Over-the-top (OTT) platforms have completely transformed how we consume entertainment, moving beyond the days of prime-time TV schedules and DVD rentals.

We now command what, when, and where we watch, thanks to the sheer convenience these services offer.

The numbers clearly show this paradigm shift: the global OTT market is experiencing explosive growth, making it more critical than ever to understand the latest OTT statistics for 2025.

Whether you are an enthusiast wanting to learn more or a business professional looking to enter this dynamic arena, this detailed article will equip you with essential insights into the ever-evolving world of OTT.

Table of Contents

ToggleThe Rise of OTT: A Global Phenomenon

The sheer scale of OTT adoption is staggering. Users are overwhelmingly choosing OTT for their entertainment needs, and the landscape is constantly shifting with new platforms emerging and established players innovating to meet changing consumer preferences.

Several key factors fuel this rapid expansion: increasing internet penetration worldwide, the irresistible allure of on-demand viewing, and the consistent delivery of high-quality, exclusive content.

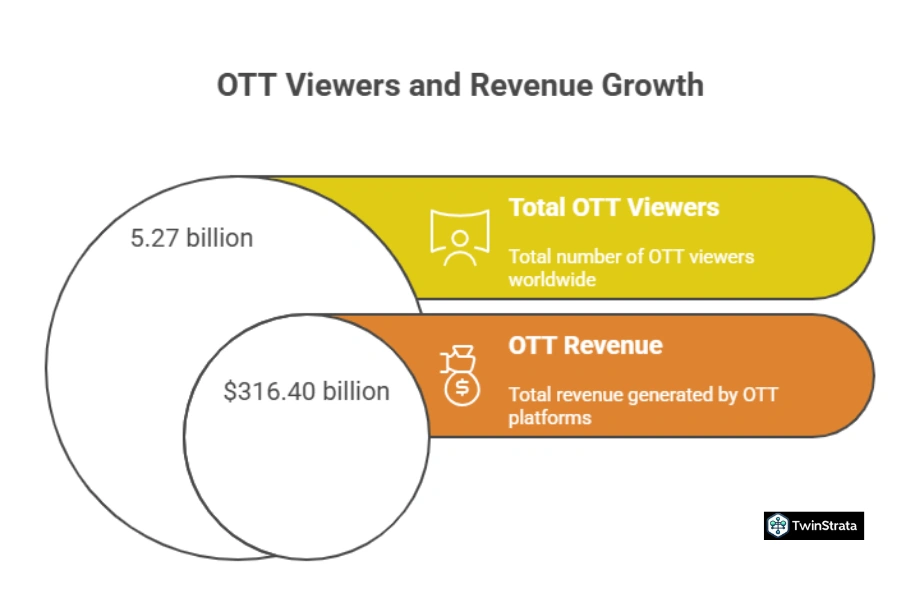

With these powerful drivers at play, the OTT market has already surpassed 5.27 billion viewers, and its revenue is on track to hit an astounding $316.40 billion.

Imagine nearly two-thirds of the world’s internet users actively engaging with these platforms! This isn’t just a trend; it’s a fundamental change in how the world accesses content.

Also read about: Netflix Subscribers Statistics

Who is Watching and How Much?

The number of OTT users has soared, reaching an estimated 5.27 billion.

The COVID-19 pandemic significantly accelerated this growth, with approximately 800 million new users joining during the lockdown period alone. While the growth was phenomenal, the trajectory remains upward.

Looking ahead, we project OTT users to reach 4.91 billion by 2029, representing a substantial 25.46% growth from 2024 to 2029. This consistent increase underscores the enduring appeal and accessibility of OTT services.

Table 1: Global OTT Users Over the Years (Billions)

| Year | Number of OTT Users |

| 2020 | 3.46 |

| 2021 | 3.67 |

| 2022 | 3.53 |

| 2023 | 3.74 |

| 2024* | 3.92 |

| 2025* | 4.12 |

| 2026* | 4.33 |

| 2027* | 4.52 |

| 2028* | 4.72 |

| 2029* | 4.91 |

Users are dedicating significant portions of their leisure time to streaming. Globally, people spend an average of 17 hours weekly watching online video content on OTT platforms.

