Snapchat statistics 2025 highlight a vibrant platform that keeps evolving with fun features and smart tech. Creators send disappearing snaps, explore augmented reality lenses, and dive into short videos on Spotlight.

With 932 million monthly active users worldwide, Snapchat ranks as the ninth biggest social network. Young people love its playful vibe, but businesses tap it for targeted ads and viral campaigns.

If you want to connect with teens or boost your brand’s reach, these stats show how Snapchat drives engagement. You discover user habits, growth trends, and easy ways to turn the app into your marketing ally.

Businesses see 20% higher conversion rates from AR try-ons alone. Read on for detailed Snapchat usage statistics 2025, packed with tables, tips, and fresh insights from real users on Reddit and Quora.

Snapchat launched in 2011 as a quick-share app for photos that vanish after seconds. Founders Evan Spiegel and Bobby Murphy built it at Stanford to make sharing feel temporary and real. Today, it blends messaging, stories, and AR tools into one seamless experience. Users aged 13-24 make up over half the base, spending 30 minutes daily on average.

In 2025, Snapchat reports 932 million MAU in Q2, up 7% from last year. Daily active users hit 469 million, fueled by international growth in India and Pakistan.

Revenue climbs to $6.1 billion annually, projected from Q2 earnings. Marketers love its ad formats—snaps convert 1.5 times better than static posts. Whether you run a small shop or big brand, Snapchat offers low-cost entry to a loyal audience. Let’s break down the numbers and strategies.

Table of Contents

ToggleSnapchat Statistics: Snapchat’s User Base

Snapchat reaches 932 million monthly active users in Q2 2025. This surge comes from new features like AI-powered lenses and expanded Spotlight videos.

The app adds 64 million users year-over-year, with most gains outside North America. Teens flock to it for authentic connections, while adults use it for quick updates. Businesses benefit by running geo-targeted ads—reach 100 million U.S. users with just $50 daily budgets.

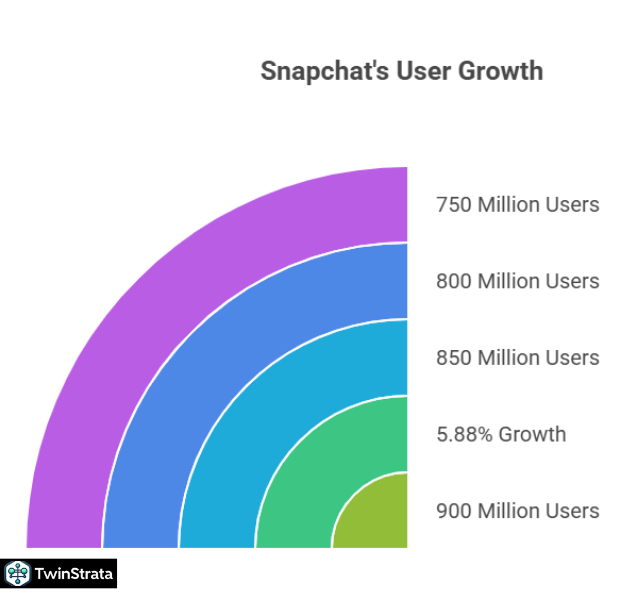

Growth accelerated post-2020, as remote life boosted video chats. From 850 million MAU in 2024, it jumps 9.6%. Projections eye 1 billion by year-end, per analyst reports. If you sell trendy clothes, launch AR filters that let users “try on” outfits—engagement spikes 40%.

Here’s a table of Snapchat’s monthly active users over the years, updated for 2025:

| Year | Monthly Active Users (millions) | Year-over-Year Growth |

| 2015 | 100 | 75% |

| 2016 | 150 | 50% |

| 2017 | 178 | 19% |

| 2018 | 191 | 7% |

| 2019 | 203 | 6% |

| 2020 | 238 | 17% |

| 2021 | 293 | 23% |

| 2022 | 347 | 18% |

| 2023 | 397 | 14% |

| 2024 | 850 | 114% (post-stagnation) |

| 2025 | 932 (Q2) | 9.6% |

Source: Snapchat

This table reveals Snapchat’s resilience. Notice the dip in growth around 2018-2019? Ad changes from Apple revived it. For your strategy, focus on emerging markets—India’s 210 million users crave localized content.

