Tesla is a name that stands for innovation, electric vehicles (EVs), and a vision for a sustainable future.

Since its founding in 2003, Tesla has reshaped the automotive industry, leading the charge in electric vehicle production, sales, and cutting-edge technology like Autopilot and Superchargers.

In 2024, Tesla sold 1.79 million vehicles and generated $97.69 billion in revenue, cementing its position as a global leader.

Whether you’re considering buying a Tesla, investing in the company, or simply curious about its impact, this article dives deep into Tesla’s 2025 statistics, trends, and insights to help you understand how Tesla can benefit you.

We’ve also included fresh data from platforms like Quora and Reddit to answer what users are asking about Tesla today.

Table of Contents

ToggleTesla at a Glance: Key Statistics for 2026

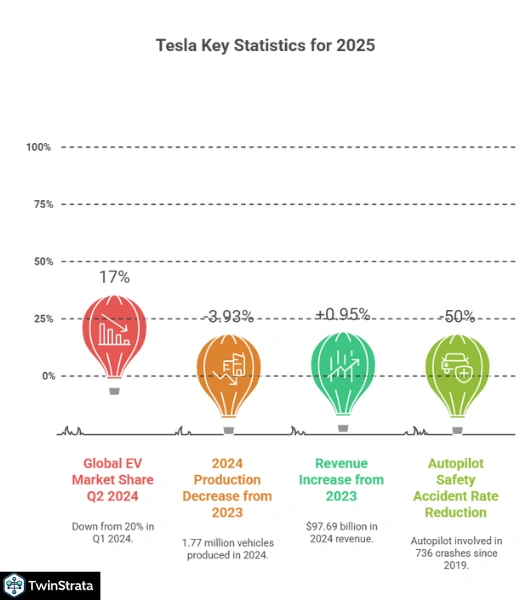

Tesla’s numbers tell a story of growth, challenges, and ambition. Here are the standout stats for 2025:

- Total Vehicles Sold: Tesla has sold over 7.95 million vehicles globally as of 2024.

- 2024 Sales: 1.79 million vehicles sold, ranking Tesla second globally behind BYD.

- 2024 Production: 1.77 million vehicles produced, a slight 3.93% decrease from 2023.

- Revenue: $97.69 billion in 2024, up 0.95% from 2023.

- Market Cap: $809.93 billion, making Tesla the 12th most valuable company worldwide.

- Global EV Market Share: 17% in Q2 2024, down from 20% in Q1 2024.

- Superchargers: Over 50,000 Superchargers across 7,702 stations in 55 countries.

- Employees: 125,665 employees as of 2024.

- Autopilot Safety: Reduces accident rates by 50%, but involved in 736 crashes since 2019.

These stats show Tesla’s dominance in the EV market, but also highlight growing competition and challenges. Let’s explore how these numbers translate into opportunities for you as a consumer, investor, or enthusiast.

Why Tesla Matters to You

Tesla isn’t just about cars—it’s about a lifestyle, an investment opportunity, and a step toward sustainability. Here’s how Tesla’s growth and innovations can benefit you:

- As a Consumer: Tesla’s vehicles, like the Model Y and Model 3, offer long-range batteries, low running costs (as low as 5 cents per mile), and access to a vast Supercharger network for convenient charging. If you’re looking to save on fuel and reduce your carbon footprint, Tesla is a top choice.

- As an Investor: Tesla’s $809.93 billion market cap and consistent revenue growth make it an attractive stock. Despite market share dips, Tesla’s focus on innovation (e.g., autonomous driving, new factories) signals long-term potential.

- As an Enthusiast: Tesla’s advancements in Autopilot, battery technology, and renewable energy inspire tech lovers and eco-conscious individuals alike.

Recent discussions on Quora and Reddit show users are excited about Tesla’s Cybertruck performance, potential new models like a compact EV, and the affordability of used Teslas. They’re also curious about Tesla’s plans for new factories, especially in India, and how autonomous driving will evolve by 2026.

Tesla’s Production and Sales: A Deep Dive

Tesla’s ability to produce and sell millions of vehicles showcases its manufacturing prowess and global demand. Let’s break down the numbers.

