PayPal is used more frequently for online payments in Germany and Brazil than in the United States.

Germany, in particular, remains a stellar market, with nearly half of German consumers utilizing PayPal for in-store or restaurant payments, and a staggering 90% for online transactions. This demonstrates the localized strength and diverse use cases for PayPal across different regions.

PayPal User Demographics: Understanding Your Audience

Understanding PayPal’s user demographics is crucial for businesses aiming to connect with their target audience effectively.

- Broad Adoption in the US: 56% of Americans report having a PayPal account.

- European Trust: A significant 75% of Europeans trust PayPal over other payment services, underscoring its reputation for reliability and security.

- Generation X and Millennials: A remarkable 85% of Gen X online consumers in the United States have used PayPal. Globally, 97% of PayPal users are Millennials. This highlights PayPal’s strong appeal to younger, digitally native generations.

- Age Distribution:

- 25% of PayPal users are aged 25 to 34.

- 19% are aged between 35 to 44 years.

- 14% are below the age of 24.

- Children Users: Children constitute up to 9% of PayPal users in the United States, indicating early adoption and integration into family digital spending.

This demographic data paints a clear picture: PayPal is a go-to payment method for a vast and diverse audience, particularly among younger and economically active demographics. Businesses can leverage this by prominently displaying PayPal as a payment option, especially when targeting these age groups.

PayPal’s Dominance in the Payment Processing Market

PayPal’s market share speaks volumes about its position as a leader in the payment processing industry.

Market Share Analysis

PayPal commands an impressive 45% market share of the global payments market, solidifying its position as the number one choice. Its closest competitors include Stripe and Shopify Pay Installments, though they lag significantly behind.

| Company Name | Market Share |

| PayPal | 45.00% |

| Stripe | 17.15% |

| Shopify Pay Installments | 15.68% |

| Amazon Pay | 2.62% |

| SecurePay | 1.5% |

| PayPal Braintree | 1.2% |

| Stripe Checkout | 1.18% |

| Afterpay | 1.12% |

Source: Statista

This dominant market share underscores PayPal’s widespread acceptance and user preference. For businesses, offering PayPal is not just an option, but a necessity to cater to a significant portion of online shoppers and ensure smooth, trusted transactions.

PayPal’s Financial Performance: Revenue and Profitability

PayPal’s financial health is a crucial aspect of its overall strength and stability. The company consistently demonstrates strong revenue generation and strategic financial management.

Revenue Statistics

In 2024, PayPal’s full-year net revenue reached an impressive $31.8 billion. This robust performance is driven by increasing transaction and value-added services revenues, both domestically and internationally.

Here’s a look at PayPal’s revenue over recent quarters:

| Quarter | Revenue Generated (in billions) | Year-on-year Percentage Change |

| Q4 2024 | $8.4 | 4% |

| Q3 2024 | $7.84 | 6% |

| Q2 2024 | $7.9 | 8% |

| Q1 2024 | $7.7 | 9% |

| Q4 2023 | $8.02 | 8.67% |

| Q3 2023 | $7.41 | 8.33% |

| Q2 2023 | $7.28 | 7.05% |

| Q1 2023 | $7.04 | 8.6% |

| Q4 2022 | $7.38 | 6.7% |

Source: Statista

Key Revenue Drivers:

- Transaction Revenue: This forms the lion’s share, with $7.588 billion in Q4 2024, representing 90.7% of net revenues.

- Value Added Services: These contributed $778 million in Q4 2024, making up 9.3% of net revenues.

- Geographical Contributions:

- US revenue amounted to $4.518 billion in Q4 2024 (57% of net revenues).

- International operations revenue was $3.634 billion in Q4 2024 (43% of net revenues).

PayPal’s Compound Annual Growth Rate (CAGR) of 12.3% over the past five years underscores its consistent ability to generate substantial revenue and makes it an attractive investment.

Profitability: Net Income and Free Cash Flow

PayPal also demonstrates strong profitability, indicating efficient operations and a healthy financial outlook.

| Quarter | Net Income (loss) (in millions) | Year-on-year Percentage Change |

| Q3 2024 | $1,010 | -1% |

| Q2 2024 | $1,128 | 10% |

| Q1 2024 | $888 | 12% |

| Q4 2023 | $1,402 | 52.22% |

| Q3 2023 | $1,020 | -23.3% |

| Q2 2023 | $1,029 | 401.8% |

| Q1 2023 | $795 | 56.2% |

| Q4 2022 | $921 | 15% |

| Q3 2022 | $1,330 | 4% |

| Q2 2022 | – $341 | -128.8% |

Source: Statista

While Q3 2024 saw a slight dip in net income, the overall trend points to strong and growing profitability. PayPal also ended 2024 with an impressive $6.8 billion in free cash flow, returning $6.0 billion to stockholders through share repurchases, demonstrating a commitment to shareholder value.