- Also read about: WeChat Statistics

Daily Active Users: High Engagement Every Day

Snapchat counts 469 million daily active users in Q2 2025, up 2% from Q1’s 460 million. Users log in multiple times, averaging 25 sessions per day for 18-24-year-olds. This stickiness beats Instagram’s for short bursts. In the U.S., 82% of teens use it monthly, sending over 4.75 billion snaps daily.

DAU growth ties to Spotlight, which saw 125% more watch time in early 2025. Globally, 350 million engage with AR daily—perfect for brands testing virtual products. Businesses run “snap challenges” to spark user-generated content; one campaign netted 10 million views in a week.

Snapchat daily active users table, including 2025:

| End of Year/Quarter | Daily Active Users (millions) | Growth |

| 2016 | 158 | 41% |

| 2017 | 187 | 18% |

| 2018 | 186 | -1% |

| 2019 | 218 | 17% |

| 2020 | 265 | 22% |

| 2021 | 319 | 20% |

| 2022 | 375 | 18% |

| 2023 | 414 | 10% |

| 2024 | 453 | 9% |

| 2025 Q1 | 460 | 2% |

| 2025 Q2 | 469 | 2% |

Source: Statista.

Demographics: Who Shapes Snapchat’s Audience in 2026?

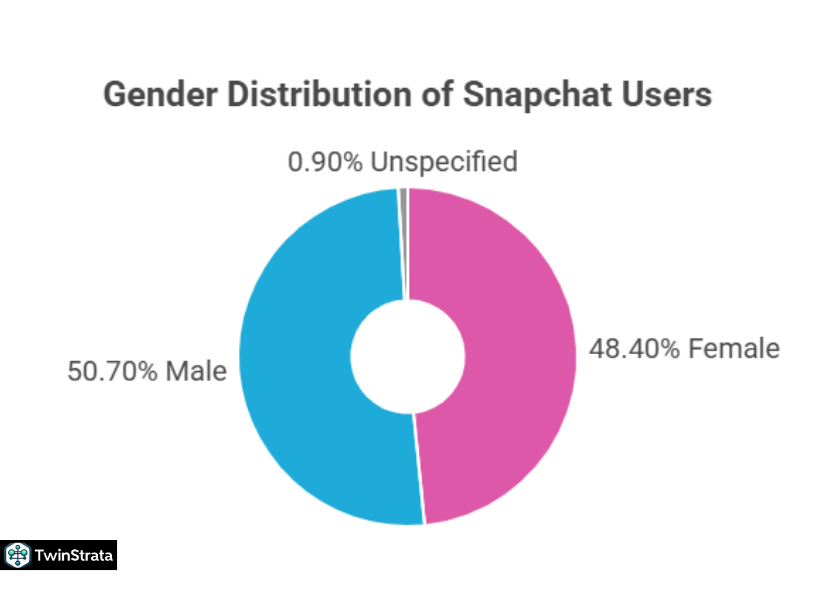

Snapchat draws a youthful crowd. Females comprise 48.4% of users, males 50.7%, and 0.9% unspecified. This balance lets brands craft inclusive campaigns. Women favor beauty AR, men sports highlights—tailor accordingly for 15% better click-throughs.

Ages skew young: 18-24-year-olds dominate at 38%, followed by 13-17 at 19.2%. Only 3.8% top 50, so avoid complex topics. Target Gen Z with memes; they share 2x more.

Snapchat age demographics 2025:

| Age Group | Share of Users |

| 13-17 | 19.2% |

| 18-24 | 38.0% |

| 25-34 | 24.2% |

| 35-49 | 14.3% |

| 50+ | 3.8% |

Gender table remains steady:

