Telegram is no longer just another messaging app; it stands as a global powerhouse, redefining digital communication.

In 2025, Telegram continues its explosive growth, attracting millions of new users daily and evolving into a versatile platform for messaging, content consumption, and even e-commerce.

This detailed guide explores the latest Telegram statistics 2025, providing insights for anyone looking to understand its impact and leverage its potential.

From user demographics to financial milestones and emerging trends, we are breaking down everything you need to know about Telegram’s remarkable journey and future trajectory.

Table of Contents

ToggleTelegram’s User Explosion: Reaching for the Stars in 2026

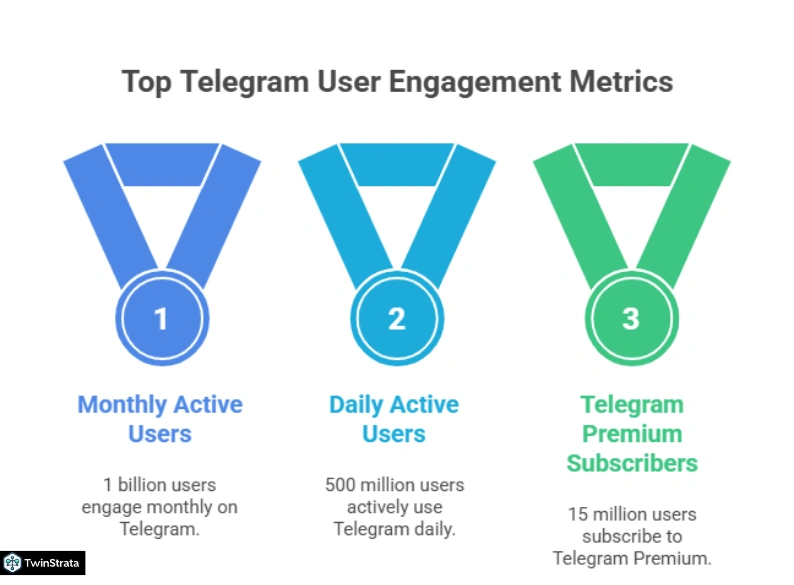

Telegram is experiencing an unprecedented surge in its user base. As of March 2025, the platform proudly boasts 1 billion monthly active users (MAU), a significant leap from 950 million in July 2024.

This growth is relentless, with approximately 2.5 million new users joining Telegram every single day. These numbers solidify Telegram’s position as the 4th most popular messaging app globally and the 7th largest social media platform overall.

Imagine half a billion people – that’s roughly 500 million daily active users (DAU) – logging into Telegram every day to connect, share, and consume content. This impressive daily engagement showcases the platform’s stickiness and its deep integration into the daily lives of its users.

A Decade of Dominance: Telegram’s MAU Growth

Telegram’s journey from a niche messaging app to a global giant is truly remarkable. Look at how its monthly active users have steadily climbed over the years:

| Month-Year | Telegram Monthly Active Users |

| March 2025 | 1 billion |

| Jul ’24 | 950 million |

| Apr ’24 | 900 million |

| Jul ’23 | 800 million |

| Nov ’22 | 700 million |

| Apr ’22 | 500 million |

| Apr ’20 | 400 million |

| Mar ’18 | 200 million |

| Dec ’17 | 180 million |

| Feb ’16 | 100 million |

| Sep ’15 | 60 million |

| Dec ’14 | 50 million |

| Mar ’14 | 35 million |

Telegram’s consistent year-over-year growth speaks volumes about its ability to attract and retain users in a highly competitive digital landscape.

Also read about: Facebook Statistics

The Premium Perk: A Growing Subscriber Base

While the majority of Telegram users enjoy the free features, a dedicated segment opts for an enhanced experience.

Telegram Premium, launched in June 2022, offers exclusive benefits like 4 GB file uploads, faster downloads, doubled limits, and unique stickers.