Merchants and Transactions: The Engine of PayPal’s Ecosystem

The sheer volume of merchants using PayPal and the transactions they process highlight the platform’s integral role in global commerce.

PayPal Merchant Accounts

PayPal has successfully cultivated a vast network of merchants who rely on its services. The company now boasts over 36 million merchant accounts in 200 markets worldwide, representing a strong CAGR growth of approximately 10.76% over the past five years.

| Year | Merchant Accounts (in millions) |

| 2023 | 35 |

| 2022 | 35 |

| 2021 | 33 |

| 2020 | 30 |

| 2019 | 24 |

| 2018 | 21 |

| 2017 | 18 |

| 2016 | 15 |

| 2015 | 13 |

The growth in merchant accounts signifies PayPal’s continued appeal to businesses of all sizes, offering them a trusted and efficient way to accept payments.

Transaction Volume and Frequency

PayPal consistently handles an enormous volume of transactions, reflecting its daily use by millions of consumers and businesses.

In 2024, PayPal’s full-year payment transactions increased by 5% to 26.3 billion. This is a testament to the platform’s scalability and its ability to manage massive transaction loads.

| Year | Number Of PayPal Transactions (in billions) |

| 2024 (Full) | 26.3 |

| 2023 | 24.98 |

| 2022 | 22.3 |

| 2021 | 19.3 |

| 2020 | 15.4 |

| 2019 | 12.4 |

| 2018 | 9.9 |

Source: Statista

This data clearly illustrates PayPal’s rapid growth in transaction volume, more than doubling its 2018 figures by 2023.

Furthermore, individual user engagement is strong, with PayPal recording an average of 60.6 transactions per active account in 2024. This marks a 3% increase from 2023, surpassing industry estimates.

| Year | Transactions Per Account |

| 2024 | 60.6 |

| 2023 | 58.7 |

| 2022 | 51 |

| 2021 | 45 |

| 2020 | 40 |

| 2019 | 40 |

| 2018 | 36 |

| 2017 | 33 |

| 2016 | 31 |

The increasing number of transactions per account highlights user stickiness and the ingrained habit of using PayPal for various payment needs.

PayPal’s Global Reach and Currency Support

PayPal’s availability in over 200 countries and regions worldwide makes it a truly global payment solution. It supports 25 major currencies, including the US dollar and Japanese yen, enabling seamless international transactions for both consumers and businesses.

This extensive reach is a significant advantage for cross-border e-commerce, allowing merchants to tap into a global customer base with ease.

Behind the Scenes: PayPal’s Workforce and Strategic Acquisitions

The human capital and strategic foresight behind PayPal’s operations are just as vital as its financial and user statistics.

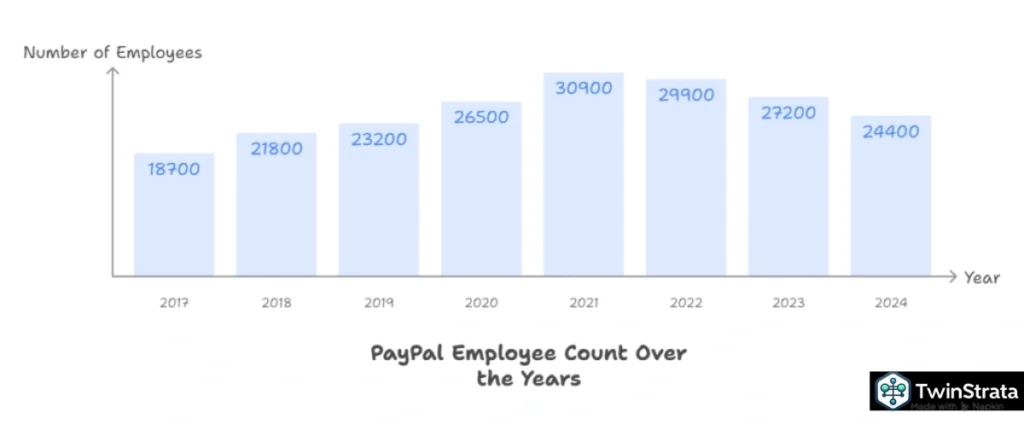

Employee Count

As of December 2024, PayPal employs approximately 24,400 individuals globally. This figure has seen some fluctuations, notably a decrease in 2022 due to economic pressures and layoffs, but the company maintains a substantial workforce dedicated to innovation and service.