Americans, known for their high consumption rates, dedicate even more time, averaging 3 hours and 9 minutes daily, which translates to an impressive 21 hours per week.

This level of engagement highlights the central role OTT now plays in daily life.

Table 2: Average Weekly Time Spent on OTT Platforms (Hours)

| Year | Average Time Spent (Hours) |

| 2018 | 10.5 |

| 2019 | 14 |

| 2020 | 16 |

| 2021 | 18 |

| 2022 | 19 |

| 2023 | 17 |

One of the most defining user behaviors is binge-watching, with over 70% of OTT users engaging in this activity. They typically consume an average of 5 episodes in a single sitting.

This intense viewing habit reflects the captivating nature of the content and the convenience of on-demand access.

Also read about: Amazon Statistics

The Money Makers: OTT Revenue Streams

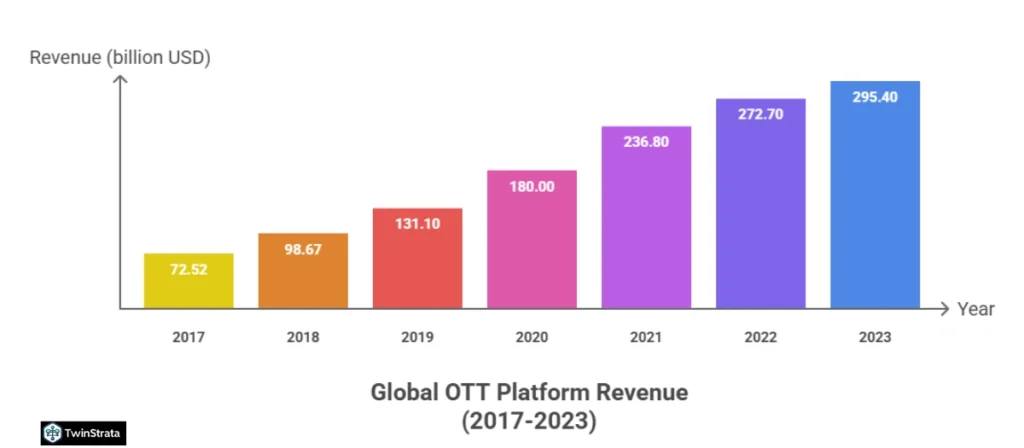

The financial performance of the OTT industry has been nothing short of spectacular. Between 2018 and 2021, revenue surged, driven by factors such as the COVID-19 pandemic and the growing affordability of OTT services.

With the widespread adoption of smart TVs, tablets, and smartphones, the market revenue is set to climb even higher in the coming years.

Worldwide OTT market revenue reached $295.40 billion in 2023, marking a 13.3% increase from the previous year. To put this in perspective, revenue jumped from $131 billion in 2019 to $180 billion in 2020 alone, an increase of nearly $50 billion in just one year!

Table 3: Global OTT Platform Revenue Over the Years (Billions USD)

| Year | Revenue Generated |

| 2017 | $72.52 |

| 2018 | $98.67 |

| 2019 | $131.10 |

| 2020 | $180.00 |

| 2021 | $236.80 |

| 2022 | $272.70 |

| 2023 | $295.40 |

By the beginning of 2025, the average revenue per user (ARPU) is expected to reach $82.7. This is a steady increase from $77 in 2023 and $80.7 in 2024, demonstrating consistent monetization improvements.

Table 4: Average Revenue Per User (ARPU) for OTT Over the Years (USD)

| Year | ARPU of OTT |

| 2019 | $42.46 |

| 2020 | $52.12 |

| 2021 | $64.53 |

| 2022 | $72.37 |

| 2023 | $77 |

| 2024 | $80.7 |

Market Growth and Future Projections

The demand for on-demand content that users can watch anytime, anywhere has powered an explosive increase in the OTT market. The global OTT market is already estimated to have reached 1.55 trillion.