In 2025, the number of Telegram Premium subscribers surpassed 15 million, a substantial increase from 5 million in January 2024.

This growth highlights a willingness among users to pay for advanced features, showcasing Telegram’s successful monetization strategy. However, premium subscribers still represent around 1% of the total monthly active users, indicating vast potential for future growth in this segment.

| Month Year | Telegram Premium Subscribers |

| July 2025 | 15 million |

| September 2024 | 10 million |

| Jan 2024 | 5 million |

| Dec 2023 | 4 million |

| Oct 2023 | 3.5 million |

| Dec 2022 | 1 million |

| Aug 2022 | 0.26 million |

| Jul 2022 | 0.15 million |

Source: Statista 1, Telegram, Statista 2.

Where in the World is Telegram Thriving?

Telegram’s global footprint is diverse and expanding. While it enjoys widespread adoption, some countries and regions stand out as key growth drivers.

Top Countries Embracing Telegram

India leads the charge, with a staggering 45% of its population regularly using Telegram. This makes India the largest market for the app, significantly contributing to its massive user base.

Other countries with high adoption rates include Brazil (38%) and Mexico (34%). Interestingly, Russia, the birthplace of Telegram, sees around 51% of its citizens using the platform.

In contrast, only 9% of the American population actively uses Telegram, indicating significant room for growth in Western markets.

| Country | Share of Respondents Who Use Telegram |

| India | 45% |

| Brazil | 38% |

| Mexico | 34% |

| South Africa | 32% |

| Spain | 32% |

| Italy | 29% |

| Germany | 16% |

| France | 11% |

| United Kingdom | 10% |

| United States | 9% |

| Japan | 1% |

Regional Dominance: Asia Pacific Leads the Way

The Asia Pacific (APAC) region stands as Telegram’s largest market, accounting for 38% of its user base, which translates to approximately 361 million monthly active users.

Europe and Latin America follow, with 27% and 21% of users, respectively. The Middle East and North Africa (MENA) region currently has the lowest share at 8%.

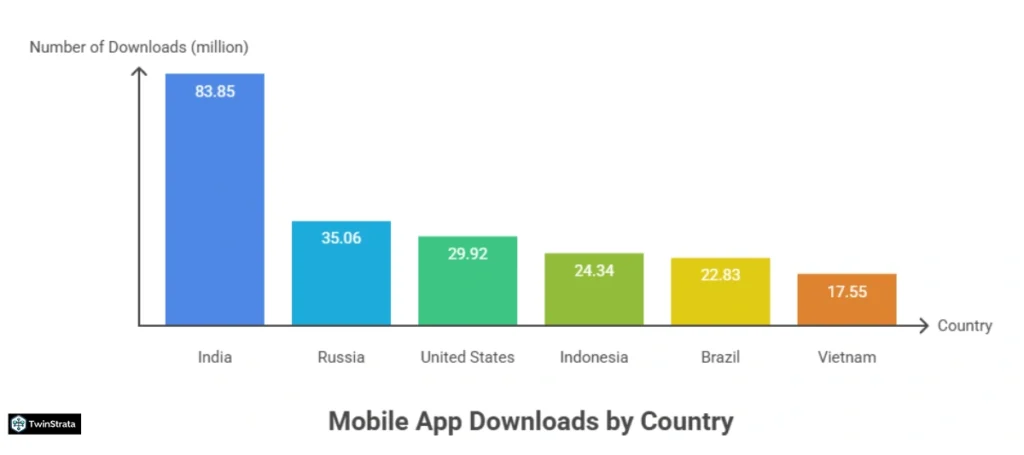

Telegram’s success in APAC is underscored by app download statistics, where India consistently ranks highest.

However, it’s crucial to acknowledge that bans and restrictions in certain large markets, such as China and Iran, prevent Telegram from reaching an even wider global audience.

Also read about: WhatsApp Statistics

Who is Using Telegram? Demographics Unveiled

Understanding Telegram’s user demographics helps businesses and content creators tailor their strategies effectively.