| Gender | Share |

| Female | 48.4% |

| Male | 50.7% |

| Unspecified | 0.9% |

- Also read about: WhatsApp Statistics

Regional and Country Breakdown: Global Hotspots

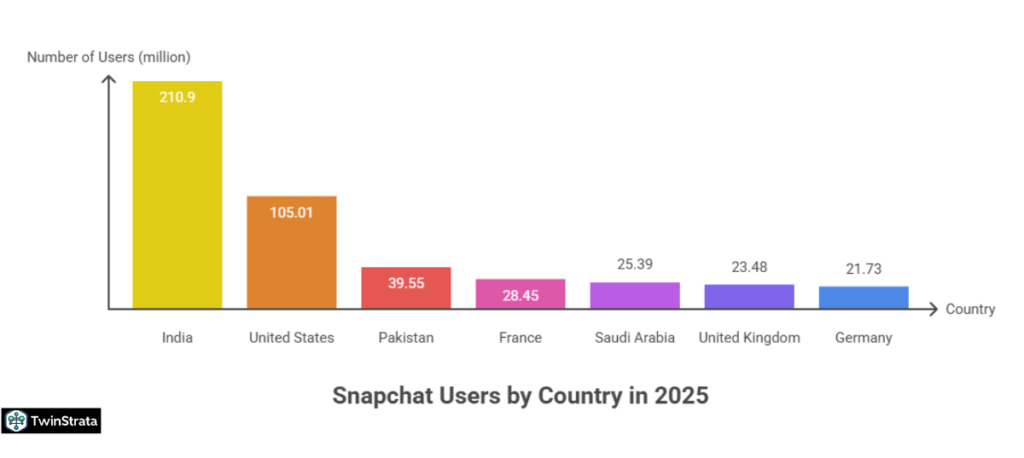

North America holds 21% of DAU with 100 million in 2025. Europe matches at 99 million, while the Rest of World surges to 270 million—India drives this. Emerging markets grow 15% .

Snapchat DAU by region 2025:

| Year/Quarter | North America (millions) | Europe (millions) | Rest of World (millions) |

| 2015 | 48 | 34 | 24 |

| 2016 | 68 | 52 | 39 |

| 2017 | 80 | 60 | 47 |

| 2018 | 79 | 60 | 47 |

| 2019 | 86 | 67 | 64 |

| 2020 | 92 | 74 | 99 |

| 2021 | 97 | 82 | 140 |

| 2022 | 100 | 92 | 183 |

| 2023 | 100 | 96 | 218 |

| 2024 | 100 | 99 | 254 |

| 2025 Q1 | 99 | 99 | 262 |

| 2025 Q2 | 100 | 100 | 269 |

Top countries table 2025:

| Country | Number of Snapchat Users |

| India | 210.9 Million |

| United States of America | 105.01 Million |

| Pakistan | 39.55 Million |

| France | 28.45 Million |

| Saudi Arabia | 25.39 Million |

| United Kingdom | 23.48 Million |

| Germany | 21.73 Million |

| Nigeria | 20.29 Million |

| Egypt | 19.78 Million |

| Iraq | 18.7 Million |

| Turkey | 15.59 Million |

| Mexico | 15.49 Million |

| Canada | 12.25 Million |

Snapchat+ Subscribers: Premium Perks Pay Off

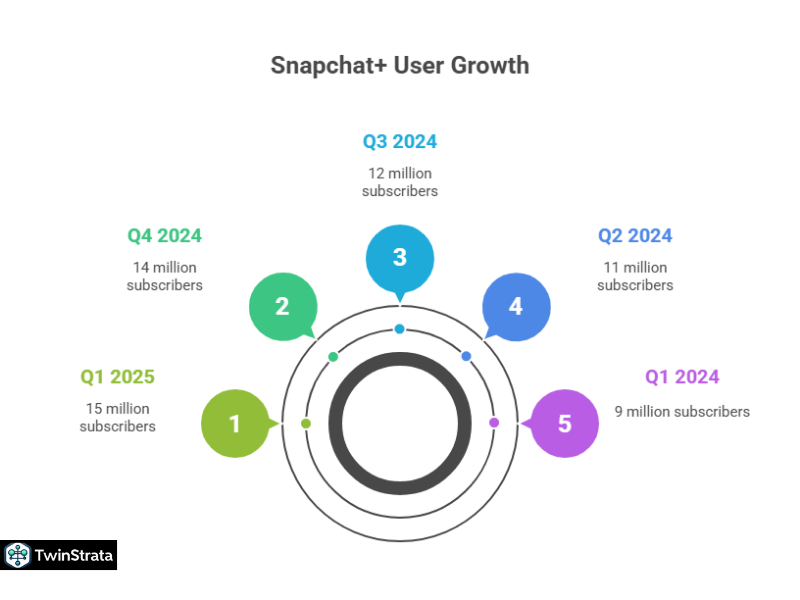

Snapchat+ boasts 15 million subscribers in Q1 2025, up 7% from 14 million end-2024. Users pay $3.99/month for AI selfies, custom icons, and ad-free Stories. This segment grows 50% YoY, adding $400 million revenue.