Industry giants like Netflix, Amazon Prime Video, Hulu, and Roku are key players driving this market forward. Their continuous innovation and content investments sustain this impressive growth.

Penetration Rates: Reaching the Masses

OTT penetration rates illustrate how widely global users adopt these platforms. Currently, nearly half of the internet-connected population has embraced OTT.

The global penetration rate of the OTT market is projected to reach 47.83% in 2024, up from 45.72% in 2023. By 2028, this rate is forecasted to hit 54.7%, a substantial increase driven by the global adoption of smart devices and easier access to high-speed internet.

Table 5: Global OTT Penetration Rate Worldwide

| Year | Penetration Rate |

| 2020 | 41.33% |

| 2021 | 44.41% |

| 2022 | 42.91% |

| 2023 | 45.72% |

| 2024* | 47.83% |

| 2025* | 49.77% |

| 2026* | 51.54% |

| 2027* | 53.12% |

| 2028* | 54.7% |

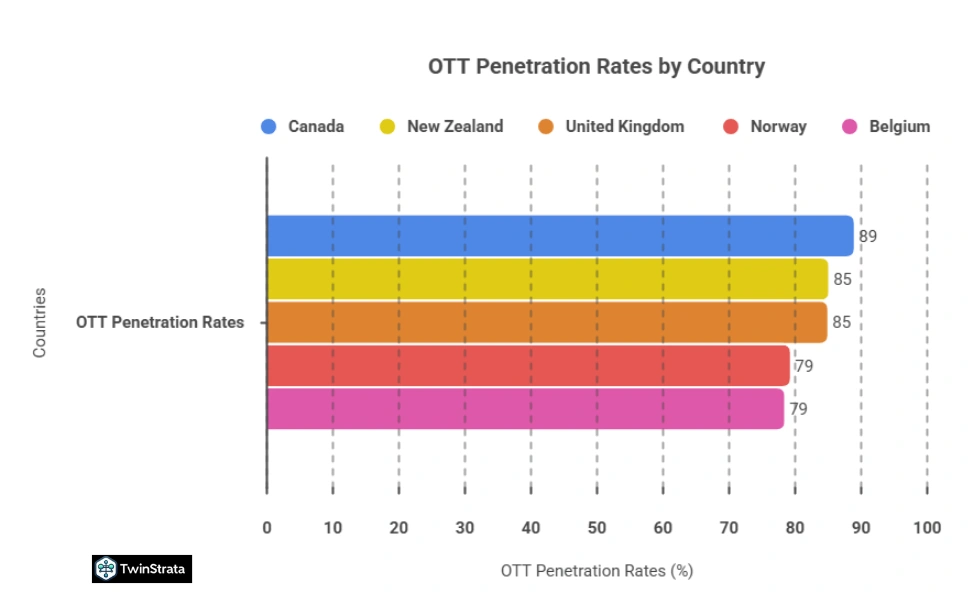

Interestingly, countries like Canada lead the charge with an impressive 89.12% OTT penetration rate, followed closely by New Zealand. This high adoption in developed nations showcases the maturity of the market and the deep integration of streaming into daily life.

Table 6: Countries with the Highest OTT Penetration Rates

| Country | OTT Penetration Rates |

| Canada | 89.12% |

| New Zealand | 85.27% |

| United Kingdom | 85.13% |

| Norway | 79.46% |

| Belgium | 78.6% |

Market Share: Who Dominates the Game?