The Young and Connected: Age Demographics

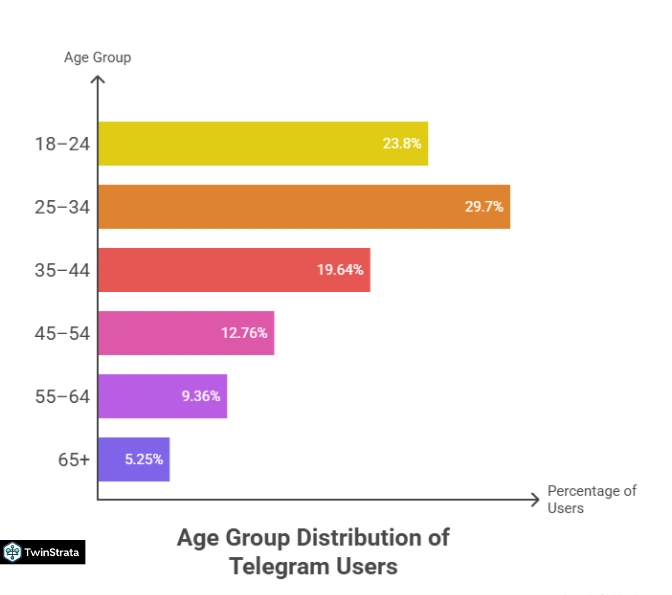

Telegram primarily attracts a younger audience. Over half of all Telegram users, specifically 53.5%, are aged between 18 and 34 years old.

The 25-34 age group represents the largest share at 29.70%, closely followed by 18-24 year olds at 23.8%. This demographic profile makes Telegram an attractive platform for brands targeting Gen Z and millennials.

| Age Group | Share of Telegram Users |

| 18-24 | 23.8% |

| 25-34 | 29.70% |

| 35-44 | 19.64% |

| 45-54 | 12.76% |

| 55-64 | 9.36% |

| 65+ | 5.25% |

Also read about: Social Media Statistics

A Male-Dominated Space, But Shifting: Gender Demographics

As of 2025, Telegram’s user base leans male, with 56.8% of users identifying as male and 43.2% as female. While this indicates a male majority, recent reports suggest a significant increase in female users over the past few years.

Experts predict that the gender gap will narrow considerably by 2030, making Telegram a more balanced platform in terms of gender distribution.

| Gender | Share of Users |

| Male | 56.8% |

| Female | 43.2% |

The Download Phenomenon: Telegram’s App Reach

The sheer number of Telegram app downloads highlights its immense global reach and consistent popularity. The app has been downloaded 2 billion times across the App Store and Google Play Store since its inception.

Monthly and Yearly Download Trends

In February 2024, Telegram saw 34.33 million downloads, a slight decrease from January’s 36.87 million but still reflecting strong demand.

Looking at yearly trends, Telegram was downloaded 409.48 million times in 2023, marking a 6.94% increase from 2021.

Projections for 2025 anticipate downloads to exceed 500 million, demonstrating continued upward momentum.

| Month-Year | Number of Downloads |

| Feb 2024 | 34.33 million |

| Jan 2024 | 36.87 million |

| Dec 2023 | 35.02 million |

| Nov 2023 | 36.92 million |

| Oct 2023 | 42.61 million |

| Sep 2023 | 36.28 million |

| Aug 2023 | 38.25 million |

| Jul 2023 | 33.97 million |

| Jun 2023 | 32.19 million |

| May 2023 | 32.86 million |

| Apr 2023 | 29.74 million |

| Mar 2023 | 29.31 million |

| Feb 2023 | 28.47 million |

| Year | Number of Telegram App Downloads |

| 2023 | 409.48 million |

| 2021 | 382.92 million |

| 2022 | 367.23 million |

| 2020 | 326.31 million |

| 2019 | 141.5 million |

| 2018 | 87.02 million |

| 2017 | 67.77 million |

| 2016 | 53.58 million |

| 2015 | 40.33 million |

Global Download Hotspots

India once again stands out, recording the highest number of Telegram app downloads in 2023, with 83.85 million downloads. Russia follows with 35.06 million, and the United States comes in third with 29.92 million.

