Since its debut in November 2019, Disney Plus has quickly become a major player in the competitive streaming world.

As of 2025, it continues to innovate, expand, and refine its offerings, solidifying its position in the global market.

This guide explores the latest statistics, financial performance, user demographics, and content strategy of Disney Plus, providing insights into how it has evolved and what lies ahead for the platform.

Table of Contents

ToggleDisney Plus Statistics: Disney Plus Subscriber Growth and Global Reach

Disney Plus has built a strong global presence, boasting millions of subscribers from around the world.

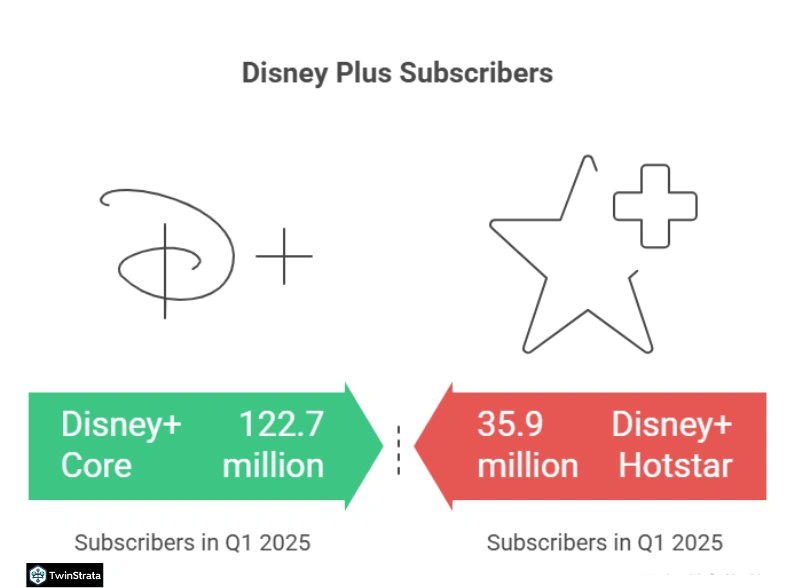

As of Q1 2025, Disney Plus has reached 124.6 million subscribers, with the majority of these coming from its core Disney+ service.

Although Disney+ Hotstar has faced some challenges, the core service continues to show solid growth, attracting new users in various regions.

Disney Plus Subscriber Breakdown (Q1 2025)

- Total Subscribers: 124.6 million

- Disney+ Core Subscribers: 122.7 million (4% increase from Q3 2024)

- Disney+ Hotstar Subscribers: 35.9 million (1% increase from Q3 2024)

Disney Plus’s subscriber growth is impressive when viewed over time. The platform has steadily increased its user base, with significant jumps in subscriber numbers from 2021 to 2025. Here’s a look at how Disney Plus’s subscriber numbers have evolved:

Quarterly Subscriber Trends

| Time | Subscribers (Millions) |

|---|---|

| Q1 2021 | 94.9 |

| Q1 2022 | 129.8 |

| Q1 2023 | 161.8 |

| Q1 2024 | 149.6 |

| Q1 2025 | 124.6 |

As we can see, Disney Plus experienced rapid growth in its early years. However, like all major platforms, it faces fluctuations based on regional challenges and market saturation.

Annual Subscriber Growth

| Year | Subscribers (Millions) |

|---|---|

| 2024 | 158.6 |

| 2023 | 150 |

| 2022 | 164.2 |

| 2021 | 118.1 |

| 2020 | 73.3 |

While Disney Plus faced some declines in 2024 and 2025, it still has a substantial base. Its ability to attract millions of new users in a competitive streaming environment shows its powerful content and global appeal.

Also read about: Netflix Subscribers Statistics

Who is Watching Disney Plus? Demographics

Disney Plus has a broad appeal across different demographics, but it particularly resonates with families and younger audiences.

The platform’s content, from family-friendly classics to blockbuster franchises like Star Wars and Marvel, caters to a wide age group.

Gender Distribution

In the U.S., Disney Plus’s user base is almost evenly split between male and female viewers, with males making up 55% and females 45%.