| Year | Number of PayPal Employees |

| 2024 | 24,400 |

| 2023 | 27,200 |

| 2022 | 29,900 |

| 2021 | 30,900 |

| 2020 | 26,500 |

| 2019 | 23,200 |

| 2018 | 21,800 |

| 2017 | 18,700 |

Source: Statista

Strategic Acquisitions: Expanding the Ecosystem

PayPal has a history of strategic acquisitions, integrating innovative companies to broaden its service offerings and strengthen its market position. These moves demonstrate PayPal’s commitment to staying at the forefront of financial technology.

| Year | Acquisitions |

| 2021 | Chargehound, Happy Returns, Paidy |

| 2019 | GoPay, Honey |

| 2018 | Jetlore, iZettle, Hyperwallet, Simility |

| 2017 | TIO Networks, Swift Financial |

| 2015 | Paydiant, CyActive, Xoom Corporation, Modest Inc |

| 2013 | IronPearl, Braintree, Venmo, StackMob |

| 2012 | card.io |

| 2011 | Where.com, FigCard, Zong |

| 2008 | Fraud Sciences, Bill Me Later |

Notable Acquisitions:

- Honey ($4 billion in 2019): This acquisition aimed to simplify online shopping by helping users find deals and earn cashback, directly boosting e-commerce engagement and sales for merchants.

- iZettle ($2.2 billion): Expanded PayPal’s footprint in point-of-sale transactions, catering to physical retail businesses.

- Braintree ($800 million): Enhanced PayPal’s developer-friendly payment solutions and brought Venmo into its fold.

- Xoom ($800 million): Strengthened PayPal’s cross-border money transfer capabilities.

These acquisitions are crucial for PayPal’s strategy to become a comprehensive commerce platform, addressing diverse customer and merchant needs across various financial services.

Consumer Behavior and Loyalty with PayPal

PayPal’s success is deeply intertwined with consumer trust and purchasing habits. The statistics reveal a strong preference and loyalty among users.

- Increased Purchase Likelihood: Consumers are 54% more likely to make an online purchase if the merchant accepts PayPal, highlighting the power of trust and convenience.

- Average Balance: The average PayPal balance of an American consumer is reported to be $485.

- Domestic Shopping Preference: 66% of PayPal consumers report shopping only from domestic merchants, indicating a preference for local businesses, though 26% of cross-border purchases on PayPal are reported from China.

- Mobile Wallet Integration: PayPal is installed on 65% of mobiles with mobile payment apps, making it a staple in the mobile payment ecosystem.

- Increased Spending: Shoppers paying through PayPal spend 12% more than those using other payment methods.

- Frequent Purchases: PayPal users purchase 60% more frequently compared to other digital buyers.

These consumer statistics demonstrate PayPal’s strong influence on purchasing decisions and its ability to drive higher conversion rates and customer loyalty for businesses.

PayPal and eCommerce: A Symbiotic Relationship

PayPal has revolutionized the e-commerce landscape, providing seamless payment solutions that have become indispensable for online businesses.

Enhanced Checkout Experiences

PayPal is actively enhancing its e-commerce offerings. In 2024, it launched several new checkout experiences, including PayPal Everywhere and PayPal Complete. These initiatives have reportedly:

- Reduced latency by over 40%.

- Increased conversion rates by over 100 basis points.

SEO Content Analyst said:

The PayPal Complete Payments platform alone handled 45% of the company’s total payment volume for SMBs, demonstrating its effectiveness and widespread adoption while helping businesses optimize payment for the company.

Businesses using PayPal generally experience:

- 25% better conversion rates compared to their peers.

- Large enterprises see 33% more completed checkouts than with traditional payment methods.

This data underscores how integrating PayPal can significantly improve a merchant’s e-commerce performance.

The Rise of Digital Products and Services

PayPal is not just a payment gateway; it’s a comprehensive ecosystem with various digital products catering to evolving payment trends.

- Venmo: A powerhouse in peer-to-peer payments, Venmo now boasts over 90 million active users in the US.

- Its monthly active user base grew by 4% in 2024, reaching more than 64 million monthly active accounts.