This concentration of downloads in specific countries underscores their importance to Telegram’s overall growth strategy.

| Country | Number of Downloads |

| India | 83.85 million |

| Russia | 35.06 million |

| United States | 29.92 million |

| Indonesia | 24.34 million |

| Brazil | 22.83 million |

| Vietnam | 17.55 million |

| Ukraine | 11.77 million |

| Kazakhstan | 9.36 million |

| France | 7.45 million |

| United Kingdom | 6.04 million |

| Malaysia | 5.52 million |

| Italy | 4.14 million |

Time Well Spent: User Engagement on Telegram

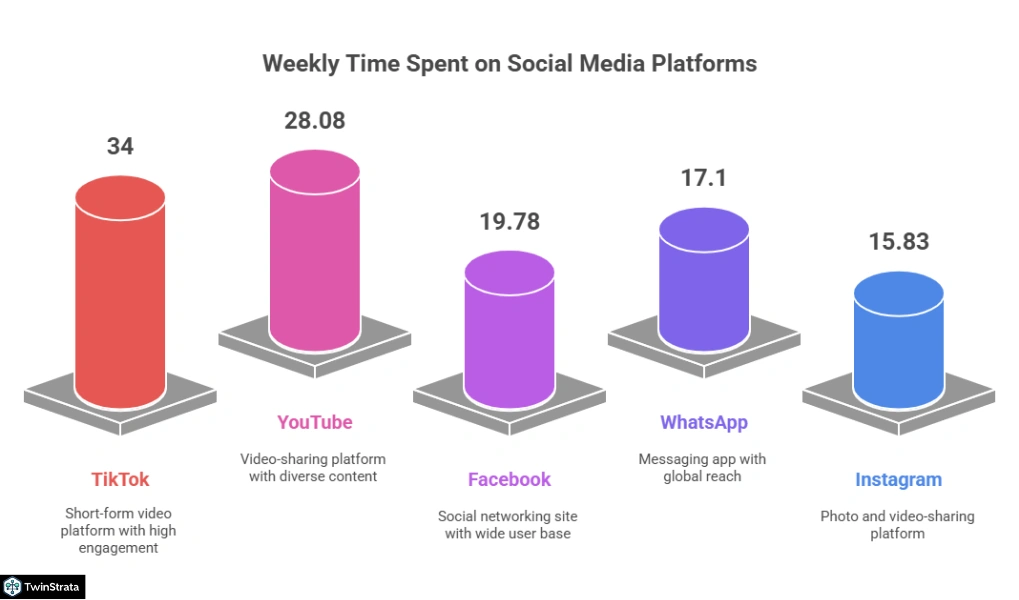

While other platforms boast longer engagement times, Telegram users are highly active during their sessions. Users spend an average of 3 hours and 45 minutes per month on Telegram, placing it 8th among social media platforms in terms of monthly usage.

However, the quality of engagement is notable. An average session on Telegram lasts for an impressive 41 minutes, and active users open the app at least 21 times a day.

This indicates that while users might not spend as many continuous hours on Telegram as on TikTok, their interactions are frequent and meaningful.

| Social Media Platform | Time Spent On The Platform Per Month |

| TikTok | 34 hours |

| YouTube | 28 hours and 5 minutes |

| 19 hours and 47 minutes | |

| WhatsApp Messenger | 17 hours and 6 minutes |

| 15 hours and 50 minutes | |

| Line | 8 hours and 14 minutes |

| X (Twitter) | 4 hours and 40 minutes |

| Telegram | 3 hours and 45 minutes |

| Snapchat | 3 hours and 33 minutes |

| FB Messenger | 3 hours and 21 minutes |

| 1 hour and 49 minutes | |

| LinkedIn App | 51 minutes |

Telegram’s Financial Pulse: Revenue and Funding

Telegram’s financial health is robust, driven by its premium subscriptions and strategic funding rounds.