This reflects Disney Plus’s ability to offer diverse content for various tastes, ensuring that it captures a wide audience.

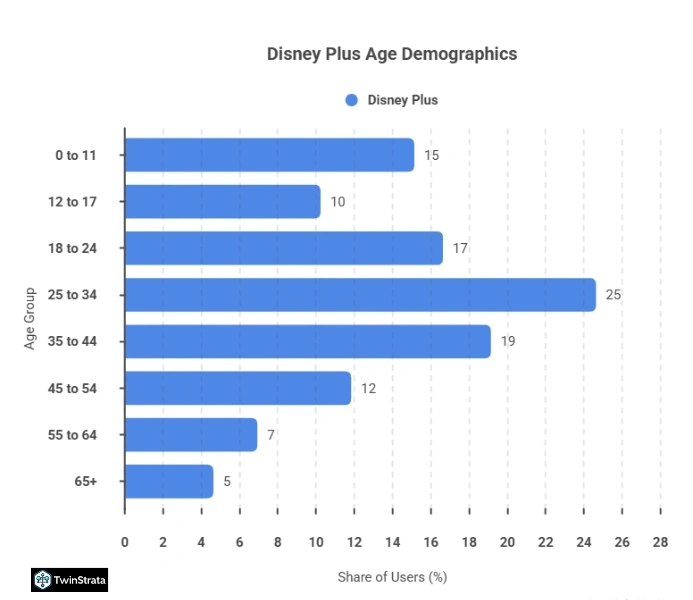

Age Demographics

Disney Plus’s largest demographic group consists of adults between the ages of 25 and 44, who make up 43.9% of the total user base.

This group is followed by children, teens, and young adults, reflecting Disney’s deep connection with family-oriented content.

| Age Group | Share of Users |

|---|---|

| 0 to 11 | 15.2% |

| 12 to 17 | 10.3% |

| 18 to 24 | 16.7% |

| 25 to 34 | 24.7% |

| 35 to 44 | 19.2% |

| 45 to 54 | 11.9% |

| 55 to 64 | 7.0% |

| 65+ | 4.7% |

The platform appeals to families with children, as well as young adults. This age distribution shows Disney Plus’s success in attracting a younger, tech-savvy audience alongside older viewers who are nostalgic for Disney’s classic offerings.

Disney Plus Financial Performance: Revenue and ARPU

Disney Plus has demonstrated strong financial performance, with increasing revenue year over year.

In the fiscal year 2024, Disney Plus generated $10.4 billion in revenue, a significant increase from previous years.

Disney Plus Revenue Over the Years

| Year | Revenue (Billions) |

|---|---|

| 2024 | $10.4 |

| 2023 | $8.4 |

| 2022 | $7.4 |

| 2021 | $5.3 |

| 2020 | $2.8 |

Revenue growth is driven by increasing subscriber numbers and price hikes. The platform’s direct-to-consumer (DTC) segment turned profitable in 2024, a major milestone in Disney Plus’s path to financial sustainability.

Average Revenue Per User (ARPU)

| Year | Core Disney+ ARPU | Disney+ Hotstar ARPU |

|---|---|---|

| Q2 2023 | $6.47 | $6.58 |

| Q3 2023 | $6.58 | $0.59 |

| Q4 2023 | $6.7 | $0.7 |

| Q1 2024 | $6.84 | $1.28 |

Disney Plus has been adjusting its pricing strategies to boost ARPU, including raising prices for Disney+, Hulu, and ESPN+ in late 2024.

Disney Plus in the Streaming Landscape

Disney Plus is firmly entrenched in the U.S. streaming video-on-demand (SVOD) market, although it faces significant competition from other platforms.

Disney Plus Market Share in the U.S.

| Platform | Market Share |

|---|---|

| Amazon Prime | 22% |

| Netflix | 21% |

| Max | 13% |

| Disney Plus | 12% |

| Hulu | 10% |

| Paramount+ | 9% |

| Apple TV+ | 8% |

| Peacock | 1% |

| Other | 4% |

Disney Plus ranks fourth in the U.S., behind Netflix and Amazon Prime Video. However, it continues to grow, and with its diverse content library and global reach, it remains a top player in the industry.