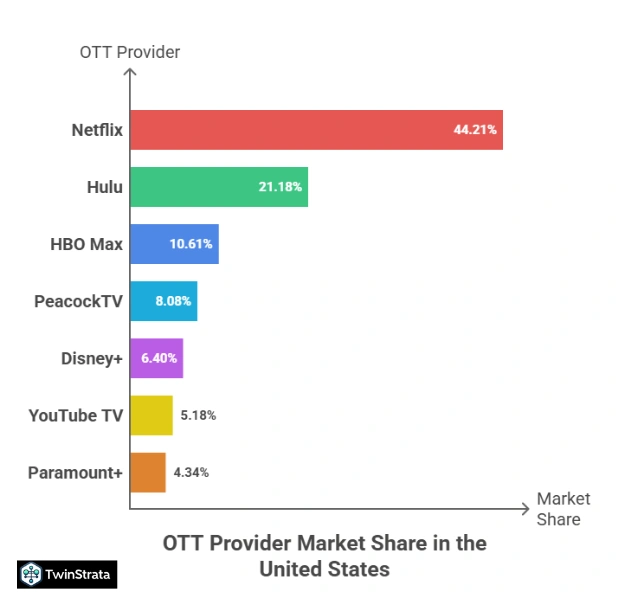

Netflix, the pioneer of the OTT market, continues to hold a dominant position. Nearly one in five OTT viewers globally use Netflix daily. However, competitors like Disney+ and Amazon Prime Video have successfully carved out significant market shares.

In the United States, Netflix commands 44.21% of the OTT video market share. This content-driven model, offering a vast library of web series, films, and diverse content, keeps it at the top.

Hulu follows with a substantial 21.18% market share, with HBO Max, PeacockTV, Disney+, and YouTube TV also being significant players.

Table 7: OTT Provider Market Share in the United States

| OTT Provider | Market Share Owned |

| Netflix | 44.21% |

| Hulu | 21.18% |

| HBO Max | 10.61% |

| PeacockTV | 8.08% |

| Disney+ | 6.40% |

| YouTube TV | 5.18% |

| Paramount+ | 4.34% |

Advertising on OTT Platforms: A New Frontier

The OTT Video Advertising market segment is expected to reach a market volume of $189.60 billion.

This impressive figure stems from brands increasingly choosing OTT platforms for their advertising, recognizing the high engagement and often unskippable nature of these ads.

A remarkable statistic: OTT ads typically boast 90% or more completion rates. This is because most devices and platforms feature non-skippable ads that remain in view, making them incredibly effective at capturing audience attention.

The impact is clear: 72% of people watching OTT remember a specific ad they saw. This high recall rate is prompting 42% of marketing professionals and agencies to increase their expenditure on OTT advertising.

Furthermore, 66% of OTT video content viewers discovered a new product or service through these ads.

A significant 65% even look up product information on a second screen while watching, and 40% have paused content to research or purchase an advertised product.

Interestingly, 57% of U.S. adults prefer low-cost or free OTT streaming platforms with ads. A quarter of OTT viewers are even willing to watch a 10-minute advertisement in exchange for free video content.

This indicates a growing acceptance of the AVOD (Advertising-based Video on Demand) model.

OTT User Behavior: Beyond the Numbers

While global user behavior has common threads like binge-watching, regional nuances exist. Yet, some fundamental habits remain consistent across the board.

Beyond binge-watching, a significant 34.97% of OTT users watch content several times a day, showcasing the deep integration of these services into daily routines.

Furthermore, 74.89% access OTT at least three times a week. Most users spend between 20 to 60 minutes per session once connected.

Looking at subscription habits, 86% of total OTT users plan to maintain or even increase their subscriptions. Specifically, 61% intend to keep their current subscriptions, while 25% are looking to add new ones.

Only a smaller segment, 14%, considers reducing their subscriptions. This loyalty and willingness to expand subscriptions highlight the perceived value of OTT services.

Platform-Specific Insights

Let’s dive into the specifics of the leading OTT platforms:

Netflix

Netflix continues its reign with over 277 million subscribers worldwide. In Q2 2024 alone, Netflix added almost 17 million subscribers, indicating robust growth. This consistent performance has positively impacted its stock performance.

Table 8: Netflix Subscribers Over the Years (Millions)

| Year | Number of Netflix Subscribers |

| 2014 | 47.9 |

| 2015 | 62.7 |

| 2016 | 79.9 |

| 2017 | 99 |

| 2018 | 124.3 |

| 2019 | 151.5 |

| 2020 | 192.9 |

| 2021 | 219.7 |

| 2022 | 230.7 |

| 2023 | 260.28 |

| 2024 (Q2) | 277.65 |

Netflix’s ad-supported plan, launched in November 2022, has been a significant success, garnering 15 million subscribers as of 2023 in just one year.