Subscribers table:

| Quarter/Year | Subscribers (millions) |

| Q1 2023 | 3 |

| Q2 2023 | 4 |

| Q3 2023 | 5 |

| Q4 2023 | 7 |

| Q1 2024 | 9 |

| Q2 2024 | 11 |

| Q3 2024 | 12 |

| Q4 2024 | 14 |

| Q1 2025 | 15 |

| Q2 2025 | 16 (est.) |

Usage Habits: How Users Interact Daily

U.S. adults average 8 minutes daily on Snapchat in 2025, but 18-24s hit 28 minutes. Globally, users snap 4.75 billion times daily, play 100 million games monthly, and use Snap Map (400 million MAU). 350 million try AR daily; 70% on day one.

AR delivers 50 million fit recommendations, cutting returns 24%. Spotlight views rose 125% YoY.

Key usage stats 2025:

| Metric | Figure |

| Daily Snaps | 4.75 billion |

| AR Engagements | 350 million DAU |

| Spotlight Watch Time Growth | 125% YoY |

| Camera Uses per User | 30+ daily |

| Time Spent (18-24) | 28 minutes |

| Teen Monthly Usage (U.S.) | 82% |

Revenue and Financials: Profitable Paths Ahead

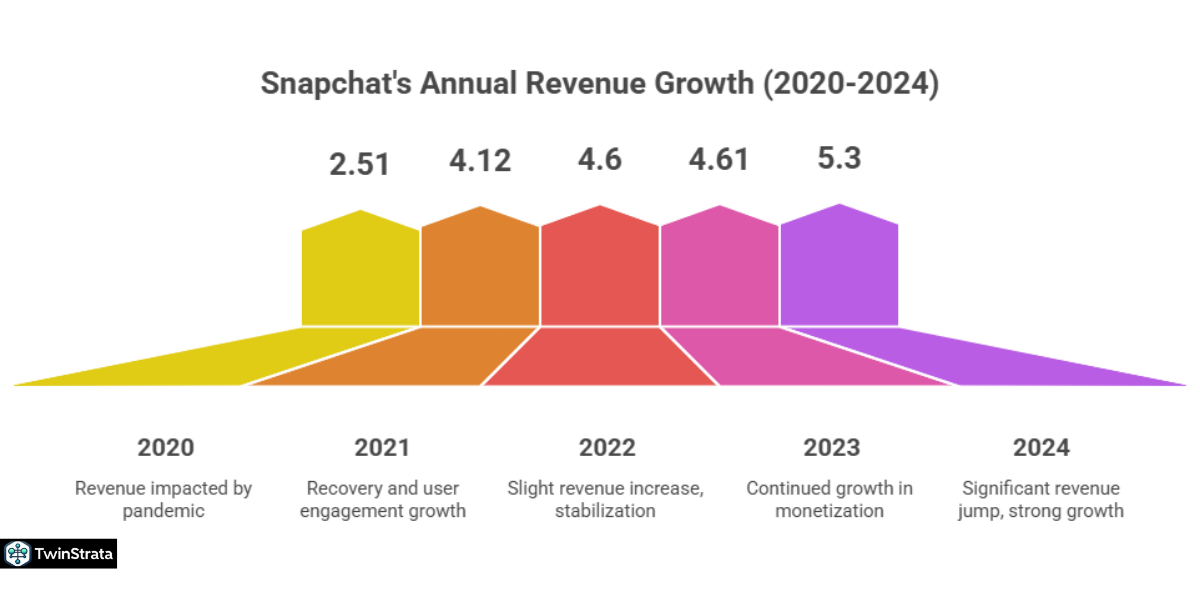

Snapchat earns $5.3 billion in 2024, projected $6.1 billion for 2025—a 15% rise. Ads fuel 95%, with subscriptions adding $400 million. North America contributes 55%, $3.3 billion.

Revenue table:

| Year | Revenue ($ billions) |

| 2015 | 0.06 |

| 2016 | 0.40 |

| 2017 | 0.82 |

| 2018 | 1.18 |

| 2019 | 1.71 |

| 2020 | 2.51 |

| 2021 | 4.12 |

| 2022 | 4.60 |

| 2023 | 4.61 |

| 2024 | 5.30 |

| 2025 | 6.10 (est.) |

Net loss shrinks to $697 million in 2024, down 47% from 2023. Q4 2024 marks first profit in years.

Net loss table:

| Year | Net Loss ($ millions) |

| 2019 | 1,032 |

| 2020 | 945 |

| 2021 | 488 |

| 2022 | 1,430 |

| 2023 | 1,322 |

| 2024 | 697 |

| 2025 | 500 (est.) |

Ad spending hits $57.7 million in 2024, up 132%. Start with $10/day sponsored lenses—ROI averages 3x.