- Venmo is particularly popular among younger demographics, with approximately 26% of users aged 18-29 and an additional 30% aged 30-39.

- PayPal projects Venmo to top $2 billion in revenue by 2027, indicating its significant growth potential.

- Pay Later (BNPL): PayPal’s Buy Now, Pay Later solutions have seen remarkable growth, with TPV reaching $33 billion in 2024, up 21% year-over-year. These solutions have driven over 2X more purchases than PayPal’s standard checkout.

- PayPal Open: This new initiative allows businesses, developers, and partners to easily discover and integrate commerce enablement tools within the PayPal ecosystem, including payments, financial services, and risk solutions. It will initially be available in the US, with plans to expand to the UK and Germany.

- Partnerships: PayPal has extended its partnership with Verifone to offer seamless omnichannel payment solutions for enterprise merchants, integrating in-person payment tools with PayPal’s Braintree for a flexible and scalable system.

These innovations and integrations solidify PayPal’s position as a forward-thinking leader in the digital payment space, adapting to new consumer behaviors and merchant needs.

Security and Trust: Addressing Concerns and Building Confidence

PayPal has built a strong brand reputation on security, offering 24/7 fraud monitoring, financial encryption, and purchase protection. This commitment to security is a major reason why 60% of consumers trust PayPal more than their bank for storing payment credentials.

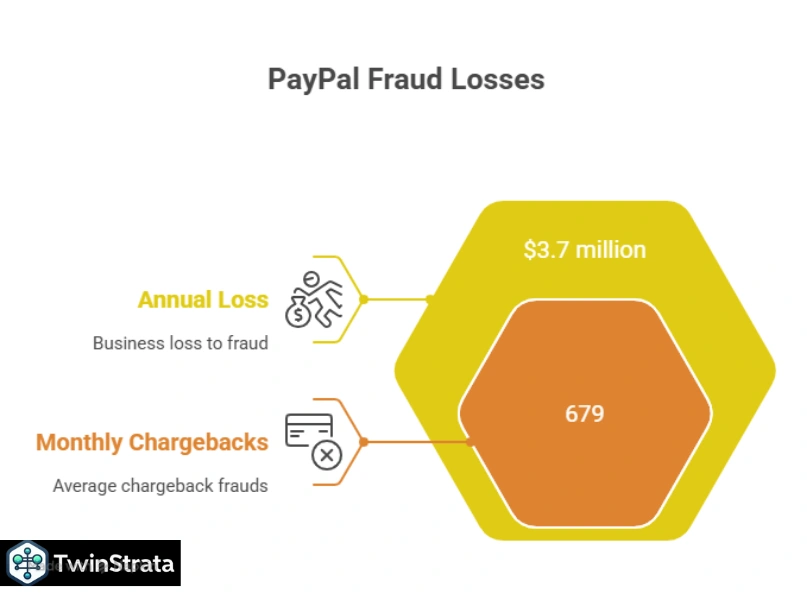

PayPal Fraud Statistics

Despite robust security measures, online fraud remains a persistent challenge for all digital payment platforms, including PayPal.

- PayPal’s fraud rate is estimated to be between 0.17 and 0.18 percent of its revenue, representing a loss of over $1 billion annually.

- Businesses using PayPal reportedly lose about $3.7 million yearly due to fraudulent online transactions.

- These companies face an average of 679 chargeback frauds monthly.

- Item Not Received or Order Not Delivered is the most commonly reported cause of PayPal chargebacks.

- PayPal offers chargeback and fraud coverage, though at a higher per-transaction rate.

While these numbers highlight the ongoing threat of fraud, PayPal’s continued investment in fraud prevention technologies and its established protection policies provide a significant layer of security for users.

Common Scams to Watch Out For:

- Phishing Emails/Messages: Always verify the sender and avoid clicking suspicious links.

- Invoice and Money Request Scams: Be cautious of unexpected invoices or money requests.

- Advance Fee Fraud: Do not pay upfront fees for promised winnings or opportunities.

- Overpayment Scams: Be wary of buyers who send more than the asking price and ask for the difference back.

- Shipping Scams: Always use tracked shipping and be cautious of requests to reroute packages.

- Fake Charities: Verify the legitimacy of charities before donating.

Staying informed and exercising caution are crucial for protecting yourself against these common threats.

What Users Are Asking: Insights from Quora and Reddit

Beyond official statistics, understanding the questions and concerns users discuss on platforms like Quora and Reddit offers valuable real-time insights into the PayPal experience.