Growing In-App Revenue

| Month-Year | Apple App Store | Google Play Store |

| Feb 2024 | 4.86 million | 1.22 million |

| Jan 2024 | 4.44 million | 1.14 million |

| Dec 2023 | 3.87 million | 0.97 million |

| Nov 2023 | 3.35 million | 0.82 million |

| Oct 2023 | 3.18 million | 0.79 million |

| Sep 2023 | 2.94 million | 0.78 million |

| Aug 2023 | 3.09 million | 0.73 million |

| Jul 2023 | 2.86 million | 0.63 million |

| Jun 2023 | 2.30 million | 0.57 million |

| May 2023 | 2.45 million | 0.62 million |

Billions in Funding

Since its launch in 2013, Telegram has successfully raised over $4 billion in funding. The latest injection of $330 million came in March 2024 through capital bond sales, following $270 million in June 2023.

These significant investments underscore investor confidence in Telegram’s future growth and potential.

| Date | Funding Received |

| Mar 18, 2024 | 0.33 billion |

| Jul 18, 2023 | 0.27 billion |

| Apr 28, 2021 | 0.75 billion |

| Mar 15 and 23, 2021 | 1 billion |

| Mar 1, 2018 | 1.7 billion |

Beyond Messaging: Telegram’s Expansive Features and Ecosystem

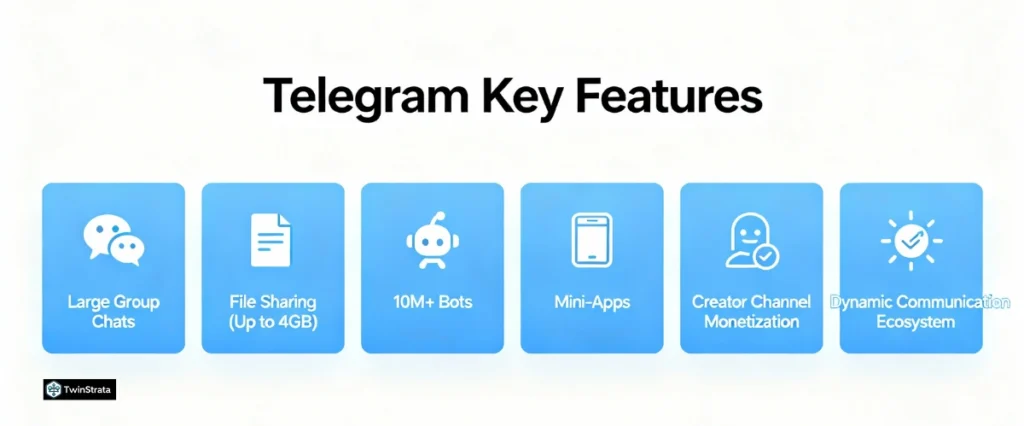

Telegram’s appeal extends far beyond simple messaging. Its robust feature set creates a dynamic ecosystem for communication, content sharing, and community building.

Powerful Group Chats and File Sharing

Telegram group chats are legendary, accommodating up to 200,000 people, making them ideal for large communities and organizations.

Users can upload substantial files, with a standard limit of 2 GB and a generous 4 GB for Premium subscribers. This capability positions Telegram as a formidable tool for collaboration and content distribution.

The Rise of Bots and Mini-Apps

Over 10 million bots are hosted on Telegram’s free bot platform. This open-source environment empowers developers to create diverse chatbots and mini-apps, ranging from simple information providers to complex interactive tools.

This thriving bot ecosystem significantly enhances user experience and expands Telegram’s functionality.