Production Statistics

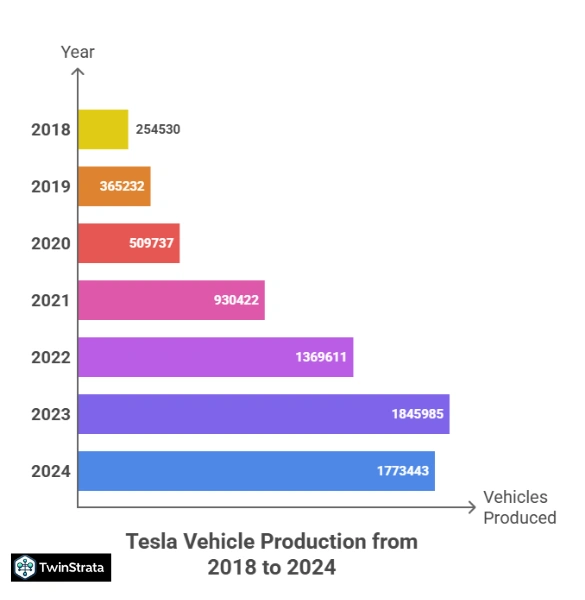

Tesla produced 1.77 million vehicles in 2024, down 3.93% from 1.845 million in 2023. Despite this dip, Tesla’s production has grown significantly over the years, from just 35,000 vehicles in 2014 to over 1.77 million in 2024.

The company operates four major factories: Fremont (California), Gigafactory Texas, Gigafactory Shanghai, and Gigafactory Berlin-Brandenburg.

| Year | Vehicles Produced |

| 2014 | 35,000 |

| 2015 | 51,095 |

| 2016 | 83,922 |

| 2017 | 100,757 |

| 2018 | 254,530 |

| 2019 | 365,232 |

| 2020 | 509,737 |

| 2021 | 930,422 |

| 2022 | 1,369,611 |

| 2023 | 1,845,985 |

| 2024 | 1,773,443 |

Q1 2024 Highlight: Tesla produced 433,371 vehicles, a 12.4% decrease from Q4 2023 but a massive leap from 365,284 in 2019. This growth reflects Tesla’s ability to scale production despite supply chain challenges.

What This Means for You: If you’re considering a Tesla purchase, high production ensures better availability, especially for popular models like the Model Y. However, slight production dips in 2024 suggest you may want to order early to avoid delays.

Sales Statistics

Tesla sold 1.79 million vehicles in 2024, slightly down from 1.808 million in 2023. Since its first car in 2008, Tesla has sold over 7.95 million vehicles globally. The Model 3 and Model Y dominate sales, with the Model Y being the world’s best-selling car in Q1 2023.

| Year | Total Sales | Vehicle Models |

| 2008 | ~100 | Roadster |

| 2009 | ~900 | Roadster |

| 2012 | 3,000 | Roadster, Model S |

| 2015 | 50,658 | Model S, Model X |

| 2018 | 245,240 | Model 3/Y, Model X/S |

| 2020 | 499,550 | Model 3/Y, Model X/S |

| 2022 | 1,313,581 | Model 3/Y, Model X/S |

| 2023 | 1,808,592 | Model 3/Y, Model X/S |

| 2024 | 1,789,226 | Model 3/Y, Model X/S, Cybertruck |

| Q1 2024 | 386,816 | Model 3/Y, Model X/S, Cybertruck |

Top Markets in 2024 (Jan-May):

| Country | Vehicles Sold |

| United States | 232,400 |

| China | 219,056 |

| Australia | 18,433 |

| Germany | 16,601 |

| United Kingdom | 16,272 |

Model Y Spotlight: In 2024, the Model Y sold 372,613 units in the US alone, despite a 6.6% drop from 2023. In China, it ranked third with 25,694 sales in January 2025. In Europe, it was the third most-sold EV with 5,890 units in January 2025.

What This Means for You: The Model Y’s popularity makes it a reliable choice for buyers seeking value and performance. If you’re in a top market like the US or China, you’ll find ample service centers and Superchargers. For investors, strong sales in diverse markets signal Tesla’s global resilience.

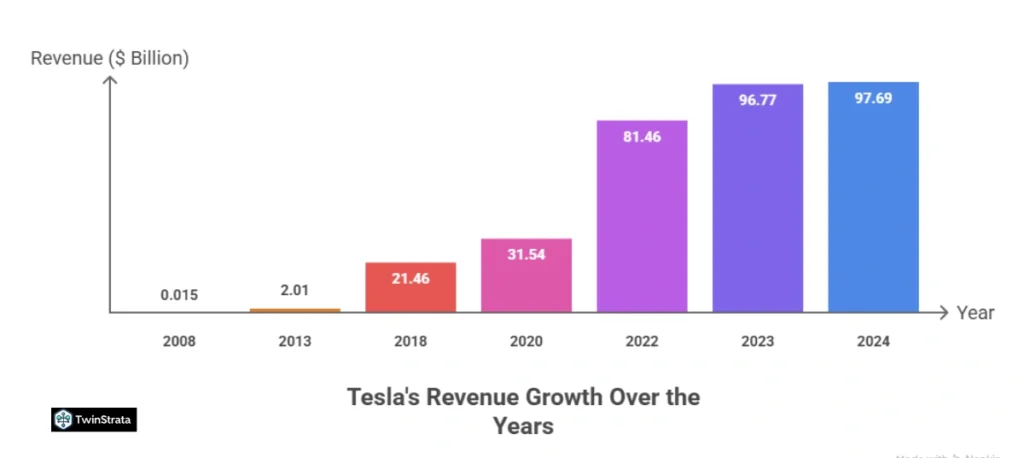

Tesla’s Revenue and Financial Performance

Tesla’s financial growth is a key reason it’s a favorite among investors.