Here are some themes and questions commonly observed:

- “Why are my PayPal transactions pending for so long?”

- Insight: Users often inquire about transaction holds, particularly for new accounts, large sums, or cross-border payments. This reflects a need for clearer communication from PayPal regarding their security protocols and estimated hold times. Businesses should be transparent with customers about potential delays.

- “Is PayPal still the most secure way to pay online in 2025, especially with so many new payment apps?”

- Insight: Despite PayPal’s strong reputation, users are constantly evaluating security in light of emerging fintech solutions. This emphasizes the need for PayPal to continuously communicate its security features and protections, especially purchase protection and fraud monitoring, to maintain user trust.

- “How can I reduce PayPal fees for international transfers?”

- Insight: Fees, especially for international transactions, are a recurring concern. Users are looking for cost-effective ways to send and receive money globally. PayPal could further highlight its competitive exchange rates and fee structures or offer loyalty programs for frequent international users.

- “What’s the best way to integrate PayPal for a small e-commerce business?”

- Insight: Small businesses are actively seeking guidance on seamless PayPal integration to maximize conversion rates. This points to a demand for simplified integration guides, robust API documentation, and perhaps tailored support for SMBs. PayPal’s focus on “PayPal Complete” aims to address this.

- “Are there any new features in the PayPal app I should know about for 2025?”

- Insight: Users are keen on discovering new functionalities and improvements within the PayPal ecosystem. This indicates an appetite for innovation and a desire to leverage the latest tools, from enhanced payment options to cashback rewards and stablecoin developments like PYUSD.

Addressing these real-world user queries directly helps PayPal, and businesses using PayPal, to better serve their audience and build stronger relationships.

FAQs About PayPal Statistics

1. How many people use PayPal globally in 2025?

As of December 2024, PayPal has approximately 434 million active users worldwide, making it one of the largest digital payment platforms globally.

2. What is PayPal's market share in 2025?

PayPal holds a dominant 45% market share in the global online payment processing market, significantly surpassing its competitors.

3. How secure is PayPal for online payments in 2025?

PayPal maintains a strong commitment to security, offering 24/7 fraud monitoring, advanced financial encryption, and buyer/seller protection programs. While no online platform is entirely immune to fraud, PayPal’s robust measures make it a highly trusted and secure option for online transactions.

4. What are the benefits of using PayPal for an e-commerce business?

Businesses using PayPal often experience 25% better conversion rates and see increased purchase frequency and higher average order values from customers. PayPal’s extensive user base and trusted brand name also attract more shoppers, while its comprehensive platform simplifies payment processing and offers various tools for growth, including BNPL and enhanced checkout experiences.

5. What new features has PayPal introduced recently?

In 2024, PayPal introduced enhanced checkout experiences like PayPal Everywhere and PayPal Complete, which have significantly improved conversion rates and reduced latency. They are also expanding the PayPal Open platform for easier merchant integration and have launched a US dollar stablecoin, PYUSD, demonstrating their foray into digital assets.

Also Read:

- Email Marketing Statistics

- Social Media Statistics

- Video Marketing Statistics

- Digital Marketing Statistics

- CRM Statistics

Conclusion: PayPal Continues to Shape the Future of Digital Payments

As we navigate through 2025, the PayPal statistics paint a clear picture of a powerhouse in the digital payment landscape. With 434 million users and a commanding 45% market share, PayPal isn’t just maintaining its lead; it’s actively innovating and expanding its ecosystem.

From its robust financial performance, evidenced by $31.8 billion in revenue in 2024, to its impressive 26.3 billion transactions processed annually, PayPal demonstrates unwavering strength and user trust.

For individuals, PayPal continues to offer a secure, convenient, and widely accepted method for managing finances and making purchases. For businesses, embracing PayPal is more than just offering another payment option; it’s about tapping into a vast, loyal customer base and leveraging a platform designed to enhance conversion rates, streamline operations, and drive growth.

The strategic acquisitions, the continuous evolution of services like Venmo and Pay Later, and the proactive approach to new technologies like stablecoins all underscore PayPal’s commitment to staying at the forefront of financial innovation.

PayPal’s future looks bright, built on a foundation of trust, technological advancement, and an unmatched global reach. As the digital economy continues to evolve, PayPal remains an indispensable player, empowering users and businesses alike to thrive in a connected world.

By understanding and utilizing these insights, you can harness the power of PayPal to your advantage, ensuring seamless and successful financial interactions in 2025 and beyond.