Geographically, Europe, the Middle East, and Africa represent Netflix’s largest market with 83.76 million customers, followed by the U.S. and Canada with 77.32 million. Latin America accounts for 43.65 million, and the Asia Pacific region has 42.43 million subscribers.

Financially, Netflix generated a colossal $33.72 billion in 2023. As of Q2 2024, its revenue already stands at over $18.93 billion, showcasing consistent financial strength.

Table 9: Netflix Annual Revenue (Billions USD)

| Year | Revenue |

| 2014 | $5.5 |

| 2015 | $6.78 |

| 2016 | $8.83 |

| 2017 | $11.69 |

| 2018 | $15.79 |

| 2019 | $20.15 |

| 2020 | $24.99 |

| 2021 | $29.698 |

| 2022 | $31.61 |

| 2023 | $33.72 |

| 2024 (Q1+Q2) | $18.93 |

Amazon Prime Video

Amazon Prime boasts approximately 200 million members worldwide. While Amazon hasn’t released updated figures since 2020, it’s safe to assume this number has well exceeded 210 million, given the substantial growth of 100 million users between 2018 and 2020 alone.

Table 10: Amazon Prime Members Over the Years (Millions)

| Year | Amazon Prime Members |

| 2014 | 31 |

| 2015 | 46 |

| 2016 | 65 |

| 2017 | 100 |

| 2018 | 125 |

| 2019 | 150 |

| 2020 | 200 |

Amazon Prime subscription services generated $35.22 billion in revenue in 2022. This contributed 6.85% to Amazon’s total revenue of $514 billion in that year.

Revenue for Prime’s subscription services jumped by $6 billion between 2019 and 2020, demonstrating its continued financial muscle.

Table 11: Amazon Prime Annual Net Sales of Subscription Services (Billions USD)

| Year | Annual Net Sales |

| 2014 | $2.76 |

| 2015 | $4.47 |

| 2016 | $6.39 |

| 2017 | $9.72 |

| 2018 | $14.17 |

| 2019 | $19.21 |

| 2020 | $25.21 |

| 2021 | $31.77 |

| 2022 | $35.22 |

Hulu

Hulu’s user base reached 48.2 million in 2023, an increase of 3.2 million subscribers from 2022. The platform saw its most significant growth between 2020 and 2021, adding 9 million users.

Table 12: Hulu Subscribers Over the Years (Millions)

| Year | Number of Hulu Subscribers |

| 2015 | 10 |

| 2016 | 12 |

| 2017 | 17 |

| 2018 | 22 |

| 2019 | 25 |

| 2020 | 32 |

| 2021 | 41 |

| 2022 | 45 |

| 2023 | 48.2 |

Hulu generated $11.2 billion in revenue in 2023, representing a 4.6% increase from the previous year. Its revenue saw a massive jump of nearly $3 billion in 2020 alone.

Table 13: Hulu Revenue Generated (Billions USD)

| Year | Revenue |

| 2015 | $2 |

| 2016 | $2.4 |

| 2017 | $3.1 |

| 2018 | $3.5 |

| 2019 | $4.5 |

| 2020 | $7.2 |

| 2021 | $9.6 |

| 2022 | $10.7 |

| 2023 | $11.2 |

Disney Plus

Disney Plus currently has 150.2 million subscribers. While it saw a slight decrease of 14 million subscribers in 2023, it experienced an impressive growth of 66 million subscribers in 2022.

Table 14: Disney Plus Subscribers Over the Years (Millions)

| Year | Number of Disney Plus Subscribers |

| 2020 | 73.7 |

| 2021 | 118.1 |

| 2022 | 164.2 |

| 2023 | 150.2 |

Disney Plus’s annual revenue surpassed $8.4 billion in 2023, a 13% increase from the previous year. The platform’s revenue surged by $5 billion between 2020 and 2022, highlighting its rapid growth since its launch.