In 2024, Tesla generated $97.69 billion in revenue, up 0.95% from 2023. Its net income reached $14.99 billion in 2023, a 127.79% increase from 2021.

Revenue Breakdown

| Year | Revenue ($ Billion) |

| 2008 | 0.015 |

| 2013 | 2.01 |

| 2018 | 21.46 |

| 2020 | 31.54 |

| 2022 | 81.46 |

| 2023 | 96.77 |

| 2024 | 97.69 |

2024 Highlight: Tesla’s Q2 2024 revenue was $46.8 billion, showing steady growth. The company’s ability to generate nearly $100 billion annually reflects its scale and efficiency.

Net Income

| Year | Net Income ($ Million) |

| 2018 | -976 |

| 2019 | -862 |

| 2020 | 721 |

| 2021 | 5,519 |

| 2022 | 12,556 |

| 2023 | 14,999 |

What This Means for You: Tesla’s consistent revenue and profit growth make it a stable investment. For consumers, strong financials mean Tesla can invest in new models, better technology, and more Superchargers, enhancing your ownership experience.

Tesla’s Market Share and Competition

Tesla holds a 17% share of the global EV market in Q2 2024, down from 20% in Q1. In the US, its EV market share dropped to 50% in Q3 2023 from 65% in 2022 due to competition from BYD, Hyundai, and BMW.

Globally, Tesla owns 1.12% of the automotive market, and in the US, it holds 3.26%.

| EV Group | Market Share Q2 2024 | Market Share Q1 2024 |

| Tesla | 17% | 20% |

| BYD Auto | 17% | 15% |

| Geely Holdings | 7% | 8% |

| Others | 59% | 57% |

What This Means for You: While Tesla faces competition, its brand loyalty and innovation keep it ahead. If you’re considering a Tesla, you’re choosing a leader in EV technology, but exploring competitors like BYD might offer cost savings.

Tesla’s Supercharger Network: A Game-Changer

Tesla’s Supercharger network is a major perk for owners, offering fast, affordable charging. As of September 2025, Tesla operates 7,702 Supercharger stations with over 50,000 connectors across 55 countries, a 31% increase since December 2023.

| Year | Supercharger Stations | Supercharger Connectors |

| 2013 | 7 | N/A |

| 2020 | 2,564 | 23,277 |

| 2022 | 4,620 | 42,419 |

| 2023 | 5,878 | 50,000 |

| 2025 | 7,702 | 50,000+ |

Top Countries for Superchargers:

| Country | Supercharger Stations | % of Total |

| USA | 2,798 | 36.3% |

| China | 2,366 | 30.7% |

| Germany | 289 | 3.8% |

| Canada | 261 | 3.4% |

| France | 241 | 3.1% |

Charging Costs:

| Model | Cost to Fully Charge |

| Model 3 | $10.95 |

| Model S | $17.83 |

| Model X | $17.99 |

| Model Y | $17.99 |

What This Means for You: Superchargers make long-distance travel easy and cost-effective, with a full charge costing as little as $10.95 for a Model 3. If you live in the US or China, you’ll find chargers almost everywhere, making Tesla ownership convenient.

Tesla’s Autopilot: Safety and Concerns

Tesla’s Autopilot reduces accident rates by 50%, but it’s not flawless. Since 2019, Autopilot has been involved in 736 crashes, including 17 fatalities. However, Tesla records one crash per 4.85 million miles driven with Autopilot, compared to 1.40 million miles without it.

| Quarter | Miles per Crash (Autopilot) | Miles per Crash (No Autopilot) |

| Q4 2022 | 4.85 million | 1.40 million |

| Q3 2022 | 6.26 million | 1.71 million |

| Q1 2021 | 4.64 million | 0.984 million |

What This Means for You: Autopilot enhances safety but requires vigilance. If you’re buying a Tesla, practice using Autopilot in low-risk settings to maximize its benefits.