Retention Rates

Disney Plus maintains a solid retention rate, with 68% of subscribers staying on after six months.

While this is lower than Netflix’s 72% retention rate, it is a strong performance, especially when considering the growing competition in the streaming market.

Content and Engagement: Disney Plus’s Appeal

Disney Plus stands out because of its vast content library, which includes beloved franchises such as Star Wars, Marvel, Pixar, and classic Disney films.

Content Library

Disney Plus boasts over 13,000 shows and movies, with more than 8,000 hours of content available to subscribers.

This extensive library ensures there is something for everyone, from kids to adults. Popular original series like Moon Knight and Obi-Wan Kenobi have contributed to its growing viewership.

App Downloads and Usage

Disney Plus has seen fluctuations in app downloads, reflecting the competitive nature of the streaming market. In Q3 2024, the platform saw 4.49 million app downloads in the U.S. — a slight drop compared to earlier years, but still impressive.

Top Disney Apps by Revenue

| App | Revenue (Millions) |

|---|---|

| Disney+ | $1,226.94 |

| ESPN: Live Sports | $223.85 |

| Hulu | $48.26 |

| Disney+ Hotstar | $16.02 |

Disney+ remains the highest-grossing mobile app within The Walt Disney Company, indicating its strong position in the mobile app market.

New Trends and Challenges in 2026

Disney Plus is constantly adapting to new trends and user feedback, with some shifts in its business strategy.

The Rise of Ad-Supported Tiers

Disney Plus has seen growth in ad-supported subscription plans, attracting a wider audience and providing a more budget-friendly option for viewers.

This is an emerging trend in streaming, as more viewers opt for ad-supported content to lower their subscription costs.

| Year | Ad-Supported Viewers (Millions) |

|---|---|

| 2022 | 109.8 |

| 2023 | 122 |

| 2024 (Projected) | 134 |

| 2025 (Projected) | 145.2 |

Content Spending Strategy

Disney has adjusted its content spending, reducing its budget from $29.9 billion in 2022 to about $25 billion in 2024. This reflects the company’s focus on quality over quantity as it strives for profitability.

Subscriber Backlash and Controversy

In late 2025, Disney faced some backlash over content suspensions, leading to calls for cancellations. This highlights the sensitive nature of subscriber relations and the impact that decisions on content and pricing can have on brand loyalty.

FAQs About Disney Plus Statistics

1. How many subscribers does Disney Plus have in 2025?

As of Q1 2025, Disney Plus has 124.6 million subscribers globally, with 122.7 million on the core Disney+ service and 35.9 million on Disney+ Hotstar.

2. What is Disney Plus's revenue for the fiscal year 2024?

Disney Plus generated $10.4 billion in revenue in fiscal year 2024, marking a significant increase from the previous year’s $8.4 billion.

3. What age group is the largest audience for Disney Plus?

The largest age group on Disney Plus is 25-44 years, making up 43.9% of the user base, showing strong appeal to young adults and families.

4. What is Disney Plus’s market share in the U.S. SVOD market?

Disney Plus holds a 12% share of the U.S. SVOD market, ranking as the fourth most popular streaming platform behind Netflix, Amazon Prime, and Max.

5. Has Disney Plus introduced ad-supported tiers?

Yes, Disney Plus has introduced ad-supported plans, with the number of viewers opting for this option steadily increasing, reaching 145.2 million by 2025.

Also Read:

- Mobile App Download Statistics

- Live Streaming Statistics

- Virtual Reality Statistics

- Screen Time Statistics

- OTT Statistics

Conclusion: Disney Plus’s Path Forward

Disney Plus remains a key player in the streaming market, with a growing subscriber base, impressive financial performance, and an extensive content library.

Despite the challenges posed by competition and occasional controversies, the platform is poised for continued success as it focuses on profitability and user satisfaction.

By adapting its pricing models, embracing ad-supported tiers, and staying innovative with content, Disney Plus is set to continue captivating global audiences well into the future.