Monetizing Channels: A Win for Creators

Telegram introduced a groundbreaking monetization model for channel owners: 50% of display ad revenue goes directly to channel owners with a minimum of 1000 subscribers.

This initiative not only incentivizes content creation but also allows owners to withdraw funds with no fees or reinvest them into further promotions on the platform. This move transforms Telegram into a viable income stream for creators.

The Most Popular Channels and Categories

Content is king, and Telegram channels are flourishing. Telegram Tips leads with 10.89 million subscribers, followed by Telegram News and Telegram Premium.

However, the truly viral channel making waves in 2025 is @hamster_kombat, a Telegram-based cryptocurrency clicker game, boasting over 41.8 million subscribers!

When it comes to categories, News channels are overwhelmingly popular, followed by 85% of Telegram users. Entertainment (62%) and Educational (58%) channels also see high engagement, while political channels are followed by 50% of users.

| Channel Category | Share of Telegram Users That Follow The Category |

| News channels | 85% |

| Entertainment channels | 62% |

| Educational channels | 58% |

| Political channels | 50% |

| News from own industry | 48% |

| Personal channels of friends | 45% |

| Channels on special military operation | 36% |

| Channels of bloggers and celebrities | 31% |

| Internal channels of companies | 19% |

| Channels of brands/companies | 17% |

| Channels on products and discounts | 16% |

| Channels with job offers | 14% |

| Channels for adults | 13% |

| Darknet-channels | 4% |

| Telegram Channel | Number of Subscribers |

| @hamster_kombat | 41.8 million |

| @blumcrypto | 29.49 million |

| @majors | 22.4 million |

| @pawsupfam | 21.4 million |

| @tapswapai | 20.1 million |

| @empirex | 17.08 million |

| @memeficlub | 16.6 million |

| @seedupdates | 16.3 million |

| @notcoin | 15.5 million |

| @Cats_housewtf | 15.4 million |

E-commerce on Telegram: A Growing Marketplace

Telegram is quietly becoming a significant player in the e-commerce space. In 2025, it generated substantial sales volumes across various segments.

Goods from China led the way with an impressive $12 million in sales, demonstrating the platform’s utility for cross-border trade.

Digital equipment, consumer loans, apparel, and shoes also contributed significantly to Telegram’s burgeoning marketplace.

| Segment | Sales Volume on Telegram |

| Goods from China | $12 million |

| Digital Equipment | $5.52 million |

| Consume loans | $3.12 million |

| Apparel and Shoes | $2.14 million |

| Sport | $0.86 million |

| Work and Education | $0.57 million |

| Hypermarkets | $0.45 million |

| Health and Beauty | $0.25 million |

| Furniture and household goods | $0.063 million |

| Food Delivery | $0.057 million |

The Security Tightrope: Challenges and Scrutiny

While Telegram champions privacy, its security features and policies have drawn considerable scrutiny. The platform’s default communication encryption is not always on, requiring users to manually enable it, and this feature does not extend to group chats.

This has raised concerns and led to investigations in several countries.

In August 2024, Pavel Durov, Telegram’s founder, faced arrest allegations regarding the app’s potential use for illicit activities like drug trafficking and the distribution of child sexual abuse images.

India is also investigating Telegram over multiple cases, including paper leaks, stock manipulation, and extortion. Cybersecurity firms have identified Telegram as a platform where malicious tools for phishing scams and the trade of stolen credentials are openly sold.

These incidents highlight the complex challenge Telegram faces in balancing user privacy with the need to combat illegal activities on its platform.

The Value of a Name: Expensive Telegram Usernames

Telegram’s unique auction platform, Fragment, allows users to buy and sell usernames using the cryptocurrency Toncoin. This has created a vibrant marketplace for valuable digital real estate.

The username @news was sold for an astounding 994 thousand Toncoin, equivalent to approximately $5.81 million in April 2024, making it the most expensive Telegram username ever.