Table 15: Disney Plus Revenue (Billions USD)

| Year | Revenue |

| 2020 | $2.8 |

| 2021 | $5.2 |

| 2022 | $7.4 |

| 2023 | $8.4 |

What Users Are Asking: Emerging Trends and Insights

Beyond the core statistics, discussions on platforms like Quora and Reddit reveal key user interests and emerging trends in the OTT space. These provide valuable, current insights:

- The Future of AVOD and Hybrid Models: Many users are actively discussing the increasing prominence of free ad-supported streaming (AVOD) and hybrid models (HVOD), which combine subscriptions with limited ads. People are seeking ways to access content affordably, and these models are seen as viable alternatives to pure SVOD.

- Niche Content and Hyper-Personalization: While major platforms dominate, there’s a growing interest in niche OTT services that cater to specific interests, such as indie films, documentaries, specific genres (horror, sci-fi), or regional content. Users appreciate highly personalized recommendations and the ability to discover unique content.

- Live Streaming Beyond Sports: While sports still dominate live streaming, users are increasingly engaging with live news, concerts, gaming events (e-sports on platforms like Twitch), and even interactive live shows on OTT platforms. The demand for real-time, engaging content is expanding.

- User Interface (UI) and User Experience (UX): Users frequently comment on the quality of app interfaces, ease of navigation, and content discovery. A seamless, intuitive experience across devices is paramount, with many expressing frustration over clunky UIs or poor search functions.

- The “Bundle” Debate: As subscription fatigue sets in for some, discussions revolve around the idea of “super bundles” where users can select a few services at a discounted rate, or à la carte options where they pay for specific shows or channels rather than entire platforms. This reflects a desire for more flexible pricing.

- Impact of 5G on Mobile Streaming: Users are excited about the potential of 5G networks to enhance mobile streaming, enabling higher quality video (4K, 8K) with minimal buffering, especially for on-the-go viewing in urban areas. This is pushing mobile-first consumption even further.

- Integration with Smart Home Devices and Voice Control: There’s a rising expectation for seamless integration of OTT apps with smart TVs, voice assistants (like Alexa, Google Assistant), and other smart home devices, allowing for easy content search and playback through voice commands.

These discussions highlight that while content quality and variety remain crucial, user experience, flexibility in monetization, and technological advancements are also key drivers of satisfaction and adoption in the evolving OTT landscape.

Device Usage and Consumer Preferences

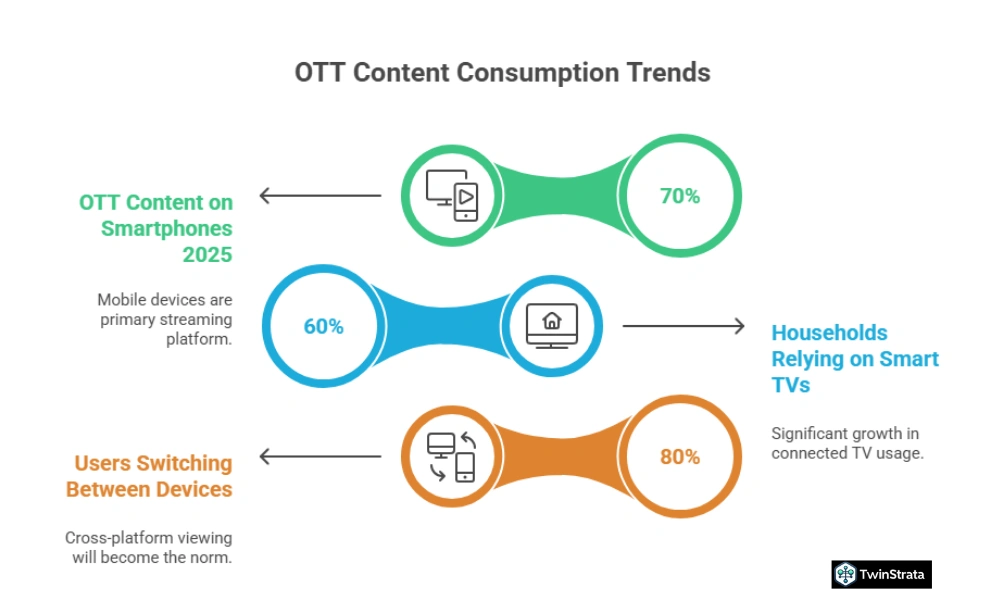

Understanding how viewers consume content is crucial. By 2025, over 70% of OTT content will be consumed on smartphones, firmly establishing mobile devices as the primary streaming platform.