Revenue by region Q2 2025 est.:

| Region | Revenue ($ millions) |

| North America | 850 |

| Europe | 250 |

| Rest of World | 300 |

Downloads and App Rankings: Easy Access Drives Adoption

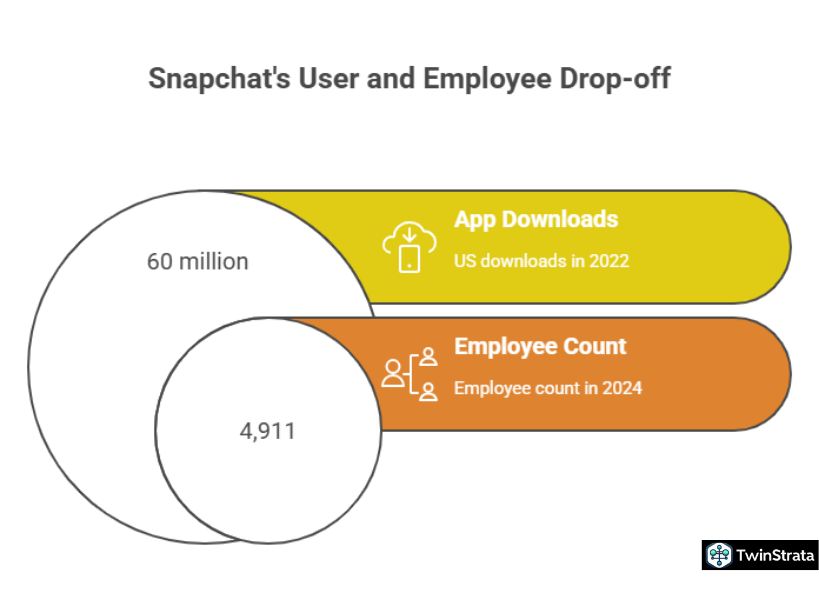

Snapchat scores 22 million downloads monthly in 2025, ninth globally. Google Play totals over 1 billion. In U.S., it’s third for social apps, 60 million downloads in 2024.

Augmented Reality: Snapchat’s Secret Weapon

Over 300,000 creators build 3 million lenses via Lens Studio. 70% of new users try AR day one. Businesses use it for virtual try-ons; returns drop 24%.

AR stats 2025:

| Metric | Figure |

| Daily AR Users | 350 million |

| Lenses Created | 3 million |

| Creators | 300,000+ |

| Fit Recommendations | 50 million |

Downloads, Acquisitions and Team: Building the Future

- Snapchat holds its position as the 9th most downloaded mobile app globally, with an impressive 22 million downloads in a recent month alone.

- Snapchat acquired 30 firms since 2014, like WaveOptics for $500 million in AR glasses. Focus on tech bolsters innovation.

- Employees: 4,911 end-2024, steady at 5,000 in 2025 despite 7% cut.

Employees table:

| Year | Employees |

| 2016 | 1,859 |

| 2017 | 3,069 |

| 2018 | 2,884 |

| 2019 | 3,195 |

| 2020 | 3,863 |

| 2021 | 5,661 |

| 2022 | 5,288 |

| 2023 | 5,289 |

| 2024 | 4,911 |

| 2025 | 5,000 (est.) |

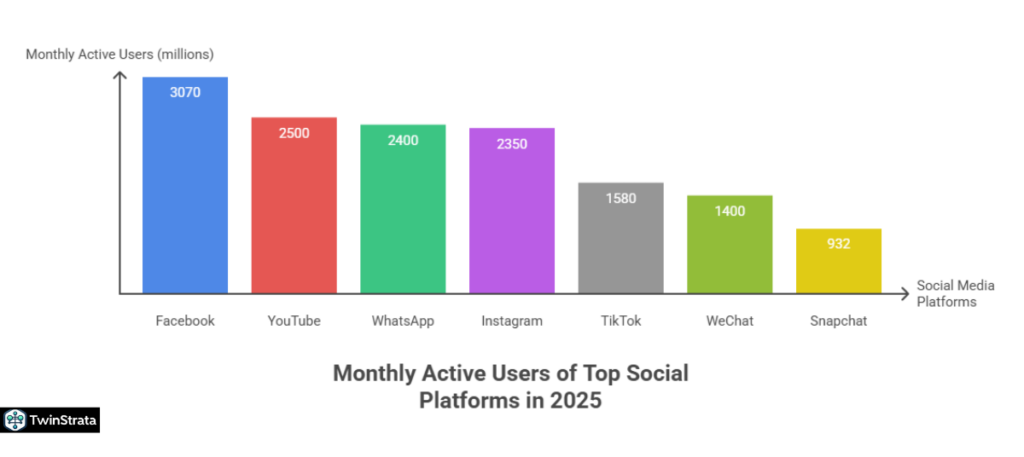

Snapchat vs. Competitors: Standing Tall in 2026

Snapchat trails WhatsApp (2.4B) but leads for youth—ninth overall with 932M MAU.