Other high-value usernames like @auto and @bank also fetched millions of dollars, showcasing the perceived value of prominent digital identities on the platform.

| Telegram Usernames | Sales Price |

| @news | 5.81 million |

| @auto | 5.27 million |

| @bank | 4.97 million |

| @avia | 4.68 million |

| @chat | 4.1 million |

| @king | 3.95 million |

| @fifa | 3.51 million |

| @game | 2.93 million |

| @sber | 2.76 million |

| @meta | 2.36 million |

What Users Are Asking: Insights from Quora and Reddit

Beyond the statistics, real user conversations on platforms like Quora and Reddit offer a glimpse into the evolving perceptions and concerns surrounding Telegram.

- Privacy and Security Settings: Users frequently ask about how to maximize their privacy on Telegram, debating the effectiveness of secret chats versus regular chats, and seeking clarity on end-to-end encryption for group conversations.

- Monetization Strategies for Channels: Many content creators are actively discussing best practices for monetizing their Telegram channels, inquiring about ad revenue sharing, external sponsorships, and effective content strategies to grow their subscriber base.

- The Future of Telegram as an “Everything App”: There’s growing speculation and discussion about Telegram’s ambition to become a more comprehensive platform, incorporating payments, decentralized identity, and a wider range of mini-apps, similar to WeChat. Users are keen to understand if Telegram will truly evolve into an “everything app.”

- Censorship and Geopolitical Impact: Following various events, discussions often revolve around Telegram’s role in disseminating information, its stance on censorship, and its impact on political discourse in different regions, especially considering its founder’s experiences.

- Cryptocurrency Integration (TON Blockchain): The integration of the TON blockchain and Toncoin within Telegram’s ecosystem, including username auctions and potential payment systems, generates significant interest and questions about its future implications for crypto adoption.

FAQs About Telegram Statistics

1. How many active users does Telegram have in 2025?

As of March 2025, Telegram has reached an impressive milestone of 1 billion monthly active users (MAU) globally, with approximately 500 million daily active users (DAU) engaging with the platform.

2. Which countries use Telegram the most?

India leads the world in Telegram usage, with 45% of its population regularly accessing the app. Other significant user bases are found in Brazil (38%), Mexico (34%), and Russia (51% of its citizens).

3. What is the demographic breakdown of Telegram users?

Telegram’s user base is predominantly young, with 53.5% of users aged between 18 and 34. In terms of gender, 56.8% of Telegram users are male, while 43.2% are female, though the female user base is growing steadily.

4. How does Telegram generate revenue?

Telegram primarily generates revenue through its Premium subscription, which offers enhanced features to paying users. Additionally, it has implemented an ad revenue sharing program for channel owners and has received over $4 billion in funding through various investment rounds.

5. What are the most popular features or aspects of Telegram?

Telegram is renowned for its large group chats supporting up to 200,000 members, its robust bot platform hosting over 10 million bots, generous file sharing limits (up to 4 GB for premium users), and a thriving channel ecosystem where creators can monetize their content.

Also Read:

- Personalization Statistics

- Smartphone Usage Statistics

- Generative AI Statistics

- Canva Statistics

- Google Searches Statistics

Conclusion: Telegram’s Unstoppable Rise

Telegram’s journey from 100 million users in 2016 to an astounding 1 billion in 2025 is a testament to its innovation, speed, and commitment to privacy.

The platform successfully caters to a young, globally diverse audience, primarily aged 18-34, with a significant male user base that is gradually diversifying.

With over $4 billion in funding, a growing Premium subscriber base, and groundbreaking monetization for channel owners, Telegram is not just surviving but thriving.

Its powerful group chats, expansive bot ecosystem, and emerging e-commerce capabilities solidify its position as a versatile and indispensable digital communication tool.

While challenges surrounding content moderation and illicit activities remain, Telegram’s rapid growth stems from a winning combination of features, user-centric design, and a clear vision for its future.

It has firmly secured its place among the world’s leading social and messaging platforms, poised for continued influence and expansion.