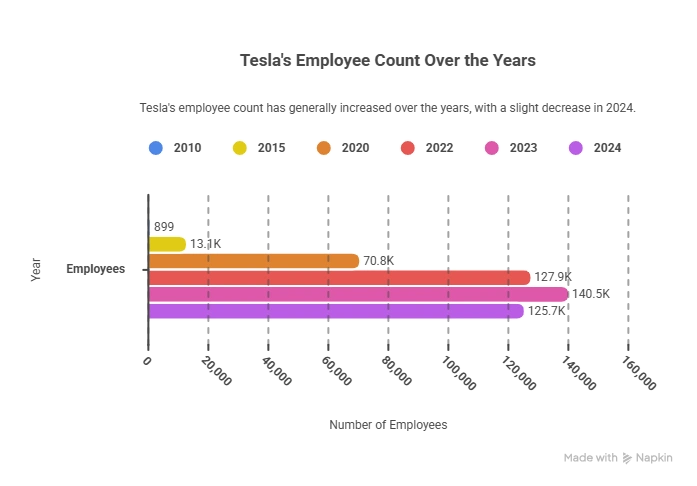

Tesla’s Workforce

Tesla employed 125,665 people in 2024, down from 140,473 in 2023. The median salary for software engineers is $198,000, with H1-B visa holders earning $145,805.

| Year | Employees |

| 2010 | 899 |

| 2015 | 13,058 |

| 2020 | 70,757 |

| 2022 | 127,855 |

| 2023 | 140,473 |

| 2024 | 125,665 |

What This Means for You: Tesla’s large workforce ensures robust support for customers and innovation. If you’re job-hunting, Tesla offers competitive salaries, especially in tech roles.

What’s New in 2025? Insights from Quora and Reddit

Users on Quora and Reddit are buzzing about Tesla’s 2025 plans. Here’s what they’re asking and how it impacts you:

- Cybertruck Popularity: Reddit users rave about the Cybertruck’s unique design and off-road capabilities. With 38,965 units sold in the US in 2024, it’s a hit for those seeking a rugged EV.

- New Compact EV: Quora threads speculate about a cheaper Tesla model under $25,000 by 2026, making EVs more accessible. This could be a game-changer if you’re waiting for an affordable Tesla.

- Factory in India: Discussions on both platforms highlight Tesla’s talks with Indian officials for a new Gigafactory. This could lower prices in Asia and increase availability for buyers in emerging markets.

- Autonomous Driving Advances: Users are excited about Tesla’s Full Self-Driving (FSD) updates, with some predicting Level 4 autonomy by 2026. This could make Tesla vehicles even safer and more convenient.

What This Means for You: If you’re eyeing a Cybertruck or waiting for a budget-friendly Tesla, 2025-2026 could be the perfect time to buy. Stay updated on Tesla’s India plans if you’re in Asia.

How to Leverage Tesla for Your Benefit

- Buying a Tesla: Choose the Model Y or Model 3 for affordability and range. Use Superchargers to save on fuel costs (as low as $10.95 per charge).

- Investing in Tesla: Monitor Tesla’s stock for dips, as its $809.93 billion market cap and innovation make it a long-term bet despite competition.

- Sustainability: Driving a Tesla reduces your carbon footprint, aligning with global eco-goals.

- Career Opportunities: Apply for roles at Tesla, especially in software or engineering, for high-paying jobs.

FAQs About Tesla Statistics

1. How many Tesla vehicles have been sold worldwide?

Tesla has sold over 7.95 million vehicles globally as of 2024, with 1.79 million sold in 2024 alone.

2. What is the cost to charge a Tesla?

On average, fully charging a Tesla costs $15.52. For example, a Model 3 costs $10.95, while a Model S costs $17.83.

3. Is Tesla’s Autopilot safe to use?

Tesla’s Autopilot reduces accident rates by 50%, with one crash per 4.85 million miles driven. However, it’s been involved in 736 crashes since 2019, so drivers must stay alert.

4. Where are Tesla’s Superchargers located?

Tesla operates 7,702 Supercharger stations with over 50,000 connectors in 55 countries, with the US (2,798 stations) and China (2,366 stations) leading.

5. What new Tesla models are coming in 2025?

While no confirmed new models are set for 2025, Quora and Reddit users speculate about a compact EV under $25,000 by 2026, based on Tesla’s focus on affordability.

Also Read:

- Latest Mobile Marketing Statistics

- Google Ads Statistics

- Online Advertising Statistics

- Content Marketing Statistics

- Email Marketing Statistics

Conclusion

Tesla remains a powerhouse in the EV industry, with 1.79 million vehicles sold in 2024, $97.69 billion in revenue, and a global network of over 50,000 Superchargers.

While competition from BYD and others has reduced its market share to 17%, Tesla’s innovation, from Autopilot to new factories, keeps it ahead.

For consumers, Tesla offers affordable charging and eco-friendly driving. For investors, its financial growth and market cap signal opportunity.

By staying informed about Tesla’s 2025 plans—like a potential compact EV or India factory—you can make smart decisions as a buyer, investor, or enthusiast.

Source: Statista, Investing.com