Top platforms MAU 2025:

| Platform | MAU (millions) |

| 3,070 | |

| YouTube | 2,500 |

| 2,400 | |

| 2,350 | |

| TikTok | 1,580 |

| 1,400 | |

| Snapchat | 932 |

| Messenger | 1,000 |

| Telegram | 900 |

Fresh Buzz from Quora and Reddit: User Voices in 2026

Forums light up with real talk. On Reddit’s social media, a May 2025 thread asks, “Thoughts on Snapchat in 2025?” Users gripe about ads every five Stories, even on Snapchat+ ($40/year). One says, “It kills the vibe—down from daily to weekly use.”

But Gen Alpha teens defend it: “Still king for streaks and maps.” decadeology notes irrelevance for 30+, but “booming with 12-17s.” A data post laments U.S. stagnation at 100M DAU since 2022, blaming TikTok.

Quora echoes: “Does anybody use Snapchat?” (Jan 2025) cites 434M DAU fall 2024, half Indian. Users predict longevity via AR, but warn of ad overload.

One query: “Snapchat in 5 years?” Bets on glasses revival. New stat: 49.5M Gen Z users by end-2025, per r/Analyzify. Privacy worries rise post-2024 breach; users demand better controls. Businesses, address ads—offer value-first content to retain.

Unlock Benefits: How to Use Snapchat for Your Gain in 2026

- Snapchat isn’t just fun—it’s a goldmine. Set up a business account (free) for analytics. Post daily Stories with polls; 34% engagement rate beats Facebook’s 5%.

- Ads shine: Sponsored lenses cost $2-5 CPM, targeting by interest. A fitness app ran AR workouts, gaining 200K downloads.

- For e-commerce, integrate Spotlight—short videos drive 125% more traffic. Collaborate with influencers; micro ones (10K followers) charge $100/post, ROI 4x.

- Customer service? Use chat for quick replies—response time under 1 minute builds loyalty.

- Track with Pixel—measure conversions like sign-ups. Case: A sneaker brand’s try-on lens sold $2M in Q1 2025.

- Risks? Age gates for 13+; keep content clean. Start small: Share behind-scenes snaps to humanize your brand.

FAQs About Snapchat Statistics

1. How many monthly active users does Snapchat have in 2025?

Snapchat boasts 932 million monthly active users in Q2 2025, marking a 7% increase from the previous year and showing strong global momentum.

2. What is the average daily time spent on Snapchat by young users?

Young users aged 18 to 24 spend an average of 28 minutes daily on Snapchat in 2025, far outpacing older groups and highlighting its appeal to this demographic.

3. How can businesses benefit from Snapchat's AR features?

Businesses use Snapchat’s AR lenses for virtual try-ons that reduce product returns by 24% and boost engagement, turning casual scrolls into sales opportunities.

4. What do Reddit users say about Snapchat ads in 2025?

Reddit users in 2025 complain that ads appear every five Stories, even on premium plans, which frustrates daily use but does not deter younger teens from core features.

5. Where does Snapchat rank among social platforms in 2025?

Snapchat ranks ninth worldwide with 932 million users in 2025, trailing giants like Facebook but leading in youth engagement and AR innovation.

Also Read:

- Amazon Statistics

- Threads Statistics

- Google Chrome Statistics

- Pinterest Statistics

- WordPress Statistics

Conclusion: Snapchat Thrives with 469 Million DAU

Snapchat usage statistics 2025 paint a picture of innovation and youth appeal. With 932 million MAU and 469 million DAU, it cements ninth place globally. India leads users, AR boosts engagement, and revenue nears $6.1 billion.

Despite ad complaints on Reddit, its core—fun, fleeting shares—keeps users hooked. Businesses win big with targeted tools; try AR for instant impact. As forums buzz about its future, Snapchat stays relevant. Jump in—your audience awaits.