However, connected TV usage is also seeing significant growth, with 60% of households in the U.S. and Europe relying on smart TVs for streaming.

Cross-platform viewing will become the norm, with 80% of users switching between smartphones, tablets, and TVs for seamless content consumption.

The rollout of 5G networks will revolutionize streaming, enabling 4K and 8K video streaming with minimal buffering, especially in urban areas. This technological leap will further enhance the viewing experience.

OTT TV App Statistics

By 2025, OTT TV apps will be installed on 80% of smart TVs. Netflix’s TV app will remain the most downloaded, expected to hit over 1 billion installations globally.

User engagement on these apps will increase by 30%, driven by improved UI/UX and personalized content recommendations.

Interestingly, 50% of OTT TV app users will utilize voice search to find content, thanks to deeper smart TV integrations. Live TV apps, such as Hulu Live and YouTube TV, will see a 40% increase in usage.

The Power of Live Streaming

Live streaming will account for 25% of total OTT viewership by 2025. Sports streaming will continue to dominate this segment, with platforms like ESPN+ and DAZN leading the way.

E-sports live streaming is set for explosive growth, expanding by 35% and attracting younger audiences.

Social media live streaming platforms (e.g., Instagram Live, Facebook Live) will integrate more deeply with traditional OTT platforms, broadening their reach.

Finally, 4K and 8K live streaming will become mainstream, with 20% of live streams offered in ultra-high definition, delivering an unparalleled viewing experience.

FAQs About OTT Statistics

1. What is the projected number of OTT users by 2025?

By 2025, the number of OTT users worldwide is projected to reach approximately 4.12 billion, continuing the significant growth observed in recent years due to increased internet penetration and demand for on-demand content.

2. How much revenue is the global OTT market expected to generate by 2025?

The global OTT market is estimated to generate over $316.40 billion in revenue by 2025, driven by a combination of subscription models, advertising, and transactional video-on-demand services.

3. What is the average time users spend weekly on OTT platforms?

Users globally spend an average of 17 hours weekly streaming online video content on OTT platforms, while Americans tend to spend even more, dedicating around 21 hours per week.

4. Which OTT platform holds the largest market share in the United States?

Netflix continues to hold the largest market share in the United States, commanding 44.21% of the OTT video market, attributed to its extensive content library and original programming.

5. What are the key factors driving the growth of the OTT market?

The primary factors fueling the growth of the OTT market include rapidly increasing internet penetration globally, the strong consumer preference for on-demand viewing, and the continuous availability of high-quality, exclusive content from various platforms.

Also Read:

- Smartphone Usage Statistics

- Google Ads Statistics

- Telegram Statistics

- Generative AI Statistics

- Email Marketing Statistics

Conclusion: The Unstoppable OTT Revolution

The OTT industry shows absolutely no signs of slowing down. With global users projected to exceed 5.27 billion and revenue reaching $316.40 billion by 2025, this market is brimming with opportunities.

Netflix continues to lead with over 277 million subscribers and $33.72 billion in revenue in 2023. Still, strong players like Amazon Prime Video, Hulu, and Disney+ are also demonstrating steady growth in both subscribers and revenue.

American users spend an average of 3 hours per day on OTT platforms, with over 70% binge-watching.

This high level of engagement, coupled with evolving monetization models (SVOD, AVOD, TVOD, HVOD), indicates a robust and adaptable industry.

The increasing preference for mobile viewing, the rise of live streaming, and the continuous improvement in user experience across smart devices all point to a dynamic future.

Whether you are a consumer seeking diverse entertainment or a business professional aiming to capitalize on this boom, understanding these OTT statistics 2025 is essential.

The revolution is here, and it’s expanding at an incredible pace, offering unparalleled opportunities for creators, platforms, and viewers alike.